This post was originally published on this site

President Joe Biden won’t get everything he wants, but the size of the coronavirus relief spending package that’s likely to come out of Congress is expected to be not far off his $1.9 trillion proposal, according to a Deutsche Bank survey.

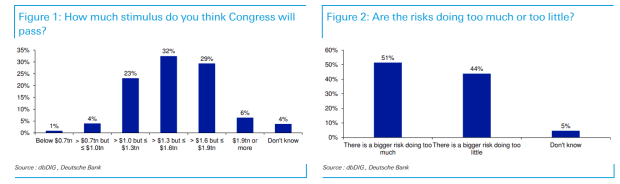

The left-hand chart below, highlighted in a Friday note from macro strategist Jim Reid, showed that 68% of the 450 global market professionals who participated in the survey over the last two days expect the package to total more than $1.3 trillion, while 35% expect it to come in above $1.6 trillion.

Deutsche Bank

Meanwhile, the chart on the right shows that a bare majority see the risks around the package tilted toward doing “too much” as opposed to “too little.”

“So the debate is relatively balanced, but generally respondents think it will be an aggressive package and slightly worry it will be too big,” Reid said.

Though the survey didn’t specifically ask, Reid said he suspects that “overheating” is the biggest concern.

Expectations for another large jolt of government spending to boost the economic recovery from the coronavirus pandemic is widely cited by analysts and investors as a main driver of the stock market’s run to all-time highs.

While momentum in the equities rally has stalled a bit this week, stocks have bounced back from a late January wobble. The S&P 500 SPX, +0.09%, Dow Jones Industrial Average DJIA, -0.19% and Nasdaq Composite COMP, +0.11% all on track for weekly gains after hitting all-time highs this week. The small-cap Russell 2000 RUT, -0.09%, underlining optimism over a surge in economic growth, has outpaced its large-cap counterparts, rising more than 10% in the year to date.

“More than the economic data or earnings reports, the equity market is being driven by current and expected liquidity pumped into the economy,” said David Donabedian, chief investment officer of CIBC Private Wealth, in emailed comments.

Investors are looking beyond expectations for the relief package to come in near the high end of estimates, also anticipating a round of heavy infrastructure spending, which would hit the economy in late 2021 and 2022, he said.

Fears of the economy overheating, which would stoke inflation, have been blamed in part for a selloff at the long end of the Treasury bond market that saw the yield on the 10-year note TMUBMUSD10Y, 1.199% flirting with 1.2% on Friday, despite a lackluster January inflation report on Thursday .

“Investors should keep an eye on what could impede progress in the equity market — bond yields,” Donabedian said. “The question is: Will all of this government spending spark a strong economic recovery but also cause inflationary pressures? This is the largest item on the risk side of the ledger and we need to keep an eye on upcoming inflation data.”

A debate broke out last week between economists over whether the proposed fiscal stimulus was too big. Economist Larry Summers, who served as Treasury secretary in the Clinton administration, argued in a Washington Post guest column that the Biden plan risked creating “inflationary pressures of a kind we have not seen in a generation,” and criticized administration officials for dismissing “even the possibility of inflation.”

Administration officials denied they were dismissive of inflation prospects. Proponents of the stimulus program have argued that the bigger danger to the economy as it attempts to bounce back from the COVID-19 pandemic is to do too little in way of a fiscal boost rather than too much. It’s easier to rein in overheating, they have argued, than to recover all the jobs lost to the pandemic and restore economic growth.