This post was originally published on this site

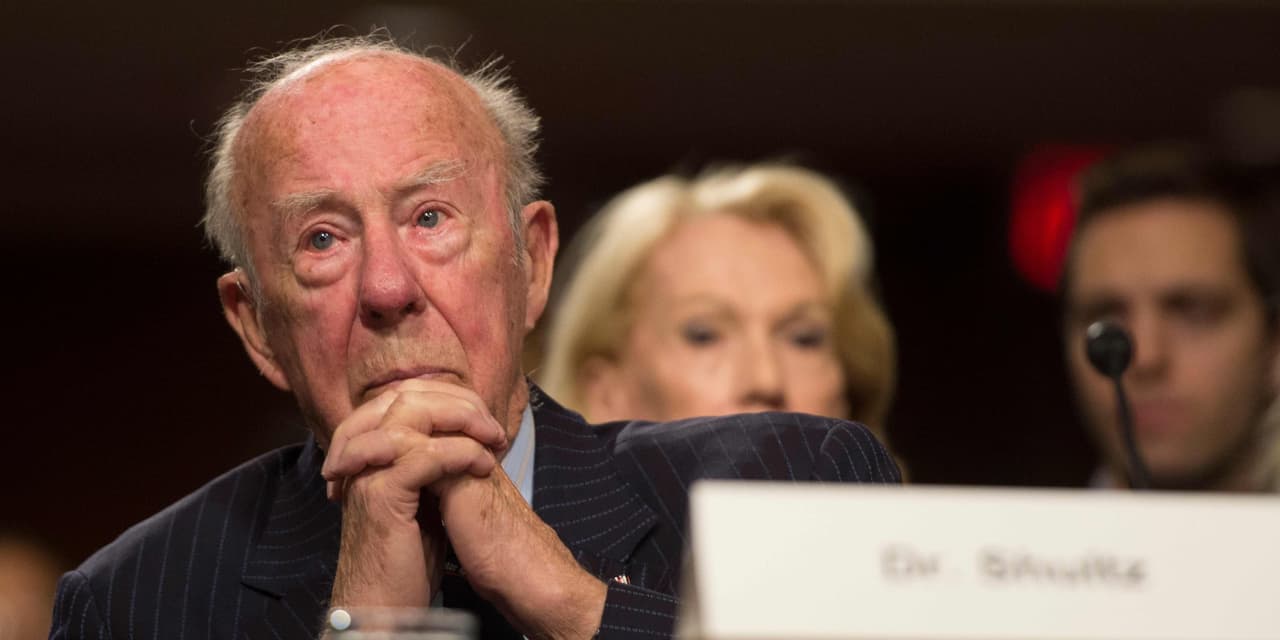

Before his death on Feb. 6, George P. Shultz, a former secretary of the Treasury and secretary of state, co-wrote a final commentary warning of the dangers posed by the vast increase in U.S. government spending in recent years, including during the COVID-19 crisis.

STANFORD, Calif. (Project Syndicate)—Many in Washington now seem to think that the federal government can spend a limitless amount of money without any harmful economic consequences. They are wrong. Excessive federal spending is creating grave economic and national-security risks. America’s fiscal recklessness must stop.

The COVID-19 crisis has provided the latest impetus for government spending, even to the point of steering the American mind-set toward socialism—a doctrine that has always harmed people’s well-being.

Dangerously shortsighted

But some say there is no need to worry about excessive spending. After all, they argue, record-low interest rates apparently show no sign of increasing. The economy was humming along just fine until the pandemic hit, and will no doubt rebound strongly when it ends. And is there even a whiff of inflation in the air?

“ Excessive federal spending is creating grave economic and national-security risks. America’s fiscal recklessness must stop. ”

This thinking is dangerously shortsighted. The fundamental laws of economics have not been repealed. As one of us (Cogan) demonstrated in his book “The High Cost of Good Intentions,” profligate government spending invariably has damaging consequences.

Axel Weber: Inflation could make a stealthy comeback, with devastating consequences

High and rising U.S. national debt will eventually crowd out private investment, thereby slowing economic growth and job creation. The Federal Reserve’s continued accommodation of deficit spending will inevitably lead to rising inflation. Financial markets will become more prone to turmoil, increasing the chance of another big economic downturn.

Willem H. Buiter: The Fed must monetize the debt created by the pandemic relief efforts

Financial markets’ current relative calm and low consumer-price inflation are no cause for comfort. Previous periods of sharp increases in inflation, rapidly rising interest rates, and financial crises have followed periods of excessive debt like a sudden wind, without warning.

