This post was originally published on this site

Shares of Tesla Inc. are falling Monday, on their debut as S&P 500 index components, but they are just giving back a little more than what they gained in the final minute as a non-index member.

The electric vehicle maker’s stock TSLA, -5.10% opened at $666.24, which was $28.76, or 4.1%, below Friday’s record close of $695.00. It has traded within an intraday range of $651.20, or down 6.3%, to $668.50, or down 3.8%, in early trading Monday.

This is how Michael O’Rourke, chief market strategist at JonesTrading described the final minutes of Tesla’s stock as a non-S&P 500 member.

“Based upon the approximately 70 million shares that traded on the close, it appears the index funds pre-traded tens of millions of shares,” O’Rourke wrote in a note to clients.

He said more than 55 million shares paired off in the final minutes of the session, but it was the last 12-to-15 million shares that caused the spike in prices into the final print.

“Up until that final minute of the session, 69.4 million shares had traded at an average price of $665.07,” O’Rourke wrote.

The stock officially entered the S&P 500 after Friday’s closing bell.

The stock was recently down $32.17, or 4.6%, at $662.83. But that price was just $2.24, or 0.3%, below the average price up until Friday’s final minute, as funds scrambling to buy the stock ahead of S&P 500 inclusion really goosed the price. In comparison, the S&P 500 SPX, -0.37% was recently down 3%.

Don’t miss: Buying Tesla stock? Here’s what one analyst says as it enters the S&P 500.

Also read: Tesla stock price target gets a 28% boost at Wedbush, but not enough to recommend buying.

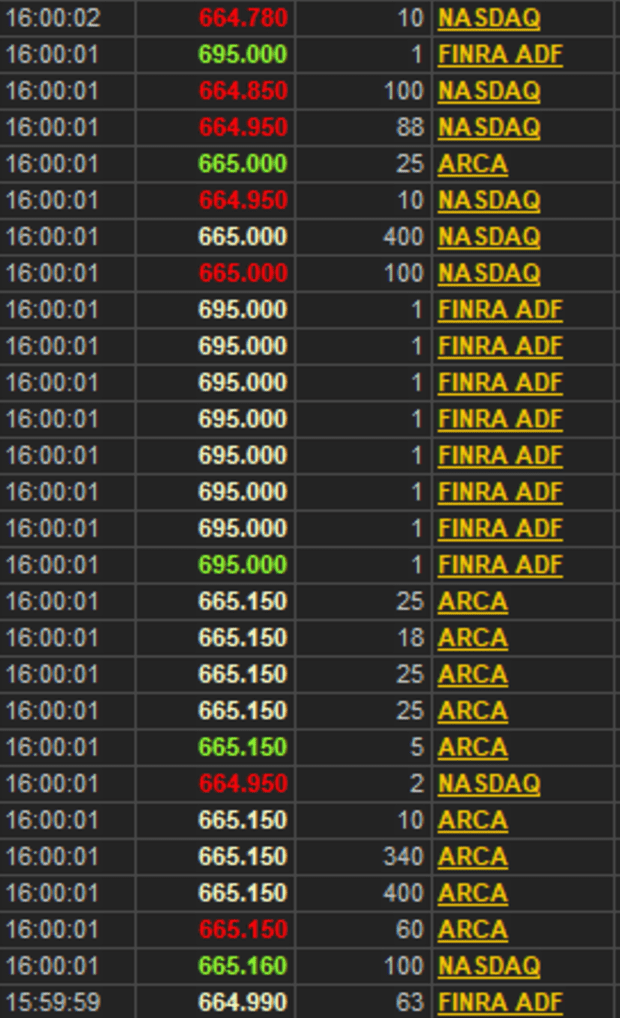

As an example of the hectic trading in the final seconds, here’s a small snapshot of time-and-sales from FactSet:

FactSet

The SPDR S&P 500 exchange-traded fund SPY, -0.31%, which would’ve been one of those funds needed to add Tesla, had $318.37 billion assets under management as of the Dec. 18 close, compared with $318.19 billion as of Thursday’s close, even as the “Spiders” fell 0.8% on Friday after closing at a record on Thursday.