This post was originally published on this site

With global markets rallying on the hopes that massive economic stimulus will accompany President-elect Joe Biden’s new administration, Goldman Sachs’ projection that the S&P 500 will end 2021 at 4,300 points seems even more realistic.

In our call of the day, the investment bank’s chief U.S. equity strategist David J. Kostin has mapped out the road to 4,300.

Goldman sees the S&P 500 SPX, -0.38% rising 14% through the year, after one of the world’s most closely watched indexes closed at 3,756 to finish 2020. A further 7% growth in the index is projected for 2022 — reaching 4,600.

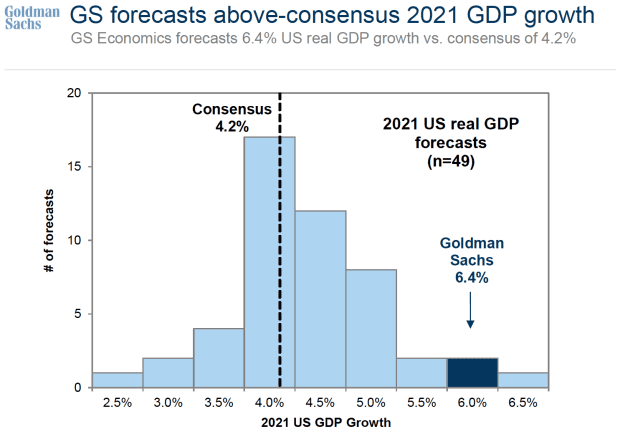

Underlying a double-digit forecast for returns in 2021 is the investment bank’s bullish projection on the U.S. economy — 6.4% real gross domestic product growth compared with the consensus of 4.2%.

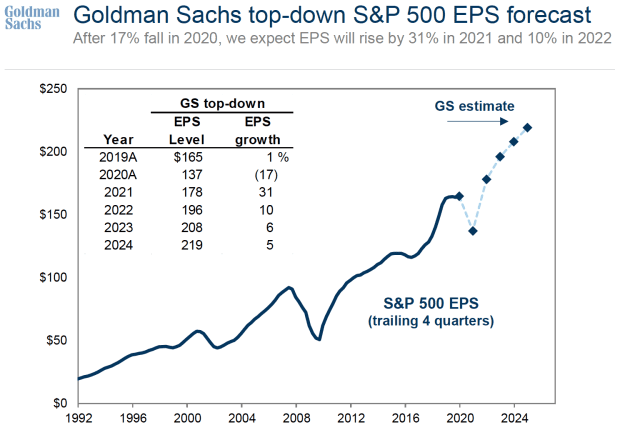

Adding to the economic boost for equities is a massive increase in earnings per share (EPS), a rebound from the dire impact the COVID-19 pandemic has had on corporate bottom lines. Goldman expects EPS to shoot up 31% in 2021 after falling 17% in 2020.

In tandem with EPS are projections of a strong rebound in margins, which Goldman expects to be higher than the bottom-up consensus forecast. An increase in margins is largely driven by operating leverage, as well as moderating costs like labor.

High-operating leverage stocks outperformed in 2020, and Goldman expects that trend to continue through this year on the back of strong economic growth.

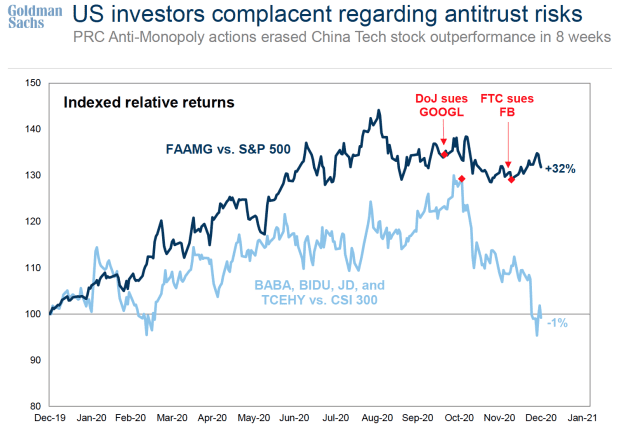

In many ways, the 18% rally on the S&P 500 in 2020 was helped by its five largest stocks: the technology giants Facebook FB, -2.38%, Amazon AMZN, -1.21%, Apple AAPL, -1.51%, Microsoft MSFT, -1.53%, and Alphabet GOOGL, -0.93%. These stocks returned 56% compared with 11% growth from the remaining 495 companies.

However, Goldman warns that investors are complacent about antitrust risks.

Whereas China’s antimonopoly actions wiped out the performance of Chinese tech stocks in just eight weeks, the market largely hasn’t reacted to the Justice Department’s lawsuit against Google and the Federal Trade Commission’s suit against Facebook.

