This post was originally published on this site

A solid set of corporate earnings helped lift European stocks higher on Thursday.

The Stoxx Europe 600 SXXP, +0.28% rose 0.3%, after ending lower for two sessions. U.S. stock futures ES00, +0.33% also advanced.

The latest reading showing core U.S. prices were flat in January helped quell talk about possible inflation coming from the Biden administration’s proposed $1.9 trillion coronavirus relief package for the world’s largest economy. “With the green light from the inflation data, Joe Biden could easily defend his $1.9 trillion stimulus package in Senate, while the Fed continues massive bond purchases and its near-zero rate policy a couple of more years,” said Ipek Ozkardeskaya, senior analyst at Swissquote.

Corporate earnings were generally well-received.

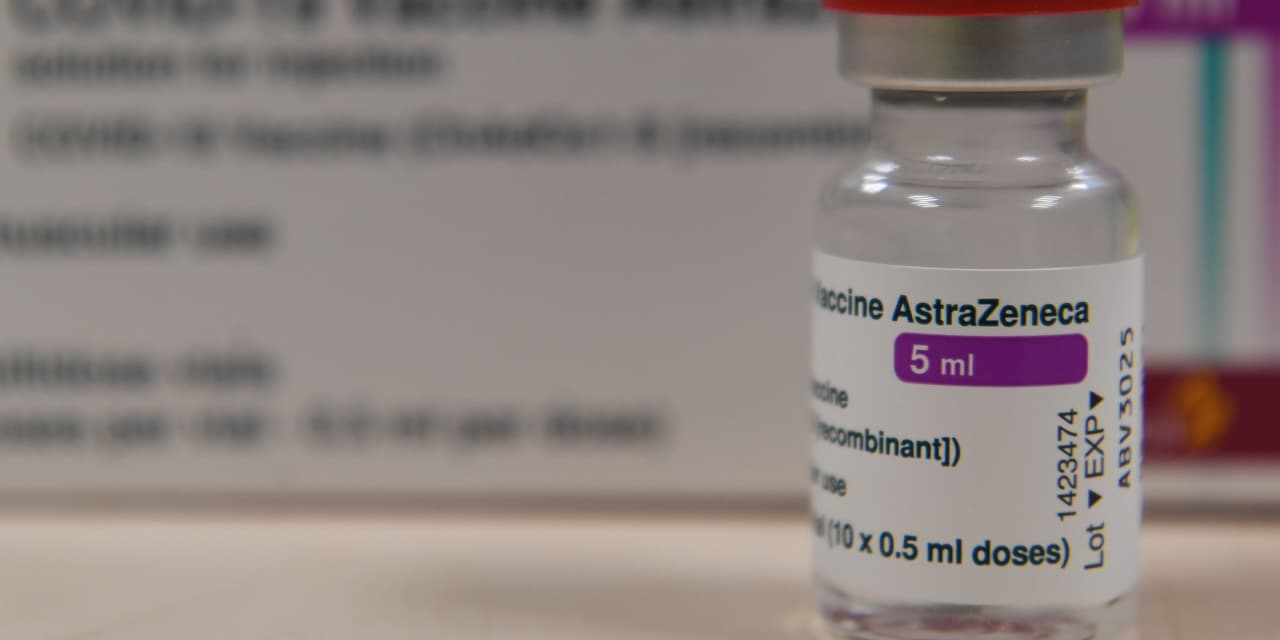

AstraZeneca AZN, +1.97% AZN, -0.87% shares edged up 2%, after the U.K.-Swedish pharmaceutical reported smaller earnings but stronger revenue than expected, declared a steady dividend, and guided for low-teens percentage growth in revenue this year. “Some of these numbers have come in below analyst expectations, however with the share price down over 15% over the last three months, one has to question whether these minor misses will matter that much,” said Michael Hewson, chief market analyst at CMC Markets U.K.

Royal Mail RMG, +5.00% shares surged 6%, after lifting its operating profit target due to increased online-shopping deliveries.

Crédit Agricole ACA, +4.26% shares rose 5%, as the French bank reported a surprise fourth-quarter profit, though it was 93% lower than a year ago.

Unibail-Rodamco-Westfield URW, -14.06% shares tumbled 14%, after the shopping-mall operator said it was suspending dividends for three years as adjusted earnings per share dropped 41% last year.