This post was originally published on this site

After a multiyear pit stop, bitcoin prices are surging like never before.

The unabated price acceleration to a recent peak near a stunning $42,000 on CoinDesk has made true believers out of many staid Wall Street pros, who may have once turned their collective noses up at the digital-asset that has only been around for a little over a decade.

However, the extraordinarily parabolic move for bitcoin, which was at last check, up 2.5% on Friday at $40,202 has raised serious questions about bubbles, like the Tulip mania of the 17th century.

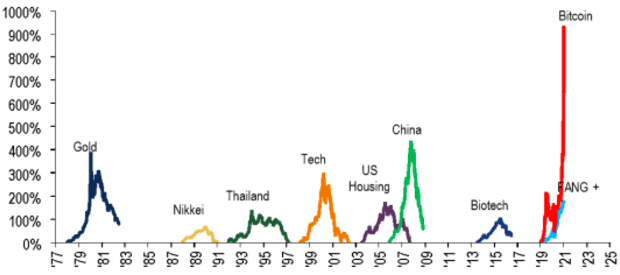

BofA Global Research in their weekly “The Flow Show” report dated Jan. 7, raised the question as to whether bitcoin’s price move represents the “mother of all bubbles.” Check out the following chart that takes a stab at comparing the climb in asset against other assets over decades.

via BofA Global Investment Strategy

Of course, the chart doesn’t go all the way back to the Tulip craze, where a single tulip commanded the same price, and often more, as a house during the peak of the Dutch craze from 1636-1637.

But BofA’s point is well taken, bitcoin’s are richly prized and comparatively are staging a precipitous climb that merits attention and, perhaps, caution.

So far in the first full week of 2021, bitcoin has already climbed nearly 37%. By comparison, the Dow Jones Industrial Average DJIA, +0.18% is up a respectable, but more mundane, 1.5%, the S&P 500 index SPX, +0.55% is on track for a 1.6% gain and the Nasdaq Composite Index COMP, +1.03% has returned 1.4% thus far.

Bitcoin’s rally this year has pushed up the collective cryptocurrency market capitalization to a record above $1 trillion and as BofA’s Michael Hartnett and his team puts it, the rise, of the “cryptocurrency market now >$1tn as Bitcoin past 2 years blows-the-doors-off prior bubbles.”

The gains appear to be far from over if you believe forecasts from JPMorgan Chase, whose researchers argue that the digital currency could be valued at $146,000 if bitcoin challenges gold GC00, -3.39% as a haven-like asset. That would certainly be worth a respectable house.

Of course, this isn’t the first time that bitcoin has been referred to as a bubble.

In a prepared testimony for a Senate Banking Committee hearing back in 2018, Turkish-born economist, Nouriel Roubini, said digital currencies are the “mother of all bubbles” and, in fact, have entered an apocalypse.

Howard Wang, co-founder of Convoy Investments, also dubbed bitcoin the biggest bubble in history before its eventual collapse back in 2017.