This post was originally published on this site

Can you really say something is a lot better than expected, if you’re not exactly sure what you were expecting?

The U.S. earnings reporting season is set to kick off on Friday, with the first reports from big banks, including Dow Jones Industrial Average DJIA, +0.15% component J.P. Morgan Chase & Co. JPM, +1.01%

Early indications suggest another quarter in which aggregate S&P 500 SPX, +0.04% earnings per share are set to beat expectations by a wider-than-usual margin. The beats could be big enough, that EPS growth could swing to positive for the first time since before the COVID-19 pandemic took hold.

Don’t miss: Banks are back — almost half of 15 large U.S. banks are expected to increase quarterly profit.

The blended EPS growth estimate for the S&P 500, which includes some results already reported and the average estimates of analysts of coming results, is negative 8.4% through Thursday morning, according to FactSet data. Although earnings season hasn’t really started yet, with just 4.2% of the S&P 500 reporting through Thursday morning, that’s already a sharp improvement from the 12.9% decline estimated at the start of the fourth quarter.

The reason for the narrowing of the loss forecast is two-fold. First, the companies that have already released results have beaten expectations by a relatively large 13% on average, according to UBS equity strategist Keith Parker.

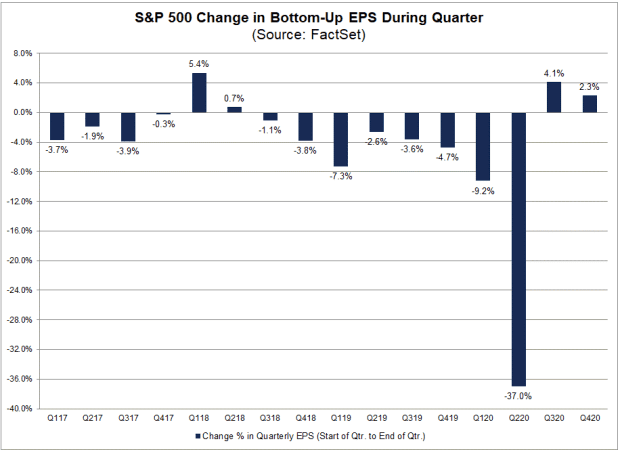

Second, FactSet Senior Earnings Analyst John Butters said in a recent research note that the EPS growth estimate has been increasing during the quarter, which is contrary to the historical norm of analysts lowering estimates during a quarter.

During the past five years, the average is for EPS growth estimates to fall by 4.5% during a quarter, Butters said. He suggested that one reason estimates have been increasing could be that analysts made “substantial cuts” to their fourth-quarter estimate during the second and third quarters.

FactSet

The big estimate cuts are likely a result of analysts assuming the worst as COVID-19 raged. With companies forced to operate largely in the dark during the pandemic, amid a disjointed U.S. government response, they were unable to provide much, if any guidance, for analysts to have confidence in their projections.

“Wall Street expectations are too low for Q4 2020, so we should see plenty of beats,” said Nicholas Colas, co-founder of DataTrek Research. “We need them.”

As an example of how far off analyst estimates have been during the pandemic, first-quarter EPS growth ended up as negative 12.9%, after starting the quarter at positive 4.7%; second-quarter growth was negative 31.2%, compared with an estimate of negative 11.0% at the start of the quarter; while third-quarter growth improved to negative 5.6% from an early estimate of negative 24.5%.

UBS’s Parker said he expects “Q4 earnings to be big,” with results coming in more than 10% above estimates. That might be enough to end the pandemic-induced earnings recession, and mark the first quarter of earnings growth since the fourth-quarter of 2019.

There is a concern, however, that the recent surge in new cases resulting from COVID-19, which have led to some renewed lockdown measures, may short-circuit the earnings recovery.. Read the Coronavirus Update column.

Delta Air Lines Inc. DAL, +3.41% reported Thursday a wider-than-expected fourth-quarter loss, with travel demand softening as the quarter progressed as a surge in COVID-19 cases prompted calls from health officials to not travel during the Thanksgiving and Christmas holidays. Also Thursday, Alaska Air Group Inc. ALK, +7.79% reported fourth-quarter load factor that was below forecasts, as revenue passengers declined in November and December from a post-pandemic peak in October.

Time will tell, if this late-quarter softness seen by some airlines will translate to other sectors.