This post was originally published on this site

Earlier this year, Berkshire Hathaway threw its heavyweight name behind Barrick Gold GOLD, +0.31% with an investment that flew in the face of Warren Buffett’s longtime aversion to gold. The news was “earth-shaking in the gold market,” one strategist said at the time.

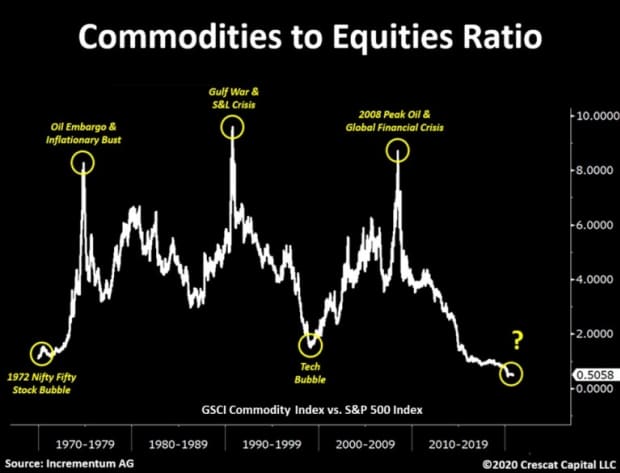

Now, Kevin Smith, Crescat Capital’s chief investment officer, says others following suit by adding exposure to gold GC00, +0.24% and taking profits from some of those highfliers will be richly rewarded when the bull market turns. Smith, who earlier this year talked about learning the ropes from a stack of Berkshire shareholders BRK.A, +1.06% letters his dad gave him long ago, used this chart to show how investors could be at a pivotal juncture.

Basically, stocks are trading at record high valuations while commodities, on the flip side, have never been so undervalued. “The setup is in place for a macro pivot in the relative performance of these two asset classes,” Smith wrote in a note to clients. “Comparable conditions were present with the 1972 Nifty Fifty and 2000 Dotcom bubbles.”

He explained that investors will soon be looking to put their money toward the highest growth and lowest valuation opportunities, and that will result in a big move away from the top-heavy stocks that have been leading this bull market into record territory.

“Analytically minded investors will soon be rotating, if not stampeding, out of expensive deflation-era growth equities and fixed income securities and into cheap hard assets, creating a reversal in the 30-year declining trend of money velocity,” Smith wrote. Some popular ways to play the rotation Smith’s predicting would be to go long Newmont Corp. NEM, +1.17% and Barrick Gold, or dabble in ETFs like GDX GDX, +0.31% and GDXJ GDXJ, +0.13%. Then, the even bigger opportunity, he says, lies in picking the winners on the exploration side.

“To be frank, buying gold or silver is not a contrarian investment position today,” Smith wrote. “There are enough people in agreement with the idea that all government backed fiat currencies are doomed to some level of devaluation through inflation due to the level of fiscal and monetary imprudence and unsustainable debt imbalances in the financial system.”

No sign of that rotation yet, with futures on the Dow Jones Industrial Average YM00, +0.22%, Nasdaq NQ00, +0.41% and S&P ES00, -0.05% all leaning higher ahead of Monday’s session.