This post was originally published on this site

Bank stocks were breaking out on Wednesday, led by a rise in rates that was rippling throughout financial markets.

But the move in benchmark government debt rates on the heels of prospective wins by Democrats in a pair of key Senate runoff elections in Georgia were most pronounced in the financial sector, where higher yields are propitious for their businesses.

The S&P 500 financial sector SP500.40, +4.32% was trading up 4.7%, aiming for its best daily gain since Nov. 9 when the sector surged 8.2%, following another political development, with former Vice President Joe Biden being declared winner by a number of news organizations over President Donald Trump following heated elections. The Financial Select Sector SPDR Fund XLF, +4.42%, or XLF, referring to its ticker symbol, was up nearly 5%, and on pace for its sharpest daily rise since November.

A separate index of the 24 biggest banks, the Invesco KBW Bank ETF KBWB, +6.82%, was up nearly 7% and pacing its best day in about 8 weeks. All of its components were sporting gains of at least 4% on the session.

Some of the biggest financial gainers on the day included Zions Bancorp. ZION, +11.24% and KeyCorp. KEY, +9.79%, rising nearly 10%, and Huntington Bancshares Inc. HBAN, +9.81%. , climbing 9%.

The jump in bank stocks comes as the benchmark 10-year Treasury note, which is tied to everything from student debt to mortgages, was yielding 1.04%, representing its richest yield since March. Bond prices fall as yield rise.

Higher rates tend to boost banks’ net interest margins, a key measure of lending profitability.

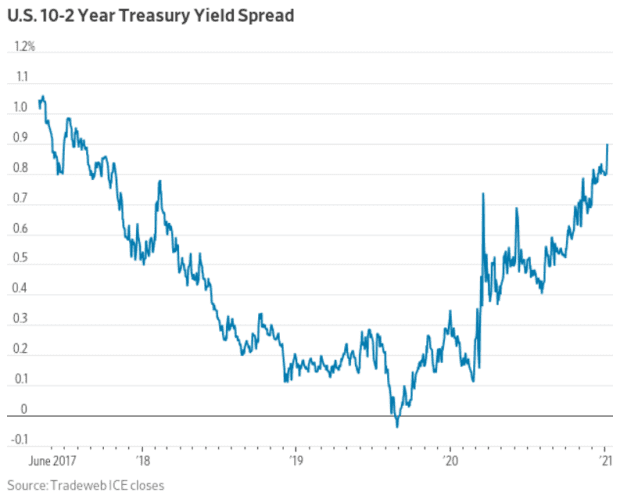

On top of the rising yields, the spread between short-dated notes and the longer-dated debt also steepened, also helping to bolster the operating models of banks which borrow short and lend out to clients for a longer term.

The spread between the 10-year Treasury note and the 2-year Treasury was at around 85.1 basis points, representing the widest margin since 2017, FactSet data show.

Dow Jones Market Data

On Wednesday, Democrats looked poised to take control of the Senate bolstering the chances that Democratic President-elect Joe Biden could push through legislative measures, including increased stimulus, that would weigh on debt, driving prices lower and yields higher.

The so-called blue wave comes as Democrat Raphael Warnock defeated incumbent Republican Kelly Loeffler in a Georgia Senate runoff, leftover from November, and another Democrat, Jon Ossoff, appeared to hold a narrow lead in another Georgia race.

Stocks came off earlier highs as supporters of President Trump stormed the Capitol building, forcing the disruption of a joint session of Congress to certify Joe Biden’s presidential victory.

Banks have been on the backfoot during the pandemic, compared against technology companies and other companies that have been viewed as less sensitive to the coronavirus pandemic.

However, the prospect of further support from the government along with rising yields are considered a recipe for many of those large financial institutions to release at least some reserves in the coming months set aside for major bankruptcies and economic downdrafts amplified by the COVID outbreak.

Even before the races in George, analysts at Barclays BARC, +8.27% BCS, +7.94% said recent gains in the banking sector, driven both by a rebound in earnings per share and continued tangible book value growth, as well as multiple expansion, has room to run. Lower loan loss provisions should be the bigger driver in earnings, even as uncertainties over rising COVID-19 cases and heightened restrictions present risks, the analysts reported.

Major U.S. banking institutions, including JPMorgan Chase & Co. JPM, +4.70%, Wells Fargo WFC, +7.08% and Citigroup C, +5.79%, will start reporting fourth-quarter results on Jan. 15.