This post was originally published on this site

While the S&P 500 SPX, +0.87% and Nasdaq Composite COMP, +0.74% set new records on Monday with the $908 billion U.S. stimulus bill finally signed into law, there were a few segments not joining the party.

For one, the small-cap Russell 2000 RUT, -0.38% closed lower, following a three-month stretch in which that index has jumped 33%.

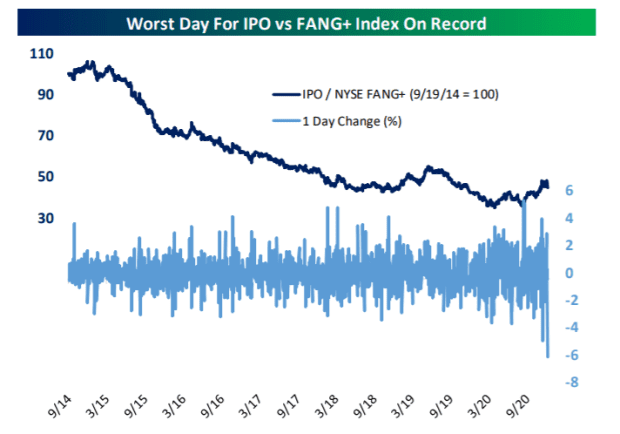

Another segment not participating in Monday’s rally were recent listings. The Renaissance IPO exchange-traded fund IPO, -4.70% stumbled nearly 5%. Analysts at Bespoke Investment Group point out that is the worst relative performance to the NYSE FANG+ index NYFANG, +1.60% — the grouping of Facebook FB, +3.59%, Amazon AMZN, +3.51%, Apple AAPL, +3.58%, Netflix NFLX, +1.00% and Google owner Alphabet GOOG, +2.14%, along with a few other technology giants including Alibaba BABA, +0.16% and Tesla TSLA, +0.29% — in its history.

Companies including exercise-bicycle maker Peloton Interactive PTON, -6.48%, Zoom Video Communications ZM, -6.34%, social-media site Pinterest PINS, -4.57%, and data-analytics provider Palantir Technologies PLTR, -7.64% each struggled.

“That’s by far the worst relative performance in the history of the NYSE FANG+ index, and may be a sign that the market is starting to re-evaluate aggressive bets on unproven companies that has also played out as part of the SPAC craze,” said the Bespoke analysts. SPACs are special-purpose acquisition companies, so-called blank check firms that intend to purchase other companies as a way of taking them public.

The Defiance Next Gen SPAC Derived ETF SPAK, -2.13%, with components including sports-betting firm DraftKings DKNG, -6.04% and spaceflight company Virgin Galactic SPCE, -7.39%, also closed lower on Monday.

The buzz

The House voted to override President Donald Trump’s veto of the defense bill, while Sen. Bernie Sanders threatened to filibuster a move to do so in the Senate unless a vote is taken on the $2,000 stimulus proposal that cleared the lower chamber.

Companies that have seen big stock-price declines may see more pressure in the coming days, as investors lock in losses for capital-gains tax purposes.

U.S. hospitalizations from COVID-19 set a record 121,235 on Monday, according to the COVID-19 tracking project. Deaths have tailed off significantly since Christmas, likely a function of holiday-reporting slowdowns.

More Israelis have received a vaccination than have contracted coronavirus, according to a government minister. In the U.S., 2.13 million people have received a dose, according to the Centers for Disease Control and Prevention, or 11% of the number who have contracted the disease.

The European Union and China are closing in on a trade deal that will give greater European access to Chinese manufacturing and greater Chinese access to the European energy space.

The market

U.S. stock futures ES00, +0.40% NQ00, +0.46% YM00, +0.43% pointed to further gains.

The FTSE 100 UKX, +2.04% rose sharply in London in its first action since the U.K. agreed to a trade deal with the European Union that will continue tariff-free access.

The dollar DXY, -0.35% was lower against key rivals, notably the euro EURUSD, +0.34%. The yield on the 10-year Treasury TMUBMUSD10Y, 0.946% was 0.94%. Bitcoin BTCUSD, +0.60% was trading below $27,000 in further turbulent action.

Random reads

A Japanese company, Sumitomo Forestry 1911, +0.23%, has started researching making wooden satellites to reduce space junk.

Two widowed penguins console each other looking at the Melbourne skyline.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.