This post was originally published on this site

Inflation in the U.S. has been low for a long time. It was running at an annual rate of 2.4% before the pandemic and has been 1.4% over the past year. But the dramatic increase in federal borrowing during the COVID-19 pandemic as well as the increase in the U.S. money supply brought about by the Federal Reserve’s securities purchases are putting inflation fear on the front burner for investors.

Jeffry Bartash explains the renewed worry over inflation, while William Watts includes inflation as one of three ingredients for a worst-case scenario for the U.S. stocks.

On the other hand, Mark Hulbert points out that historically, stocks have been a hedge for investors against inflation.

More on government stimulus money and inflation:

Texas, the grid and renewable energy

The power outages in Texas have led to finger-pointing, with some people blaming renewable energy (specifically, frozen wind turbines) and some blaming fossil fuels and global warming. Rachel Koning Beals explains how varied remedies can prevent another power crisis.

Read on: After power outages end, Texas must debate its electricity independence

More on climate change:

What would Bogle say?

Brett Arends considers whether Vanguard founder Jack Bogle would want to invest in today’s stock market.

An income idea: The place of junk bonds in a retirement portfolio

Digging deeper into marijuana stocks

MarketWatch photo illustration/iStockphoto

President Joe Biden’s election in January and the Democratic sweep of Congress has given investors in marijuana companies and exchange-traded funds hope for massive gains if cannabis is fully legalized in the U.S. Here’s a deep dive into the differences between U.S. and Canadian marijuana stocks, featuring data sets and interviews with the only two active ETF managers in the space.

Go to Cannabis Watch for full coverage of this dynamic industry.

Read on: To profit from planned merger of Tilray and Aphria, buy Aphria, says this analyst

The IRS, stimulus checks and tax refunds

Getty Images

The Internal Revenue Service has finished sending out the second round of stimulus checks. If you didn’t receive yours, here’s what to do. Andrew Keshner also explains the dangers of borrowing against an anticipated income-tax refund.

Stories about exodus from Silicon Valley are exaggerated — or premature

Levi Sumagaysay describes how San Francisco tech companies’ growth and employment have continued through the pandemic, even if there are some dark undercurrents.

A tech investing idea

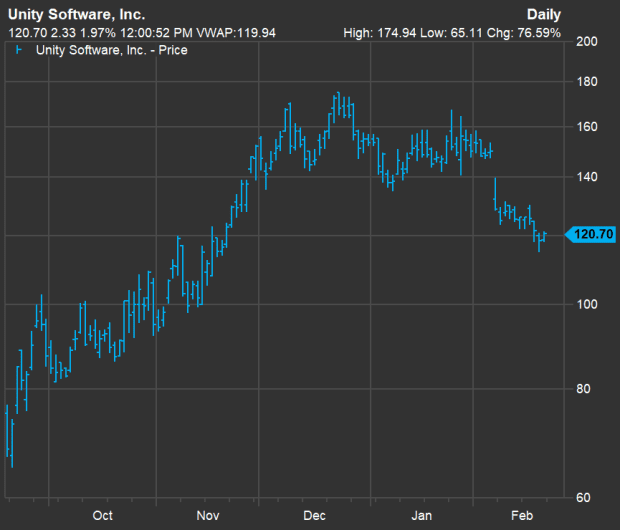

Unity Software priced its initial public offering at $52 on Sept. 17, 2020.

FactSet

Shares of Unity Software U, +2.56% have pulled back this month, as this chart shows. Cody Willard believes this is a good time to consider the stock because of the company’s leading market share as a platform for videogame developers.

In an early COVID epicenter, streets and bars now buzz

In Madrid, 900 people were dying a day during the early days of the coronavirus. Now it’s 300, and that feels acceptable. “We are learning to live with death,” a Spaniard says.

Also: COVID-19 is on the run — expect the pandemic to be under control by Memorial Day

MarketWatch premium

A perk of being a MarketWatch subscribers: an explanation of how short sellers help all investors and a look at two ETFs that provide high levels of income to investors while moderating risk.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.