This post was originally published on this site

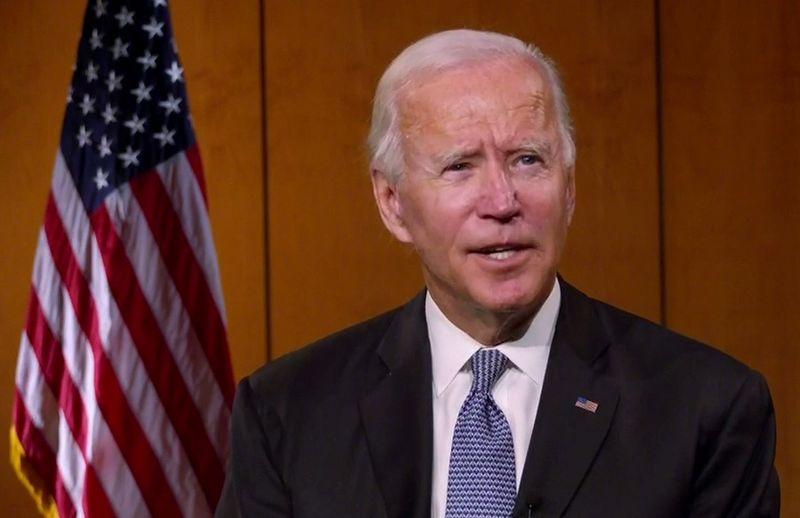

Investing.com – U.S. stocks are seen edging higher Wednesday, with investors cautiously awaiting President-elect Joe Biden’s inauguration. Netflix (NASDAQ:NFLX) will also be in the spotlight after stellar results.

At 7:25 AM ET (1225 GMT), the Dow Futures contract was up 33 points, or 0.1%, S&P 500 Futures traded 12 points, or 0.3%, higher, and Nasdaq 100 Futures climbed 100 points, or 0.8%.

Biden is set to become the 46th President of the United States, around 12 PM ET (1700 GMT), replacing Donald Trump. The ceremony will take place amid heightened security in Washington in the wake of the riots in early January.

Biden is likely to appeal for unity, but investors will also be looking to see if he comments further on his spending plans after his nominee for Treasury Secretary, Janet Yellen, told the Senate Finance Committee late Tuesday that the federal government needed to “act big” to repair the economic damage caused by the pandemic.

It’s ”important to point out that this is only the first package from Joe Biden. He is already working on a second, focused on infrastructure and green energy. This could help maintain economic momentum in the coming years,” said ING analyst James Knightley, in a research note.

Biden could also signal that his administration intends to rejoin the Paris climate agreement, reverse Trump’s decision to withdraw the U.S. from the World Health Organization, and look for more cooperation with regard to international trade.

Away from the political fanfare in Washington, the corporate spotlight will be on Netflix (NASDAQ:NFLX) after the world’s largest streaming service reported strong growth in subscriber numbers and a big improvement in cash flow after the close Tuesday.

The company added it expected free cash flow to break even in 2021, stating it may no longer need to raise external financing and will explore returning excess cash to shareholders via share buybacks.

The earnings slate continues Wednesday. The last of the big six banks is set to post results before the open, and Morgan Stanley (NYSE:MS) is expected to follow its rivals by posting stellar trading results. Consumer goods heavyweight Procter & Gamble (NYSE:PG) earlier raised its guidance for shareholder payouts in the current fiscal year after another pandemic-assisted quarter for sales. UnitedHealth (NYSE:UNH), US Bancorp (NYSE:USB) and United Airlines (NASDAQ:UAL) are also reporting Wednesday.

Oil prices pushed higher, helped by expectations that Biden’s stimulus plans will boost fuel demand.

U.S. crude inventory data due from the American Petroleum Institute will be in focus later Wednesday, a day later than usual due to Monday’s holiday.

U.S. crude futures futures traded 1.2% higher at $53.59 a barrel, while the international benchmark Brent contract rose 0.8% to $56.36.

Elsewhere, gold futures rose 0.4% to $1,847.45/oz, while EUR/USD traded 0.1% lower at 1.2111.