This post was originally published on this site

U.S. Treasury yields soared on Wednesday after early voting indicated Democrats were on track to win both Senate seats in Georgia and thus control of Congress, an outcome that would give the Biden administration more room to enact his policy agenda.

What are Treasurys doing?

The 10-year Treasury note yield TMUBMUSD10Y, 1.008% was at a March high of 1.019%, 6.4 basis points higher than in the previous day. The 2-year note rate TMUBMUSD02Y, 0.132% edged 1.2 basis points up to 0.135%, while the 30-year bond yield TMUBMUSD30Y, 1.775% climbed 7.9 basis points to 1.783%, more than an eight month high.

What’s driving Treasurys?

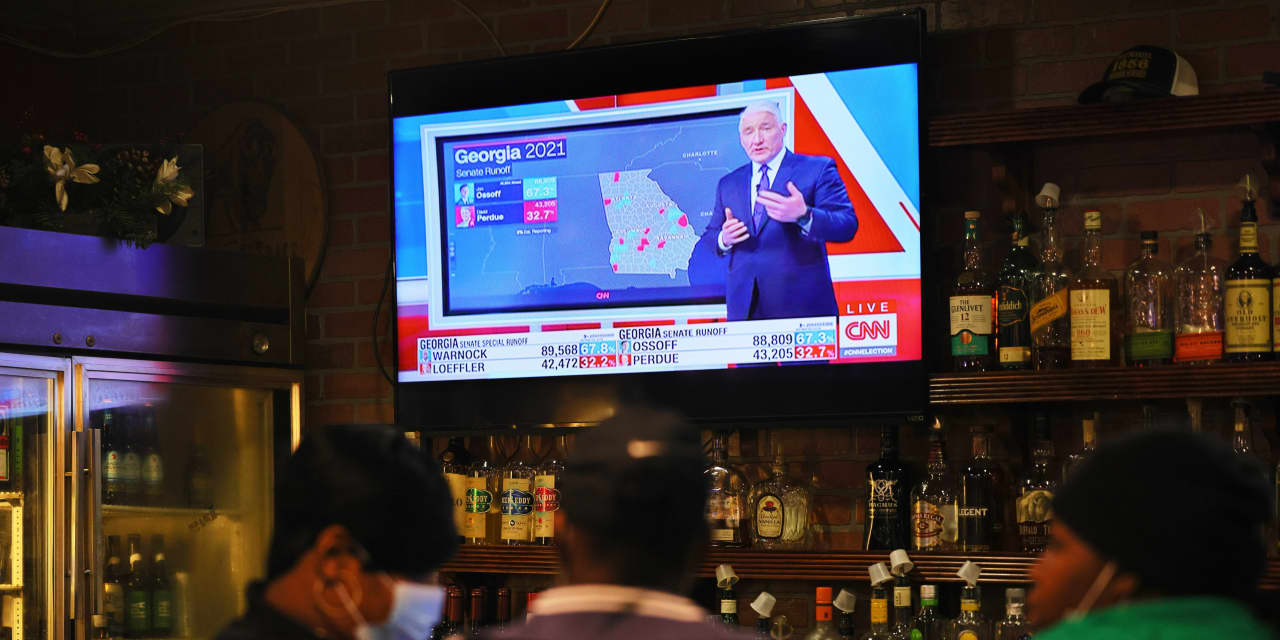

Preliminary voting results show Rev. Raphael Warnock beating Republican incumbent Sen. David Perdue and Jon Ossoff set to win over his counterpart Sen. Kelly Loeffler in the Georgia Senate runoff elections.

With control of the Senate in sight, Democratic lawmakers may now have more scope to pass more aggressive fiscal measures that could weigh on the bond market through increased debt issuance and higher inflation expectations, according to analysts.

Indeed, the 10-year note broke through the key 1% level that has contained the benchmark maturity since March.

In U.S. economic data, Automatic Data Processing Inc. will release its employment report for December at 8:30 a.m. ET, November factory orders will then come out at 10 a.m. Finally, the Federal Reserve will release its minutes from its December policy meeting.

What did market participants say?

“In theory higher supply and a fiscal demand boost would see a steepening of the U.S. [yield] curve. However, one caveat to this would be if stocks took fright at the less supportive tax/ regulatory environment,” said analysts at Rabobank.