This post was originally published on this site

The numbers: Nearly 800,000 people applied for unemployment benefits in early February, signaling that scores of workers are still losing their jobs despite the rollout of coronavirus vaccines and a decline in Covid-19 cases.

Initial jobless claims filed traditionally through the states fell by 19,000 to 793,000 in the seven days ended Feb. 6, the government said Thursday.

Economists surveyed by Dow Jones and The Wall Street Journal had forecast initial jobless claims to total a seasonally adjusted 760,000.

The decline was basically a mirage, though. New claims from two weeks ago were raised to 812,000 from an originally reported 779,000, an unusually large revision that likely reflects ongoing problems in the collection of unemployment data.

Another 334,524 applications were filed through a temporary federal-relief program.

Adding up new state and federal claims, the government received 1.15 million applications last week for unemployment benefits, based on actual or unadjusted figures. Combined claims have yet to drop below 1 million a week since last May.

Before the pandemic, new claims were running in the low 200,000s and they had never risen by more than 695,000 in any one week.

See: A visual look at how an unfair pandemic has reshaped work and home

What happened: New applications for jobless benefits fell the most in Florida, New York, Kansas, Maryland and Texas. The only states with large increases were Ohio and California.

The number of people already collecting state jobless benefits, meanwhile, fell by 145,000 to a seasonally adjusted 4.5 million. That’s the lowest level since the pandemic began.

Yet an additional 4.77 million who’ve exhausted state compensation are getting benefits through an emergency program funded by the federal government. That marked a large 1.17 million spike from the prior week, another sign that many people still can’t find work or go back to their old jobs

Altogether, the number of people reportedly receiving benefits from eight separate state and federal programs jumped by an unusually large 2.59 million to an unadjusted 20.43 million as of Jan. 23. The increase probably stems in part from the government extending unemployment benefits and making them more generous.

Fewer than 2 million people were getting benefits before the pandemic erupted.

Note to readers: Jobless claims have correctly reflected the rise and fall in unemployment during the pandemic, but a government watchdog agency found the number of distinct individuals applying for or collecting benefits has been inflated by fraud, double counting and other problems. Economists say to pay attention to the direction of claims instead of the totals.

Read: Jobless claims inflated, GAO finds

Also: Why the inaccurate jobless claims report is still useful to investors

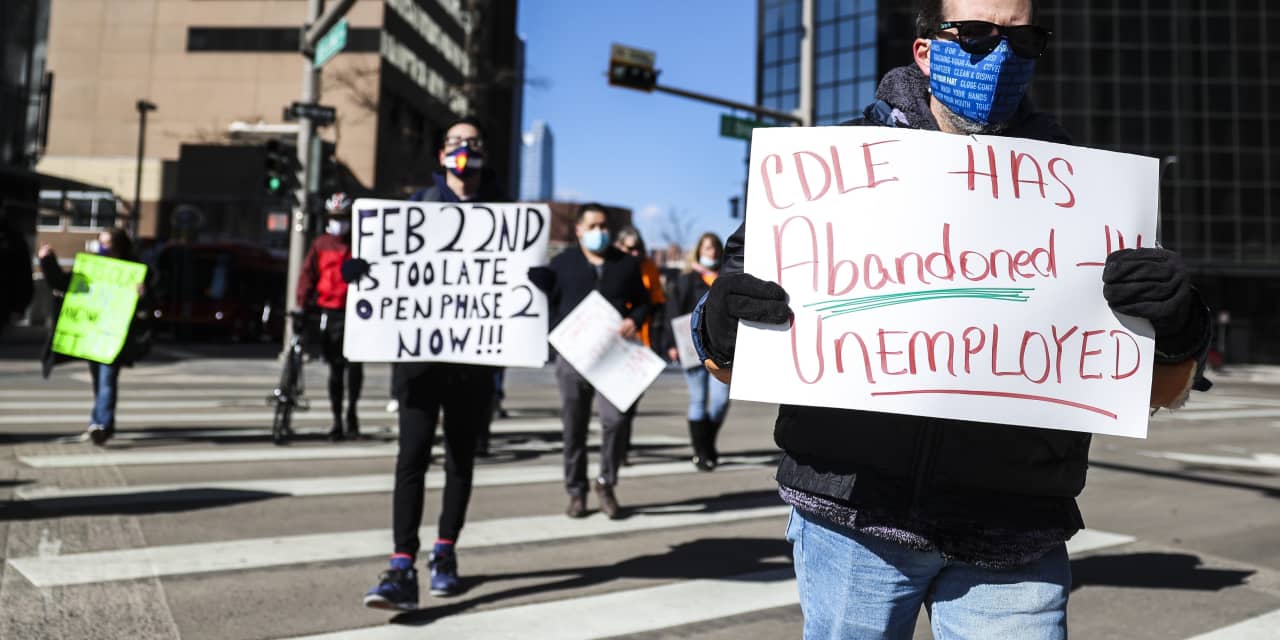

The big picture: The record wave of coronavirus cases over the winter is fading again and more workers might be allowed to return to their jobs soon. Many employees at restaurants, hotels, theaters, casinos and the like were laid off at the end of 2020 after states reimposed some restrictions to stem the spread of the virus.

Hiring is likely to accelerate later in the year as more Americans are vaccinated and the economic recovery pick up steam, but it could be slow going for a few months. The big worry is that many jobs could be lost permanently if companies aren’t allowed to resume normal or somewhat normal operations soon.

Market reaction: The Dow Jones Industrial Average DJIA, +0.20% and S&P 500 SPX, -0.03% were set to open lower in Thursday trades.