This post was originally published on this site

The S&P 500’s trailing 12-month return is poised to rocket by 60 percentage points by the end of March.

This isn’t because the U.S. stock market is about to explode upwards. Instead, what’s required to accomplish this feat is that the stock market stay level between now and late March. That’s when the February-March 2020 “waterfall” decline will drop out of the trailing 12-month period—and at that point, the S&P 500’s SPX, -0.03% trailing 12-month return jumps to 78% from its current 18%.

The reason to point this out is not just to remind us to be on the lookout for what would otherwise be an inexplicable jump in trailing 12-month returns, or to put in context advisers’ marketing materials that will suddenly be able to claim outrageously large trailing-year returns.

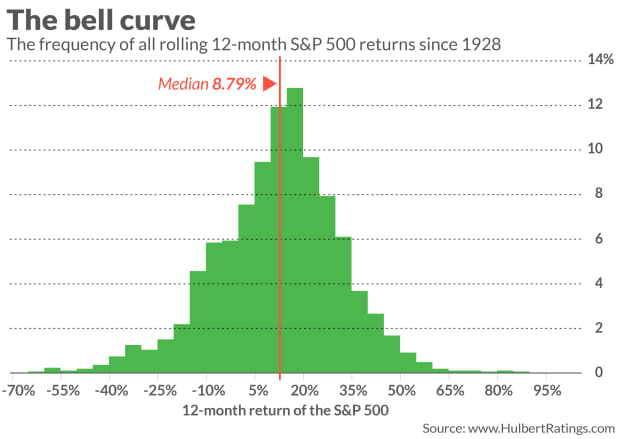

The other reason to focus on this: A 78% 12-month return would be one of the highest in U.S. stock market history, and regression to the mean will almost certainly kick in. Just take all rolling 12-month returns for the S&P 500 since 1928: a 78% gain would be higher than 99.5% of them, as is illustrated in the histogram above.

Why would spectacular gains set up investors for disappointment? One big reason is that corporate earnings cannot grow fast enough to support the market producing more than a year or so of high double-digit returns.

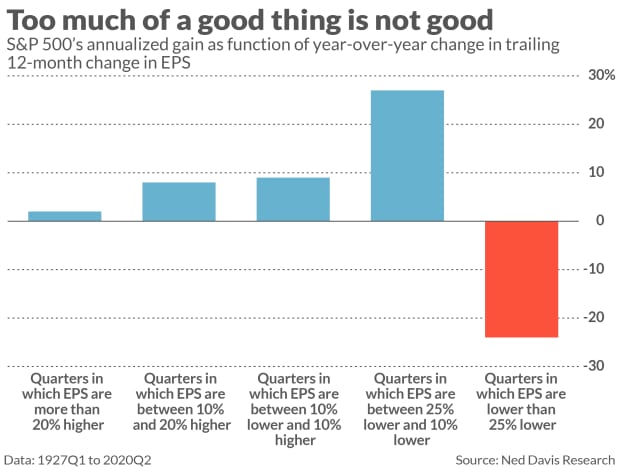

This is shown dramatically by an analysis conducted by Ned Davis Research. The firm found that the S&P 500 on average is mostly flat during quarters in which earnings per-share are much higher than they were a year previously. The details are summarized in the chart below:

Notice that the stock market historically has performed the best in those quarters in which the S&P 500’s earnings per share were between 10% and 25% lower than where they stood one year previously. In contrast, the S&P 500 produces an average gain of just 2.6% during those quarters in which year-over-year earnings growth is above 20%.

Also notice that year-over-year EPS growth is poised to not just be 20%. According to S&P estimates, as-reported EPS for the S&P 500 in 2021 will be 68% higher than for 2020.

The reason the stock market doesn’t typically respond favorably to such impressive earnings growth is that it is forward looking — a discounting mechanism. The market will have already shot upwards in the quarters prior to when it actually produces high-double-digit earnings growth. When that quarter of explosive earnings growth finally arrives, the market will have long since shifted its focus to what subsequent quarters will bring.

How the market reacted to the end of the Spanish Flu pandemic

An interesting additional perspective comes from reviewing how the stock market performed after the Spanish Flu pandemic receded a century ago. That’s relevant because many of today’s more exuberant bulls are forecasting what they are calling a repeat of the “Roaring 20s” that occurred in the wake of the Spanish Flu.

The third and final wave of that pandemic didn’t end until the middle part of 1919. Yet the U.S. stock market did not rally over the subsequent year and a half. Over the latter half of 1919, in fact, the Dow Jones Industrial Average DJIA, +0.29% was flat—gaining just 0.2%. It lost 32.9% in 1920. It wasn’t until December 1924 that the Dow rose above were it stood in October 1919.

The Roaring 20s of our imaginations are more a function of the latter half of that decade than the earlier, at least as far as the stock market is concerned.

As you contemplate the stock market’s prospects over the next couple of years, a Wall Street saying to keep in mind is to “buy the rumor and sell the news.” Investors collectively over the last year have bought the rumor that the pandemic was about to be a thing of the past and economic growth accelerate. With at least a glimmer of hope that this rumor may finally be about to become a reality, it may be time to think about shifting to “sell the news.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Famed investor Jim Rogers says don’t buy America stocks at highs. Here’s what he likes instead

Plus: Inflation worries are back. Here’s what you should worry about – and what you shouldn’t