This post was originally published on this site

Micron Technology Inc. shares rose in the extended session Thursday after the memory-chip maker’s earnings confirmed that the industry is turning a corner.

Micron’s MU, +2.59% results and forecast topped Wall Street estimates, and shares rose 1.8% after hours, following a 2.6% rise to close at $79.11 in the regular session.

Micron reported fiscal first-quarter net income of $803 million, or 71 cents a share, compared with $491 million, or 43 cents a share, in the year-ago period. Adjusted earnings, which exclude stock-based compensation expenses and other items, were 78 cents a share, compared with 48 cents a share in the year-ago period.

Revenue rose to $5.77 billion from $5.14 billion in the year-ago quarter. Analysts surveyed by FactSet had forecast adjusted earnings of 68 cents a share on revenue of $5.66 billion.

DRAM sales made up 70% of revenue, the company said. Compute and network sales rose 29% to $2.55 billion, while mobile sales gained 3% for $1.5 billion in revenue for the quarter.

Micron expects adjusted fiscal second-quarter earnings of 68 cents to 82 cents a share on revenue of $5.6 billion to $6 billion, while analysts had forecast earnings of 67 cents a share on revenue of $5.55 billion.

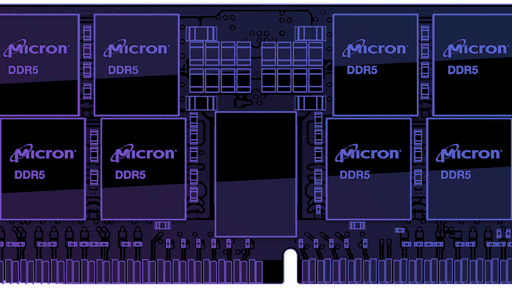

“We are excited about the strengthening DRAM industry fundamentals,” said Micron Chief Executive Sanjay Mehrotra. “For the first time in our history, Micron is simultaneously leading on DRAM and NAND technologies, and we are in an excellent position to benefit from accelerating digital transformation of the global economy fueled by AI, 5G, cloud, and the intelligent edge.”

Micron specializes in DRAM and NAND memory chips. DRAM, or dynamic random access memory, is the type of memory commonly used in PCs and servers, while NAND chips are the flash memory chips used in USB drives and smaller devices, such as digital cameras.

Over the past 12 months, Micron shares have gained 36%, compared with a 57% increase on the PHLX Semiconductor Index SOX, +3.86%, an 18% rise by the S&P 500 index SPX, +1.48%, and a 44% gain by the Nasdaq Composite Index COMP, +2.56%.