This post was originally published on this site

The new year is obviously young but already there is a pretty clear theme on display in financial markets.

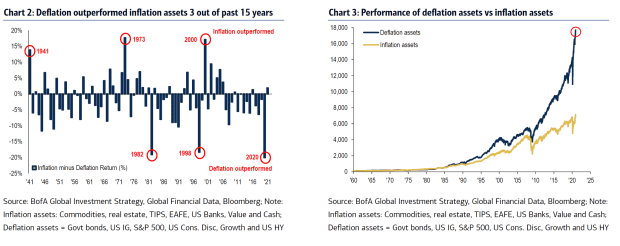

According to Bank of America, inflation assets are outperforming deflation assets by the most since 2006.

Bank of America says inflation assets include commodities GSG, +1.16%, real estate, Treasury inflation-protected securities, U.S. banks and value stocks. Deflation assets include government bonds TNX, +3.77%, corporate bonds, the S&P 500 SPX, -0.38% and growth stocks.

Investors are pouring their money into the inflation theme. Last week saw the second-largest inflow to energy stocks, the third-largest inflow to Treasury inflation-protected securities, sixth-largest inflow to emerging markets, and the largest inflows to bank loans in nearly four years, according to the Bank of America data. Municipal bonds, which are exempt from federal and most state taxes, saw record inflows.

The inflation theme is playing out in response to unprecedented central bank and fiscal stimulus, as the COVID-19 pandemic continues to sideline many industries. On Thursday, U.S. President-elect Joe Biden laid out his $1.9 trillion recovery proposal, and Federal Reserve Chair Jerome Powell said the talk of tapering its bond purchases is premature.

“Lots of secular inflationary trends coincide with vaccine/reopening/supply catalysts,” said Michael Hartnett, chief investment strategist at Bank of America.