This post was originally published on this site

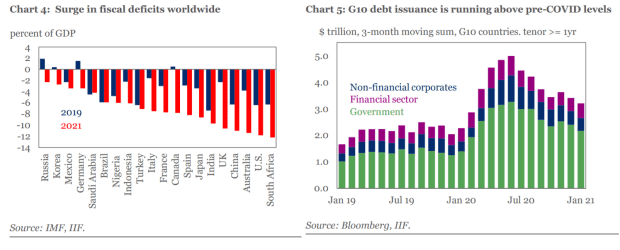

Governments and countries accumulated more debt during the COVID-19 pandemic than they did during the 2008-09 financial crisis, a leading trade group said on Wednesday.

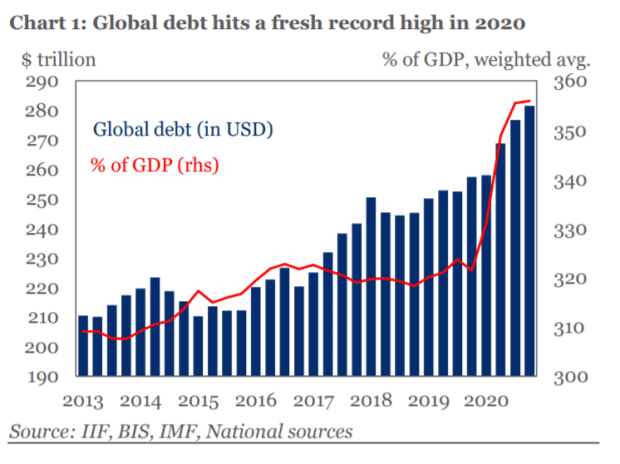

The Institute of International Finance said global debt-to-GDP surged by 35 percentage points to over 355% in 2020, rising by $24 trillion to $281 trillion. The global debt ratio rose 10 percentage points in 2008 and by 15 points in 2009.

The IIF said government debt rose to 105% of GDP, from 88% in 2019. Mature countries added $10.7 trillion in government debt to try to contain the crisis, the IIF said. The IIF said global government debt should rise another $10 trillion this year.

The pace of COVID-19 vaccination differs considerably across countries, and difficulty in vaccine rollout could delay recovery, prompting further debt accumulation, the trade body said.

Switzerland was the only mature market economy recording a modest decline in government debt ratio, the IIF added.

Nonfinancial private-sector debt rose to 165% from 124%. Many large firms in the U.S. and Japan took advantage of supportive government measures to boost their cash stockpiles. The IIF said the decline in the number of firms filing for insolvency has been extraordinary but is dependent on continued government support.