Shultz and Taylor’s book “Choose Economic Freedom” shows that economic indicators in the United States gave no hint in the late 1960s of the subsequent rapid rise in inflation and interest rates in the early 1970s. Likewise, financial markets during the years immediately preceding the 2007-09 Great Recession provided little indication of the calamity that would ensue.

So, what should today’s policy makers do? Higher tax rates are not the answer. Even before the pandemic hit, every federal tax rate would have had to be increased by one-third in order to finance the current level of federal spending without adding to the national debt. Such an increase would have harmful effects—similar to those of mounting public debt—on economic growth and job creation.

Counterpoint by Robert Skidelsky: In a complete turnaround from the Great Recession, fiscal policy is now the only game in town

No peace dividend

Congress may be tempted to reduce defense spending to help close the deficit, as it often has done in the past. But these previous efforts demonstrably failed. Rather than reduce the budget deficit, Congress instead used the savings from lower defense outlays to finance additional domestic spending.

Unless policy makers abandon their misguided beliefs about budget deficits, cutting defense expenditure now would produce the same result. More important, it would be a grave strategic mistake, weakening national security and emboldening the country’s foreign adversaries—particularly now that China is flexing its muscles in Asia and investing heavily in its military.

Throughout U.S. history, the federal government’s ability to borrow during times of international crisis has proven to be an invaluable national-security asset. Two hundred years ago, the ability to borrow was instrumental in America maintaining its independence from England. During the Civil War, it was crucial to preserving the union. And it proved decisive in defeating totalitarian regimes in the two world wars of the 20th century.

The U.S. government’s careless spending is jeopardizing this asset. If the country continues along its current fiscal path, the federal government’s borrowing well will eventually dry up. When it does, America will be far less able to counter national-security threats. As hostile foreign governments and terrorist organizations recognize this, the world will become a far more dangerous place.

Policy makers’ mistaken belief that deficits and debt don’t matter is the sad culmination of a long downward slide in fiscal responsibility. From 1789 to the 1930s, the federal government adhered to a balanced-budget norm, incurring fiscal deficits during wartime and economic recessions, and running modest surpluses during good times to pay down this debt. This prudent management of the federal finances was instrumental in establishing America’s strong position in world financial markets.

FDR ruined it

President Franklin D. Roosevelt’s New Deal broke this norm, and deficit spending has since become a way of life in Washington, with the federal government outspending its available revenues in 63 of the 75 years since the end of World War II.

At first, elected officials were deeply concerned about the adverse consequences of their excess spending. But over time, this anxiety gradually lessened. Annual deficits grew so large that by the mid-1970s the national debt was growing faster than national income.

During the last decade, any remaining fiscal concerns in either the Democratic or Republican parties have seemingly vanished.

Freed from a belief that rising deficits and debt are harmful, policy makers unleashed a torrent of new spending. By fiscal year 2019, the federal government was spending $1 trillion per year more in inflation-adjusted terms than it had a dozen years earlier. In fiscal year 2020, the federal government added nearly another $2 trillion of new spending in response to the pandemic, raising the national debt to 100% of national income. This year, another trillion dollars of new spending—if not more—appears to be on the way.

The momentum toward more spending and exploding debt may currently appear unstoppable. But sooner or later, people will look at the facts, see the destructive path fiscal policy is now on, and recognize that they and the economy will be better off with a different approach.

At that point, America’s democratic system will say the expenditure growth must stop.

George P. Shultz, a former secretary of state (1982-89), secretary of the Treasury (1972-74), and secretary of labor (1969-70), was a fellow at the Hoover Institution. He died on Feb. 6 at the age of 100. John F. Cogan is a senior fellow at the Hoover Institution and a faculty member in the Public Policy Program at Stanford University. John B. Taylor, a former undersecretary of the Treasury (2001-05), is professor of economics at Stanford University and a senior fellow at the Hoover Institution. He is the author of “Global Financial Warriors” and co-author (with George P. Shultz) of ” Choose Economic Freedom.”

This commentary was published with permission of Project Syndicate—America’s Excessive Government Spending Must Stop.

More economic commentary from Project Syndicate:

Diane Coyle: It’s about time that economists gave nature its due

Mariana Mazzucato: From vaccines to moonshots, governments can succeed if they focus on accomplishing the mission

James K. Galbraith: Biden’s economic rescue plan is bold enough to actually work