This post was originally published on this site

General Electric is no longer the blue-chip titan it was back in the 1990s. But the more the company’s past accounting practices come to light, the less clear it becomes that the company under legendary CEO Jack Welch was ever what it claimed to be.

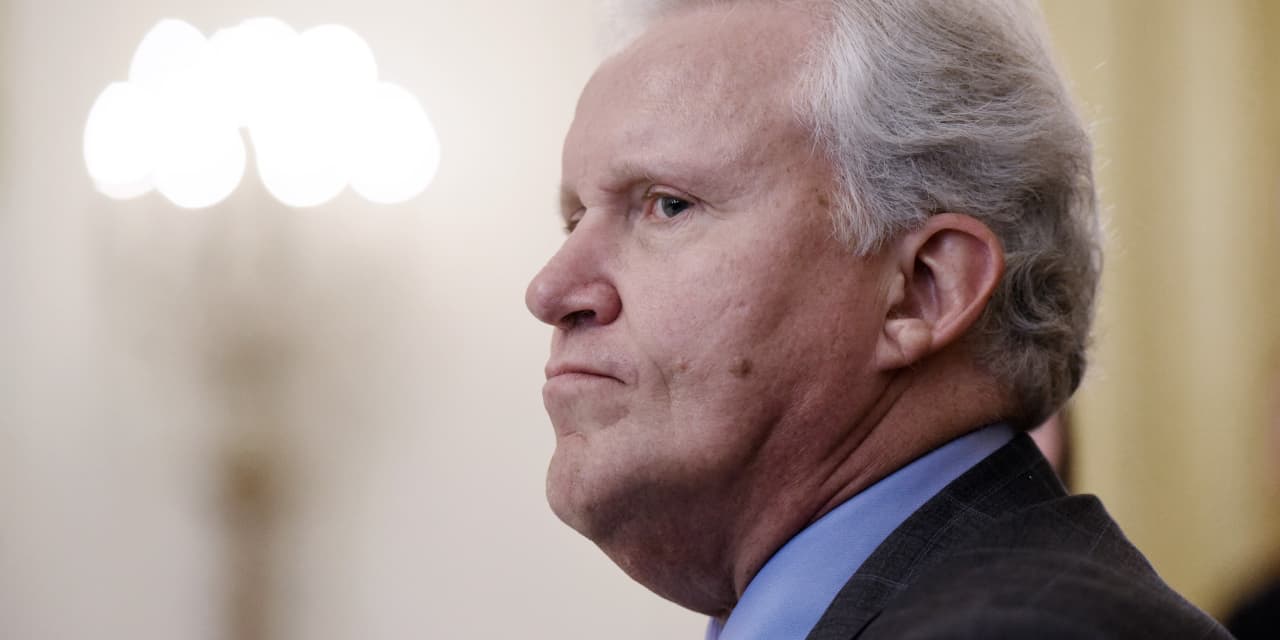

Jeff Immelt, successor to Welch, who died last year, was interviewed by “Freakonomics” author and broadcaster Stephen Dubner, who put to Immelt the question of whether the company’s “really creative and aggressive accounting” was a counterproductive institutional practice.

Well, what I learned growing up in GE was how to be a good operator, how to invest in growth, how to drive productivity, how to manage costs, those kinds of things. Interwoven in this story is always going to be the growth of financial services. And financial services has, let’s say, historically just been more fluid because of the way reserves are done and things like that.

Dubner followed up, asking about how GE’s power business accounted for orders. Immelt sounded a bit more defensive. “We paid external auditors hundreds of millions of dollars a year to review our books. We had a 20-person disclosure committee that was made up of midlevel managers that approved everything we said, everything we ever did. We were regulated by the Fed for six years. I had two audit committee chairs. One was a retired CEO of JPMorgan, the other then was the retired commissioner of the SEC. I know what’s been written, Stephen, but all I can tell you is what we tried to do,” he said.

Immelt stepped down in 2017 after 16 years as chief executive.

GE was fined $200 million by the Securities and Exchange Commission over alleged disclosure violations in its power and insurance businesses between 2015 and 2017. The SEC in a separate settlement said GE used improper accounting methods to increase its reported earnings or revenues and avoid reporting negative financial results in 2002 and 2003.

Over the last 20 years, GE’s stock GE, -1.94% has dropped by a 3.8% compound annual growth rate, compared with the 8.1% gain for the S&P 500 SPX, -0.44% over the same time frame, according to FactSet Research data.

Listen to the full interview with Immelt here.