This post was originally published on this site

Bitcoin’s surge to unprecedented levels above $23,000 on Thursday is being met with much ballyhoo on Wall Street, but at least one technical expert warns that the popular digital currency could be primed for a pullback.

Tom DeMark says that based on his timing models, the world’s most prominent cryptocurrency is likely to retreat soon.

Read: Stock-market timing expert DeMark ‘confident’ S&P 500 surges 5% in next 2 weeks

“Although it appears treacherous to take such a stance, here is what our combined timing models are suggesting about Bitcoin at this time,” he said, pointing to what he described as “pending upside trend exhaustion,” which could play out Thursday or Friday, initiating a downside move for the nascent asset.

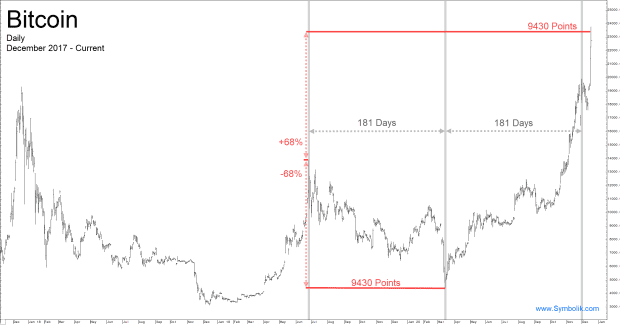

“The prior instances in which this long term model has spoken include the precise December 18, 2017 high, the precise low day December 14, 2018, and then the precise June 26, 2019 high day,” DeMark wrote.

He said that each warning for bitcoin’s BTCUSD, +0.34% retrenchment was the precise high or low day.

DeMark is a technical analyst who employs market-timing measures to determine when to buy and sell and asset.

The prominent analysts says that bitcoin’s decline from its June 26, 2019 high to a bottom March 16 was 9430 points, and adds that “if one were to add 9430 points to the June 26, 2019 high it projects upside to 23,288 which is the zone in which the current market is trading.”

Symbolik.com

“Obviously, there is no certainty in the forecasting business and often it is prudent to await confirmation of the completion of a trend rather than making a bold prediction,” he said. “Nevertheless awaiting a close less than the close 4 or 5 days earlier and next day downside follow through would sacrifice opportunity.”

DeMark used a charting service, called Symbolik, founded by his son T.J. DeMark, which promises to provide cloud-based, institutional-quality analytical tools, to make his bitcoin call.

DeMark said bitcoin could pullback anywhere between roughly 5.5% and 11% but that the decline could also be steeper. He also acknowledges that the asset could perpetuate its gains and ignore the exhaustion signal, if investors continue to pile into the asset.