This post was originally published on this site

Analyst Joe Osha at JMP Securities is now more bullish on Tesla Inc.’s stock than ever, and his reasons are about the electric vehicle maker’s potential over the next few years, and not about the stock’s inclusion in the S&P 500 index.

Osha raised his stock price target by 53% to $788, the highest he’s ever had on Tesla, from $516. His new target is 21.3% above Monday’s closing price of $649.86. Osha reiterated his market outperform rating, that he’s had on the stock since Oct. 22, after Tesla reported third-quarter results.

The stock TSLA, -6.49% bounced 0.8% in premarket trading Tuesday. On Monday, its first day as an S&P 500 SPX, -0.39% member, the stock had dropped 6.5% after spiking up 11.6% two days before inclusion to a record on Friday, in trading action often referred to on Wall Street as “buy the rumor, sell the fact.”

Osha said he has based his investment position on Tesla on the idea that he needs to look “a few years out,” to 2025, to have a reasonable idea of what Tesla might become.

“As we have watched the company evolve over the past six months, our 2.5 million unit delivery target for 2025 has looked increasingly plausible,” Osha wrote in a note to clients. “Now, as we exit the year, and we review [Tesla’s] competitive position, both the market opportunity and [Tesla’s] potential shipments are looking larger than we thought.”

So he raised his 2025 unit delivery target to 3.05 million vehicles. And that new view is what prompted him to increase his stock price target.

Nowhere in Osha’s note, which was sent to clients on Monday, did he mention the S&P 500 inclusion.

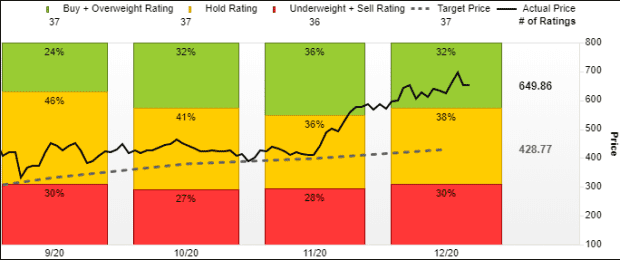

Osha’s bullish view makes him a minority on Wall Street. Of the 37 analysts surveyed by FactSet who cover Tesla, 32% have the equivalent of a buy rating, 38% have the equivalent of hold and 30% have a sell rating.

Also read: Tesla stock price target gets a 28% boost at Wedbush, but not enough to recommend buying.

His price target of $788 is 83.8% above the average analyst target of $428.77, which is 34.0% below Monday’s close.

FactSet

Osha’s more-bullish view on Tesla isn’t just company specific. He now projects total battery electric vehicle (BEV) shipments in 2025 to be 15.7% of global vehicle sales, up from his previous estimate of 14.0%.

He thinks Tesla will capture approximately 45% of the addressable BEV market in 2025, which is actually down from his current estimate of 54%.

“Given the pace at which we are seeing policy evolve, we could imagine revising our BEV industry numbers up further in coming years,” Osha wrote.

Tesla’s stock has rocketed 676.7% this year through Monday, while the S&P 500 has gained 14.4%.