This post was originally published on this site

Think of a presidential pardon as a “Get Out of Jail Free” card. The game of Monopoly has only one such card, but presidents have an unlimited supply.

Rarely has a president left office without making at least one pardon that was highly questionable, and highly criticized. Gerald Ford’s pardon of Richard Nixon in 1974, George H.W. Bush’s pardons of half a dozen Iran-Contra felons in 1992, Bill Clinton’s pardon—on his last day in office—of Marc Rich, the fugitive financier, and Barack Obama’s pardon of Army Pvt. Chelsea Manning are among those that come to mind.

Donald Trump is no different. Among those in two big batches of pre-Christmas pardons this week, are several felons nabbed during Special Counsel Robert Mueller’s Russia probe—which contrary to what the president claims, uncovered numerous, hard-core crimes such as perjury, bank and tax fraud, illegal foreign lobbying, and witness tampering. Trump’s pardons also include relatives, such as the father of son-in-law Jared Kushner, and four private security contractors who had been convicted in the brutal murders, in 2007, of 17 unarmed men, women and children in Iraq.

Corrupt lawmakers

Sleazy as all that is, for our purposes here, however, let’s focus on three others whose crimes were forgiven by the president: Former Republican congressmen Chris Collins of New York, Duncan Hunter of California, and Steve Stockman of Texas.

All three are (or were) financial felons. Collins, one of the first members of Congress to back Trump’s candidacy, pleaded guilty last year to charges of lying to the FBI and to conspiring to commit securities fraud. He had been serving a 26-month prison sentence.

Hunter was due to begin serving an 11-month sentence next month after pleading guilty in 2019 to one charge of misusing campaign funds.

Stockman, meantime, was convicted in 2018 on charges of fraud and money laundering and had been serving a 10-year sentence. His sentence was commuted.

There has always been something particularly egregious about pardons for representatives of the people who have abused the public trust. Collins, Hunter and Stockman were sent to Washington to look after their constituents, but wound up looking out for themselves. They are criminals and their punishments were well-deserved.

Temptations abound

There is so much money floating around in Washington, it’s so easy to stick your hand in the till, that some lawmakers simply can’t resist. The salary, the perks, the power, and the possibility of millions in lobbying fees in a post-congressional career just aren’t enough. Some want more, they want it now, and they’re arrogant enough to think they’re entitled to it.

Washington’s loose culture all but encourages such behavior. For example, in September 2008, Treasury Secretary Hank Paulson and Fed Chairman Ben Bernanke met privately with legislators and told them that the U.S. economy was in trouble and that financial markets could plunge.

According to a 2011 report by CBS’s “60 Minutes,” one person in that meeting, Rep. Spencer Bachus (R-Ala.), then the chairman of the House Financial Services Committee, immediately went out and bet against the market. The show also raised questions about trades made by, among others, big names such as House Speaker John Boehner (R-Ohio) and Minority Leader Nancy Pelosi (D-Calif.).

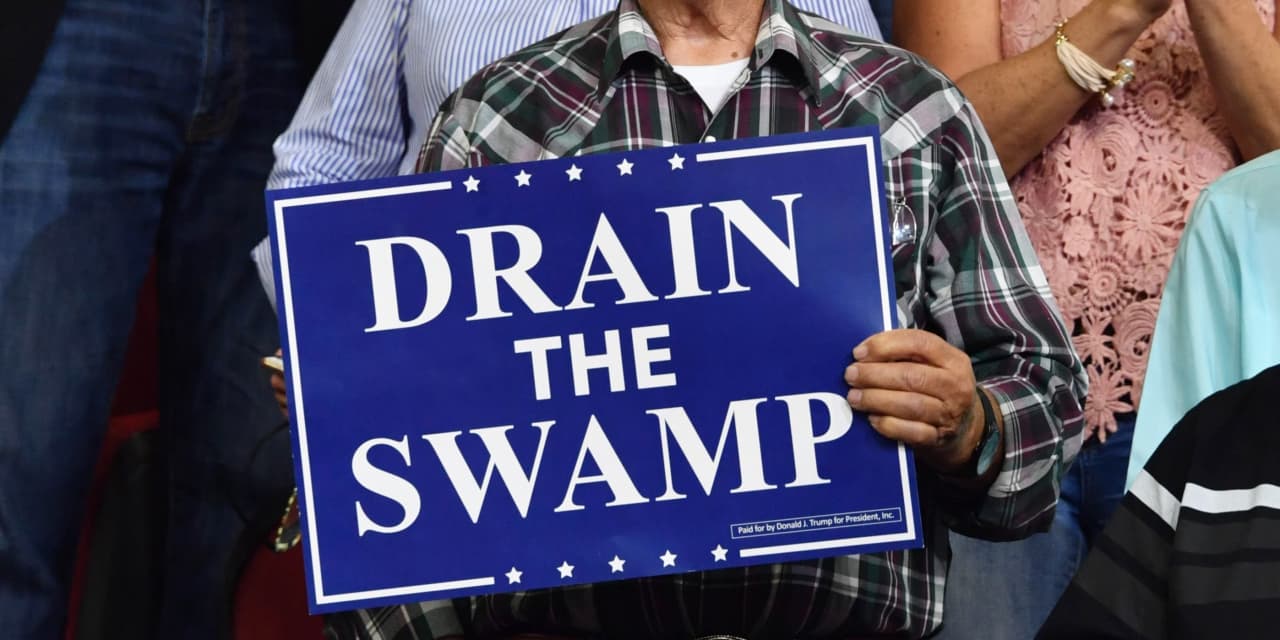

“ No party, and no ideology is immune from the greed that is a transcendent part of this city that was built on, and continues to be, a swamp. ”

But none of this was illegal. These sorts of actions—“honest graft” if you will—were allowable even though it was the same sort of activity that potentially could have landed them in jail if they weren’t elected officials.

Senators selling stocks

And just this year, U.S. senators from both sides of the aisle—Republicans Kelly Loeffler of Georgia, Jim Inhofe of Oklahoma and California Democrat Dianne Feinstein—landed in hot water for selling stocks just before the stock crash that was triggered by the coronavirus pandemic. All three have since been cleared of any wrongdoing, but a similar probe into trades by a fourth senator, North Carolina Republican Richard Burr, remains open.

There have been efforts to self-police Congress. In April 2012, months after the CBS report ran, the so-called Stop Trading on Congressional Knowledge Act (“STOCK Act” for short) was passed nearly unanimously (96-3 in the Senate and 417-2 in the House) and signed by President Barack Obama. The law made it illegal for members of Congress to engage in insider trading. It also applied to federal employees, including the president, vice president, and other members of the executive branch.

So what happened? Just a year later, and with much less fanfare, the law’s financial disclosure requirements were watered down. Both the House and Senate did so quickly and quietly, using a fast-track procedure known as “unanimous consent.” In the House, it took 30 seconds before a largely empty-chamber (it was a spring Friday afternoon) and there was no debate. The Obama White House also quietly announced that the reversal had been signed by the president.

Trump’s critics are outraged that he would pardon financial felons such as Collins, Hunter and Stockman. It sets the wrong example, they say.

But the real outrage is the broader and enduring culture within the Beltway that has always allowed the foxes to guard the henhouse. No party, and no ideology is immune from the greed that is a transcendent part of this city that was built on, and continues to be, a swamp.