This post was originally published on this site

You are probably familiar with last year’s boom, bust and boom again pattern for broad stock indexes.

The movements were magnified for chip makers.

Based on previous recoveries, B. Riley analyst Craig Ellis argues that investors can reap significant double-digit gains following an expected pullback for the industry.

He named eight small-cap semiconductor stocks that he favors in a note to clients Jan. 4. They are listed below.

Two charts

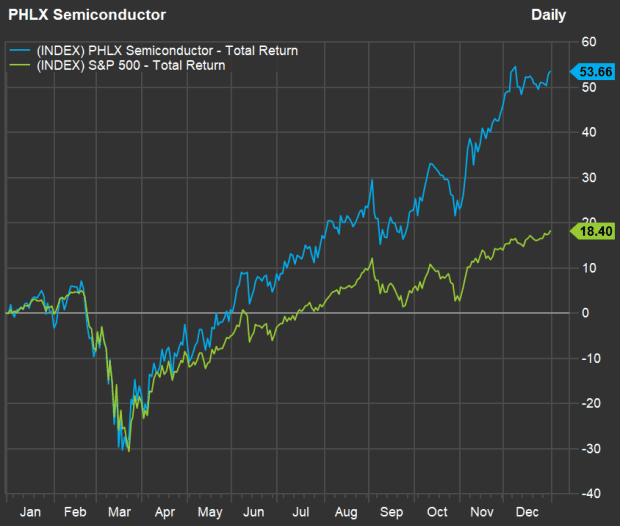

Let’s look at two charts focusing on the action in 2020. Here are total returns for the PHLX Semiconductor Index SOX, -0.44% and the S&P 500 Index SPX, -1.48% :

(FactSet)

SOX was down as much as 29% late in March, while the S&P 500 was down as much as 30%. The subsequent recovery was incredible, broadly driven by the federal government’s stimulus and the Federal Reserve’s dramatic moves to lower interest rates and increase the money supply.

But the semiconductor group had a variety of factors driving outperformance. Those secular developments — including the evolution of the auto industry, the Internet of Things (IoT), 5G phone upgrades — are the “best in decades” for the chip makers, according to Ellis.

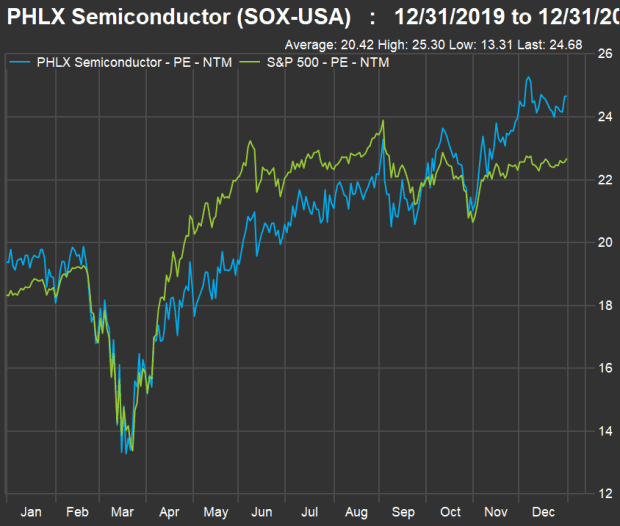

This chart shows how indexes’ forward price-to-earnings ratios (based on rolling 12-month consensus earnings estimates among analysts polled by FactSet) moved through 2020:

(FactSet)

Now look again at both charts. You see a sharp divergence in the first chart, with the PHLX Semiconductor Index nearly tripling the return of the S&P 500. In the second chart, both groups show tremendous increases in forward P/E valuations. For SOX, the forward P/E moved to 22.4 from 19.8. For the SPX, the forward P/E moved to 22.7 from 18.3.

So the semiconductor group is trading at a higher forward P/E valuation than the S&P 500. But it isn’t that much higher, when you consider how much better SOX performed in 2020.

Now look at the projected growth rates, based on consensus estimates among Wall Street analysts polled by FactSet:

For the iShares PHLX Semiconductor ETF SOXX, -0.42%, sales per share are expected to increase by 9% in 2021 and another 8% in 2022. Earnings per share are expected to grow by 17% in 2021 and another 13% in 2022. Free cash flow per share (cash flow less planned capital expenditures) is expected to increase 19% in 2021 and another 13% in 2022.

For the SPDR S&P 500 ETF SPY, -1.31%, sales per share are expected to increase by 8% in 2021 and another 7% in 2022. EPS are expected to go up by 22% in 2021 and another 17% in 2022. Free cash flow per share is expected to increase by 29% in 2022 and another 15% in 2022.

So that could be a warning for large-cap semiconductor stocks — if consensus estimates are close to being accurate, the S&P 500 will show significantly better increases in EPS and free cash flow over the next two years.

Semiconductor outlook for 2021

Getting back to the strong secular trends for chip makers, Ellis expects them to be enhanced by “global growth recovery tailwinds” during the second half of 2021 as the pandemic is cooled by the rollout of COVID-19 vaccines.

In the Jan. 4 note, Ellis called valuations for SOX components “rich,” with “a retreat overdue.” But he also pointed to the group’s recovery after the 2008 recession, which “argues for +18% further SOX upside, with secular driver and digital transformation adjustments raising that to +25%+.”

B. Riley’s small-cap semiconductor stock picks

Ellis listed eight small-cap manufacturers of semiconductor, electronic components or production equipment he believes will provide compelling upside potential if investors can scoop them up after declines:

Click on the tickers above for more about each company.

Here’s more information about each company — scroll the table to see all the data:

B. Riley Securities, FactSet

SOXX index

Moving back to the large-cap semiconductor space, there are 30 stocks in the PHLX Semiconductor Index and all are held by the SOXX ETF. Here they are, ranked by percentage of analysts polled by FactSet that rate each a “buy” or the equivalent, along with price targets and other data:

So 85% or more of analysts have “buy” ratings for Lattice Semiconductor Corp. LSCC, -1.07%, Taiwan Semiconductor Manufacturing Co. TSM, +2.45% and Monolithic Power Systems Inc. MPWR, -0.39%, but the share prices for these companies have gotten ahead of the 12-month price targets. If you scroll to the right, you can see impressive sales and earnings growth estimates for many of the companies. A 12-month price target horizon is actually a short one for a long-term investor.

Don’t miss: 20 electric vehicle stocks besides Tesla and Nio that analysts expect to rise the most over the next year