This post was originally published on this site

The year 2020 will be forever etched in the minds of citizens across the globe.

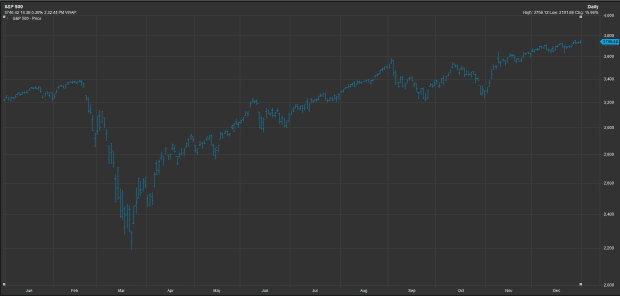

The equity market wasn’t the main conduit for the response to the pandemic and social unrest that emerged, but it was one way that Wall Street interpreted the pace of the rapidly spreading contagion and the human ingenuity that rapidly brought about remedies and cures to combat COVID-19.

Here are some of the key moments of a year that saw the Dow Jones Industrial Average DJIA, +0.65% end with an annual gain of about 7%, despite plunging into a bear market eight months ago. The S&P 500 index SPX, +0.64% booked a nearly 16% return in 2020, while the Nasdaq Composite Index COMP, +0.14% rose 43.4% and the small-capitalization Russell 2000 index RUT, -0.26% climbed 19% on the year.

FactSet

- Jan. 2 marked the first trading day in 2020 and the Dow booked a 330-point rise, seemingly oblivious as China’s central bank increased stimulus measures amid the viral outbreak that was first reported in Wuhan and was just a glimmer of what it would become across the globe.

- Dow books a closing high on Feb. 12. The S&P 500 ends at an all-time high on Feb. 19.

- On Feb. 28, the Dow, S&P 500 suffer worst weekly decline since 2008, as Federal Reserve Chairman Jerome Powell says the central bank is “closely monitoring” the coronavirus spread.

- On March 3, the Fed announces a half-a-percentage-point rate cut a half-hour into the trading session, saying that while the economy’s fundamentals remain strong, the “coronavirus-poses evolving risks to economic activity.” (A number of other central banks across the global also cut rates)

- March 11, the Dow ends in bear-market territory for the first time in more than a decade, after the World Health Organization designates the global spread of COVID-19 a pandemic.

- March 12, the Dow marks its worst day since the 1987 crash. as virus-driven recession risks rise (Volatility in markets began triggering limit-down trading to mitigate the selloffs.)

- On March 15, the Fed cuts interest rates a full percentage point on a Sunday night to near 0% and begins a roll out of a number of programs aimed at backstopping faltering credit markets and supporting the economy.

- March 23, the equity market touches its lowest point of the pandemic era.

- March 26, Investors take some comfort from the overnight passage of a historic $2 trillion economic stimulus effort on the same day that a report showed that a record 3.28 million Americans applied for unemployment benefits

- April 3, stocks end lower after the worst jobs report in 11 years, which showed 701,000 Americans lost their jobs in March.

- April 29 marks the biggest drop in U.S. gross domestic product since 2008. GDP, the official scorecard for economic growth, shrank at a 4.8% annualized pace.

- May 25: Death of George Floyd sparks social unrest around the globe.

- National Bureau of Economic Research, or NBER, in June says that a 128-month expansion — the longest dating to 1854 — came to a halt in February, beginning a recession.

- June 5: Investors cheer a May jobs report that unexpectedly showed a 2.5 million rise in nonfarm payrolls and a fall in the unemployment rate. The Dow rose nearly 830 points, or 0.3%, while the S&P 500 advanced 2.6% and the Nasdaq Composite touched an intraday high.

- June 16: Data shows sales at U.S. retailers surged 17.7% in May as the economy started to reopen and claw its way out of what’s likely to have been the shortest and deepest recession in American history.

- Nov. 9: Trump’s vaccine czar says the first vaccine should be submitted for emergency authorization around Thanksgiving

- Nov. 15: Trump acknowledges President-elect Joe Biden’s 2020 election win for first time — then says he ‘concedes nothing,’ repeating unfounded claim of ‘rigged’ vote

- Nov. 17: Moderna Inc. said its COVID-19 vaccine candidate met its primary endpoint in the initial analysis of data from a Phase 3 trial, demonstrating 94.5% efficacy

- Dec. 3: U.K. authorizes the COVID-19 vaccine from Pfizer and BioNTech.

- Dec. 11: FDA grants emergency authorization of the Pfizer-BioNTech vaccine.

- Dec. 18: FDA authorizes Moderna’s COVID-19 vaccine.

Quotes of the year:

“The coronavirus outbreak will be temporary and will not change the long-term improvement of China’s economy,” said Pan Gongsheng, a PBOC vice governor, at a news briefing in February.

“I tell investors to hang in there, because this is the opportunity,” Diane Jaffee, senior portfolio manager at TCW told MarketWatch in late February.

“Monetary policy is an unlikely cure for the coronavirus,” said Mike LaBella, head of investment strategy at QS Investors, a Legg Mason affiliate, in a March statement as the Fed conducted its first emergency rate cut in response to the coronavirus outbreak, eight days before the WHO declared the novel strain of coronavirus a pandemic.