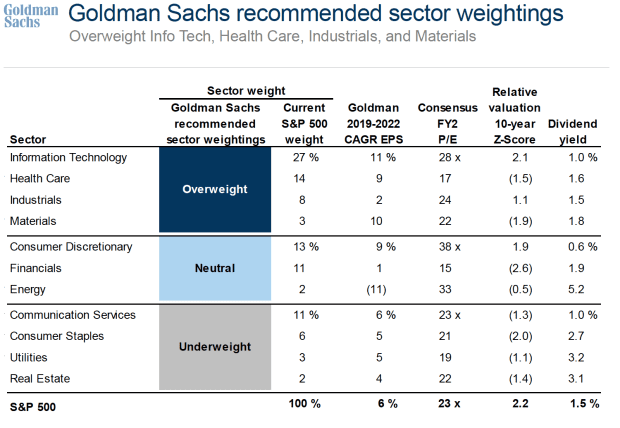

Closing out the road map to 4,300 is Goldman Sachs’ recommended sector weightings. The investment bank has information technology, health care, industrials, and materials classified as overweight, while communication services, consumer staples, utilities, and real estate are underweight.

The buzz

A day after Donald Trump became the first president to be impeached twice, Biden is set to propose a $2 trillion increase in fiscal spending to help the U.S. economy get through the COVID-19 pandemic, according to a report from CNN.

Alibaba 9988, +5.00% and Tencent 700, +5.62% stocks surged in Hong Kong, and Baidu lifted in the Nasdaq premarket, after reports that American investors won’t be banned from investing in the Chinese internet giants, after all.

It is a big day for data. 965,000 Americans filed initial jobless claims last week—expectations were around 800,000—up from the 787,000 two weeks ago. It’s the highest level since August.

Continuing jobless claims were 5.271 million, higher than the expectation of around 5 million. But Federal Reserve Chair Jerome Powell’s 12:30 p.m. EST speech on the economy is likely to be the star of the economic show.

The National Highway Traffic Safety Administration has asked electric-car maker Tesla TSLA, -1.10% to voluntarily recall 158,000 Model S and Model X cars, after tentatively concluding that a possible defect in the vehicles’ display screen could impact safety.

Running out of crypto? According to Cointelegraph, exchange platform eToro is struggling to keep up with “unprecedented demand,” warning cryptocurrency traders limited liquidity meant there may be limitations on buy orders.

Plus: Bitcoin and its ‘funny business’ should be regulated globally, says European Central Bank chief

Spaceflight company Virgin Galactic’s SPCE, +20.61% stock is up almost 12% in the New York premarket, after ARK Investment Management filed with the Securities and Exchange Commission to launch a space-exploration exchange-traded fund.

The markets

U.S. stock markets are ahead, with the Dow DJIA, -0.22% up more than 100 points and both the S&P 500 SPX, -0.38% and Nasdaq COMP, -0.12% higher. Asian markets NIK, +0.85% HSI, +0.93% SHCOMP, -0.91% rallied across the board while European indexes SXXP, +0.72% UKX, +0.84% DAX, +0.35% PX1, +0.33% ended the trading day in the green.

Market optimism comes as investors eye a possible $2 trillion stimulus proposal from Biden. Sentiment is also buoyed by the rare de-escalation of tensions between the U.S. and China, as it looks like American investors won’t be blocked from investing in some Chinese internet giants.

The chart

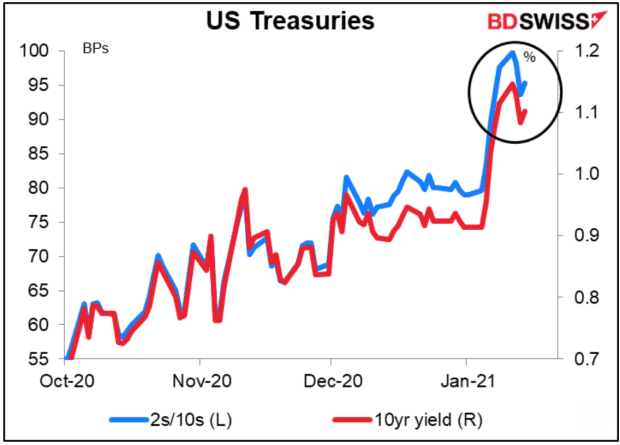

U.S. Treasuries are in focus in our chart of the day from Marshall Gittler at BDSwiss.

Yields on the 10-year Treasury note TMUBMUSD10Y, 1.128% initially moved lower on Wednesday, pushed down by strong demand for 30-year bonds in a $24 billion auction. But the fall was reversed late in the day after the report on Biden’s stimulus plans.

Random reads

Wanted: U.K. bison rangers, no previous experience expected.

The mayor of a Houston suburb was chosen by pulling a name from a hat.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.