This post was originally published on this site

If nothing else, America’s new investing class got a blunt education that brokers can, and do, refuse orders. Robinhood and several other brokerages on Thursday refused or limited trading in GameStop and other stocks that have been surging due to interest from retail investors looking at Reddit and other social-messaging services.

“If your trades are causing the broker to take on ‘unreasonable risk,’ then they will either offer a terrible spread or refuse the order,” points out Tim Vollans of the Macrodesiac blog. “If a retail broker can’t pass the order on there is no trade. It takes two to tango, and the deep pockets decided not to play anymore.”

Robinhood said it had to act to meet its own capital requirements and clearinghouse deposit obligations. (Here’s a good Twitter thread explaining these rules.) But after raising more than $1 billion this week and tapping credit lines from its banks, the number-one app on both the Apple AAPL, -3.50% and Android GOOGL, +1.88% stores in the U.S. says it is ready to allow limited buying again. So is there still time for one last hurrah?

Down 44% on Thursday, videogames retailer GameStop GME, -44.29% was rallying in premarket trade — up more than 100% in the early hours — and movie-theater chain AMC Entertainment AMC, -56.63%, another Reddit board favorite, was surging too. It is also the final day of the trading month, so beaten-up hedge funds that have been betting against the company will be less inclined to put fresh money to work.

Just a quick look at the fundamentals — according to FactSet, GameStop at Thursday’s close was trading 38 times book value, and 63 times cash flow. Just as a comparison, Best Buy BBY, -1.11%, the electronics retailer, was trading 7 times book value and 5 times cash flow. But the only number that matters right now is short interest as a percentage of float. Depending where you look, it is somewhere in the 95% to 100% range, which actually represents a decline but still shows many funds haven’t closed their bets against the company.

Jani Ziedins of the Cracked Market blog says both sides of the GameStop trade have been too greedy. “The problem is when these people are sitting on a mountain of profits, rather than thank their lucky stars and lock-in these once-in-a-lifetime profits, they are too busy gloating and taunting the other side. Instead of being satisfied with nearly $500, bulls insist on waiting until this goes all the way to $1,000. And bears that captured a 77% tumble in 120-minutes, rather than jump on this historic move, they demanded it to go all the way to $5.

“And you know what, both sides are equally guilty of holding too long and letting these historic profits evaporated before their very eyes. As the saying goes, ‘Bulls make money, bears make money, and pigs get slaughtered.’ Don’t be a pig and take these spectacular profits when you have them. Because if you don’t, they will almost certainly be gone in a few hours.”

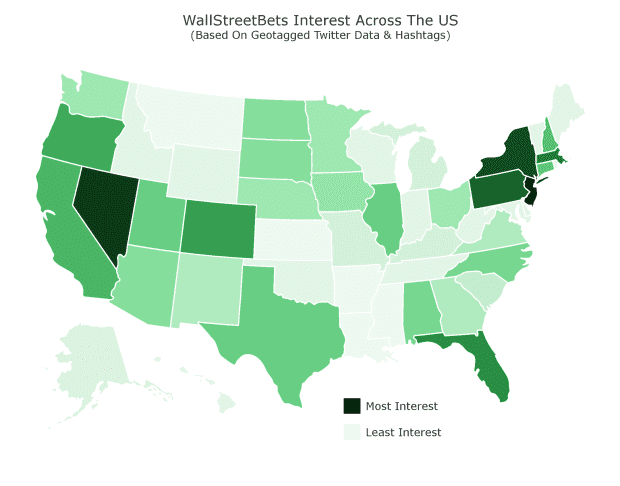

The chart

So where are the people who are on the Reddit Wall Street Bets based? According to bitreporter.com, which looked at geotagged Twitter TWTR, +7.01% data over the last month, the two top states are New Jersey and Nevada, where not coincidentally, gambling is legal. That fits with another research paper that finds a connection between actual gambling and so-called stock-market gambling.

The buzz

Novavax NVAX, +2.16% shares are set to rally, as the U.S. biotech said its COVID-19 vaccine was effective against coronavirus and the new U.K. strain, though not the South African variant.

Visa Inc. V, +1.67% reported better-than-expected earnings and revenue on Thursday and announced a new $8 billion buyback program, due to strong debit-card and e-commerce demand.

Friday’s earnings calendar includes industrial conglomerate Honeywell HON, +1.74%, toothpaste maker Colgate-Palmolive CL, +1.44%, drug company Eli Lilly LLY, +1.23%, and oil producer Chevron CVX, +0.93%.

The economics calendar includes data on personal income and speeches from two regional Federal Reserve presidents.

The markets

Not a great look, after the pretty solid 300-point bounceback for the Dow Jones Industrial Average DJIA, +0.99% on Thursday. Futures on the S&P 500 ES00, -0.62% slumped about 1% and the Nasdaq-100 contract NQ00, -0.97% dropped even more. The yield on the 10-year Treasury TMUBMUSD10Y, 1.074% moved back to 1.07%.

Futures on silver SI00, +5.59%, which has attracted retail interest, rose nearly 5%.

The tweet

Not everyone is pleased with the sudden interest in stocks.

Random reads

The inspirational tale of Bud the female parrot, who can fly again after her new owner cut potato chips from her diet.

Streaming service Spotify SPOT, -1.44% has patented technology to suggest songs based on mood.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.