This post was originally published on this site

It’s not just the lives of Americans that rest on a quick rollout of coronavirus vaccines, it’s the livelihoods of millions of people who lost their jobs during the pandemic.

Almost every forecast for the U.S. economy predicts a big rebound in growth and employment in 2021, but it sure doesn’t feel that way right now with the coronavirus still spreading like wildfire.

The last few weeks alone have shown weaker hiring, rising layoffs, and declining consumer spending, all of which point to a faltering economy.

Many businesses have closed, cut their operating hours and laid off workers, leaving some 10 million Americans who had jobs before the pandemic still out of work.

Also: The U.S. lost 140,000 jobs in December. How bad was it?

The bad news hasn’t stopped investors from piling more money into the stock market, however. They are also betting on a big rebound in the economy this year and next.

What they are watching most is the speed at which the vaccines are administered, how rapidly the pandemic recedes and what steps new President Joe Biden will take to boost the economy until the crisis passes.

Read: Consumer inflation increases in December on higher gas prices

Does that render moot the next month or two of economic data, the stuff that usually moves markets. Not all all.

These reports will tell us how much ground the economy has lost in the past few months, how much ground it has to make up —- and whether the hoped-for snapback in the economy is actually underway.

“Do the data over the next few months matter? They certainly do,” said Richard Moody, chief economist at Regions Financial.

The key measure to watch is weekly jobless benefit claims, one of the few weekly government reports that’s very sensitive to changes in the health of the economy.

See: MarketWatch Economic Calendar

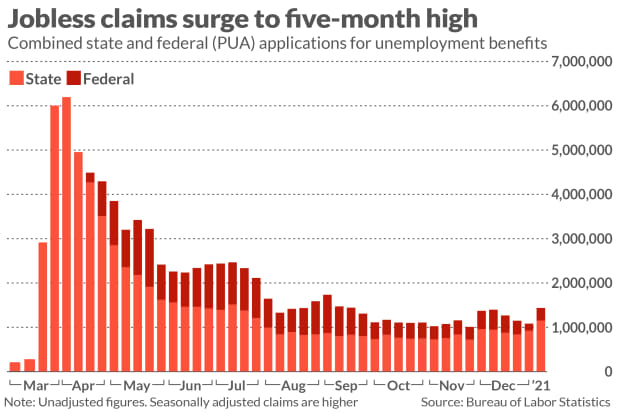

Jobless claims, a rough measure of layoffs, began to rise again in November just as the latest and biggest wave of coronavirus cases spread across the country. Last week new claims surged to almost 1 million from a pandemic low of 711,000 two and a half months ago.

Read: Jobless claims surge to 5-month high of 965,000

The report is not without its problems. A government watchdog agency found that jobless claims have been inflated during the pandemic.

Read: Jobless claims inflated, GAO finds

Also: Why the inaccurate jobless claims report is still useful to investors

Yet the direction of jobless claims has largely followed the path of the coronavirus cases and the resulting ups and downs in employment.

The latest snapshot on claims will be the most important report next week after the Martin Luther King holiday which closes financial markets on Monday, but most attention next week will be directed toward the inauguration of President-elect Joe Biden on Wednesday.

Read: U.S. budget deficit climbs to $144 billion in December – and more red ink on the way

On Thursday Biden outlined a sweeping new proposal for up to $2 trillion in federal spending that included $1,400 cash payments to households, supplemental unemployment payments, and money for distributing COVID-19 vaccines, among other items, but it’s unclear how much will eventually pass Congress and how long it will take to filter into the broader economy. Stay tuned.