This post was originally published on this site

That was fast.

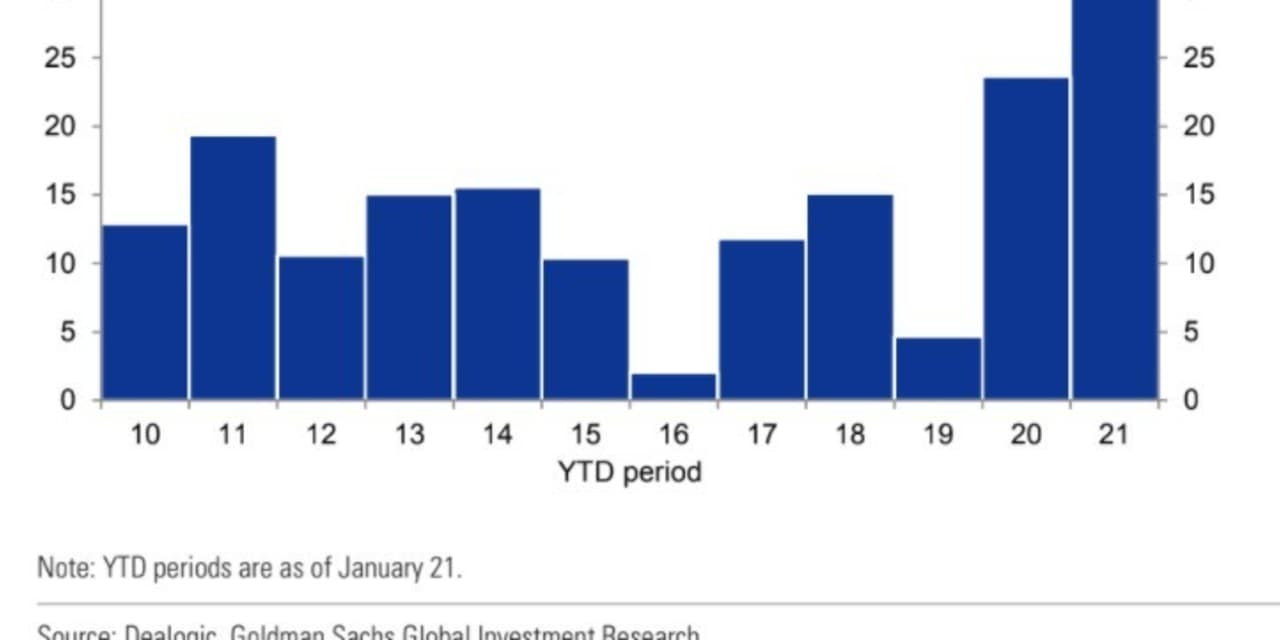

U.S. companies considered risky enough to warrant below investment-grade, or “junk,” credit ratings have borrowed about $32 billion in the corporate bond market so far in 2021, the fastest clip ever.

Goldman Sachs analysts pegged the new bond supply as “off to its strongest start ever,” through Jan. 20, or about 35% ahead of last year’s pace, “which itself was elevated relative to historical standards.”

Even while the pandemic crippled much of the U.S. economy last year, U.S. companies borrowed record amounts in the bond market, including making a big push in January. In doing so, they have seized on ultralow borrowing costs available through a global hunt for yield and the persistence of highly accommodative central bank policies, including by the Federal Reserve.

See: ECB leaves policy unchanged, but makes a ‘slight hawkish’ tweak to statement

But as Goldman’s team, led by Lotfi Karoui, pointed out in a weekly note, about 78% of this year’s junk-bond issuance has been earmarked for debt repayment and refinancing, or a “bondholder friendliness” that allows businesses to “further capitalize on historically low debt issuance costs,” without necessarily adding to their overall debt burdens.

Biden’s Treasury Secretary nominee Janet Yellen and a former Fed Chair, said this week during a confirmation hearing that the best policy was for lawmakers to “act big” to support struggling Americans, even though the federal debt is rising.

Yellen also said she would be a “voice for fiscal sanity” in the Biden administration, while also pointing both to interest rates that likely will stay low for a long time, and noting higher rates as a risk.

At last check, the Fed’s balance sheet was at $7.4 trillion, up from a recent low of about $3.8 trillion in Aug. 2019. The central bank’s balance sheet has mushroomed with its purchase of hundreds of billions of dollars worth of Treasury debt TMUBMUSD10Y, 1.091% and agency mortgage bonds each month since last spring, when U.S. COVID-19 infections first surged. For a few months, the Treasury was even buying corporate debt for the first time ever, through its slate of now curtailed emergency lending facilities.

With cash sloshing through financial markets, riskier assets have benefited, including U.S. stocks that booked their best inauguration day rise in 36 years, amid optimism about the new Biden administration’s ability to tamp down the pandemic and boost the economy.

Even so, stocks were taking a slight breather Friday, after setting records highs intra-week, with Dow Jones Industrial Average DJIA, -0.37% about 0.3% lower in afternoon trade and the S&P 500 index SPX, -0.13% off by about 0.2%. The junk-bond sector’s benchmark iShares iBoxx $ High Yield Corporate Bond ETF HYG, -0.19% was off 0.2%.

Karoui’s team at Goldman expects the U.S. junk-bond market to issue $300 billion in bonds for the full year, or roughly a 30% drop from the prior 12 months.

The team also brushed aside mounting investor concerns about the risk of rising interest rates, due to a “policy mistake that would ‘kill’ the business cycle.”

“We continue to think this risk is low at the current juncture and remain of the view that spreads are unlikely to drift wider in response to higher nominal yields,” the wrote.