This post was originally published on this site

“ ‘The single greatest risk that we are dealing with today is the loss of the U.S. dollar as the reserve currency. If we keep doing what we are doing right now, I think it is 10 or 15 years away.’ ”

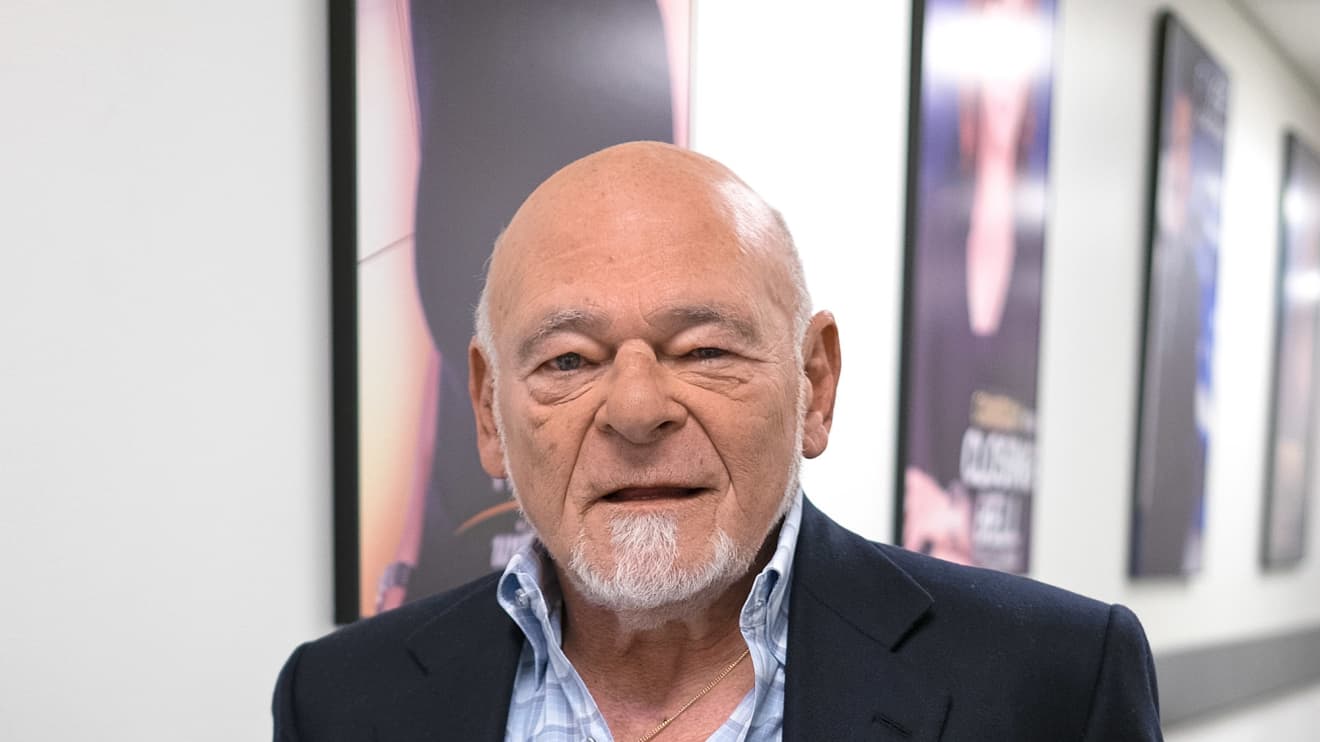

That’s Sam Zell, the founder and chairman of Equity Group Investments, warning in a recent RealVision interview that “a 25% reduction in our standard of living” could take place if the dollar DXY, +0.02% loses its reserve status, which he says is a very real possibility.

“Unlimited debt and irresponsible activity don’t lead to positive outcomes,” the billionaire real-estate mogul added. “That’s a disastrous kind of scenario.”

Zell isn’t the only heavy-hitter concerned about what a crumbling dollar could do to the U. S. economy. Bridgewater’s Ray Dalio recently warned that “we’re very close” to losing that status.

“The system needs to be re-engineered to do this. But if we don’t do this engineering well, we’re going to spend in an unlimited way and deal with that by creating debt that won’t ever be paid back,” Dalio told MarketWatch back in September. “Within the next five years you could see a situation in which foreigners who have been lending money to the United States won’t want to.”

As for Zell, he also shared his thoughts on the current investing climate in comments from the RealVision interview compiled by Business Insider.

“We can look at some parts of the stock market today and say, ‘Everybody is crazy,’” he said, “I look at valuations and see extraordinary numbers that I can’t support.” He pointed specifically to one of the market’s highfliers. “I can’t even begin to give you an intelligent assessment of Tesla TSLA, -5.10%. ”

Then there’s bitcoin BTCUSD, -2.88% and it’s nosebleed ride to record highs.

“I am very skeptical, frankly, of bitcoin.” he said. “Ultimately, it may be the answer or one of the answers. But right now, it’s a world that’s extraordinarily populated by chameleons and other fast-talking characters. I don’t believe everybody involved in it are the kind of people I’d like to follow. ”

Finally, Zell also had a message for those confident that they have a pulse on where the volatile stock market is headed in 2021: “Everybody else seems to have a kind of timing game in their own head. ‘Well, I can get out before so and so happens,’” he said. “The world is full of skeletons of people who believed they could get out before the bad event came.”

Anybody who bought blue chips early in Monday’s session enjoyed some great timing, considering the Dow Jones Industrial Average DJIA, +0.19% bounced back from a steep retreat early to turn positive. The S&P 500 SPX, -0.37% and the Nasdaq Composite COMP, -0.18% were still in the red.