This post was originally published on this site

A new COVID-19 strain, said to be highly infectious caused panic among investors on Monday before calm eventually returned.

The U.K.’s health minister Matt Hancock warned that the new strain, was “out of control” as the government scrapped a planned relaxation of the rules over the holiday period. Prime Minister Boris Johnson said the strain could be 70% more transmittable.

A number of European countries, including France, Italy and the Netherlands have suspended all travel to and from the U.K. Italy, Australia and South Africa have also detected the new strain.

In our call of the day, Markets.com analyst Neil Wilson described the market move as near-term volatility and said “corrections of this nature” are to be expected on the road to full vaccine deployment.

“This is the kind of near-term volatility we can expect until the full force of vaccines is felt. There has been a lot of hope already priced in with the vaccine-inspired November rally so we cannot expect a straight line higher for stocks,” he said in a note on Monday.

He added that the rotation trade began to unwind, at least in the U.K., due to tighter measures and travel restrictions, with oil companies BP BP, -0.10% and Royal Dutch Shell RDSB, +0.14% and British Airways owner IAG IAG, +4.45% among the notable fallers on Monday, and online grocer Ocado OCDO, -2.74% and food-delivery company Just Eat Takeaway JET, +0.39% among the few European stocks rising.

With the full impact of the vaccine some months away, Wilson warned investors to be prepared for a rough ride. “The cavalry may be coming but the homesteaders need to batten down the hatches and face another onslaught before they arrive,” he said.

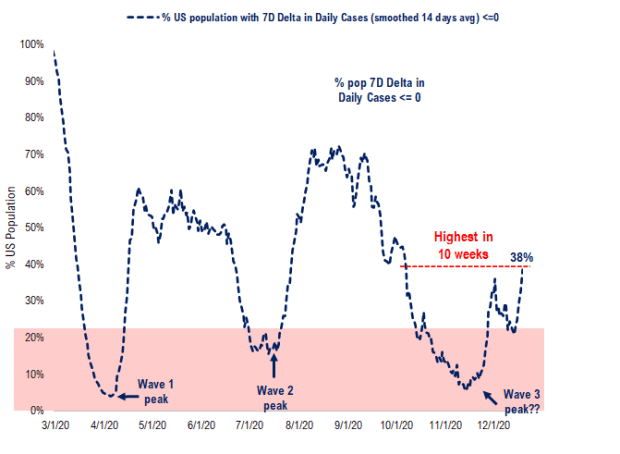

The chart

Source: Johns Hopkins and Fundstrat

Our chart of the day from Fundstrat shows that the percentage of the U.S. with falling cases is at 38% — the highest level since early October, which its analysts said may suggest the third wave has peaked. But they added that the situation in California was “pretty serious.”