This post was originally published on this site

A highflying stock market is reminding nervous investors of the 2000 dot-com bubble burst, but they might be better off studying more recent history, analysts said.

It is important to remember “that current Fed policy, absolute interest rates, the yield curve, credit trends and money availability are in a very different place than in 1999-2000,” wrote Tony Dwyer, chief market strategist at Canaccord Genuity, in a Monday note.

In addition, high valuations — measures of a stocks price relative to other metrics such as earnings — are being gauged against last year’s pandemic-inspired trough in profit rather than building on record earnings, as was the case in 2000, he said.

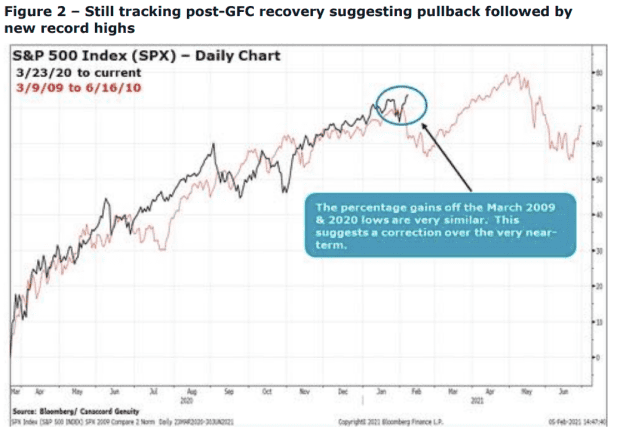

Dwyer said 2021 could instead play out more like the postcrisis scenario seen in 2010, which would point the way to a “solid year” for the market, but with a bumpy ride thanks to “multiple first-half corrections” along with a compression in price-to-earnings ratios that is likely to come from a historic surge in earnings per share rather than something more onerous.

Dwyer highlighted how the S&P 500 SPX, +0.34% move off its March 23 pandemic low has echoed the index’s rebound off its March 2009 low (see chart below).

Canaccord Genuity

Through the Feb. 2 close — 218 days after the March 23 low — the S&P 500 was up 71%. In the 218 days after the March 9, 2009, low, the index rose 70%, according to Dow Jones Market Data.

At this point in the post-2009 playbook, the S&P 500 began a pullback. This time around, the S&P 500 has continued to march higher, logging back-to-back record finishes on Thursday and Friday and was up 0.4% in early afternoon trade on Monday.

After a late January wobble tied to the trading frenzy around GameStop Corp. GME, -7.90%, stocks have enjoyed a broad February rally. The Dow Jones Industrial Average DJIA, +0.41% was up around 150 points, or 0.5%, on Monday, on track to top its record close from Jan. 20.

DataTrek Research co-founder Nicholas Colas, who has regularly highlighted the “2009 playbook” since the March lows, noted last week that the 2010 pullback was pretty much a “textbook” affair, with the S&P 500 falling 8.2% over 13 trading days. The index recovered over the following 30 trading days, ending March 2010 at new highs, he said.

Colas said the observation wasn’t “so much a trading call as an illustration of what happens as we get deeper into a cyclical recovery.”

He noted that the 2020 chart has diverged from the 2009 path several times and might continue to do so in 2021, but argued that with so many observers looking for a pullback, the playbook might offer guidance “on what to expect and where to start buying.”

Meanwhile, Dwyer highlighted another echo of 2010. He noted that since the start of earnings season, according to Refinitiv data, fourth-quarter 2020 year-over-year earnings have improved by 11.9 percentage points (from -10.3% to +1.6%), the fifth-largest improvement on record dating back to the third quarter of 2002 and matched only by the 2009-10 recovery.