This post was originally published on this site

As the Treasury Department holds its largest auctions on record, global central banks could play a familiar role in helping to sop up the deluge of debt supply set to hit markets this year.

The strong economic rebound by major exporters such as Taiwan, China and Thailand relative to the U.S., along with a weaker dollar, could help underpin demand for government bonds as Americans wonder who will finance U.S. deficits set to expand as a result of the pandemic-induced fall in economic activity and fiscal relief packages.

That could see reserve managers for overseas central banks reprise their historical role as a key buyer of U.S. government debt, after being edged out by domestic investors and the Federal Reserve in the past few years.

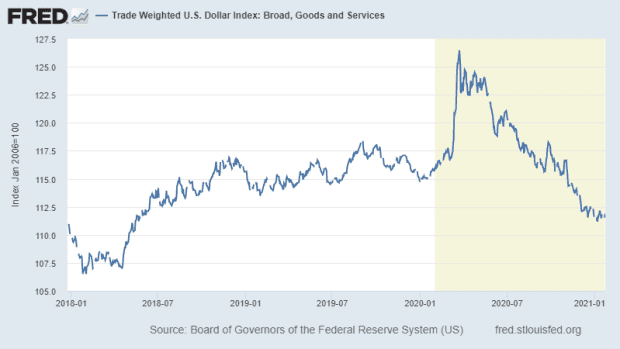

The trade-weighted U.S. dollar index is down to 111.89, around its lowest levels since May 2018. The dollar has shed 11% of its value relative to other currencies from its recent peak hit last March.

Meanwhile, the 10-year Treasury note yield TMUBMUSD10Y, 1.068% was at 1.07%, around 16 basis points higher than where it started at the end of the year. Bond prices move in the opposite direction of yields.

FRED

Analysts at BofA Global Research says central banks serve as ballast for the Treasurys market when the dollar comes under pressure for two reasons.

One, central banks needs to buy more dollar-denominated holdings to offset the decline in the value of such assets.

Two, a weaker greenback has led the central banks of major exporting economies to accumulate U.S. government debt in a bid to limit the strength of their currencies, and sap the competitiveness of their exporters.

Oliver Brennan, head of macro strategy at TS Lombard, says emerging market central banks are likely to show increased demand for U.S. dollar-denominated reserves. He estimated foreign exchange reserves among these deep-pocketed market participants had risen by $500 billion since the beginning of last year.

But it’s unclear how much of this accumulation has or will translate into demand for U.S. government bonds.

Though some Asian economies like Taiwan, Singapore and India have seen an increase in their official Treasurys holdings last year, the overall sum held by overseas central banks and sovereign-wealth funds has largely remained stable, increasing marginally to $4.17 trillion in November from $4.10 trillion in Nov. 2019.

The paucity of inflows could reflect the efforts of central banks to diversify the makeup of their foreign exchange reserves, said Khoon Goh, head of Asia research at ANZ, in emailed comments.

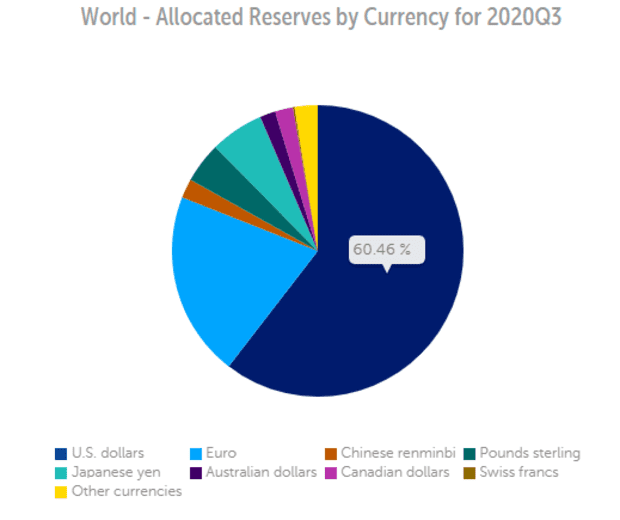

Goh pointed to data from the International Monetary Fund, which showed a gradual decline in U.S. dollar-denominated assets as the overall share of central banks’ reserves down to 60.5% in the third quarter of 2020, from 63.5% in the third quarter of 2017.

IMF

But Goh said central banks were likely to slow down the pace of reserve accumulation due to increased scrutiny and pressure from the U.S. Treasury Department over currency intervention policies.

U.S. Treasury Secretary Janet Yellen in her confirmation hearing said the value of the dollar should be determined by markets, and that the U.S. should oppose attempts by other countries to weaken their currency to gain a competitive advantage.