This post was originally published on this site

Americans checking-account balances are sharply declining as they await progress on continued stimulus talks between lawmakers.

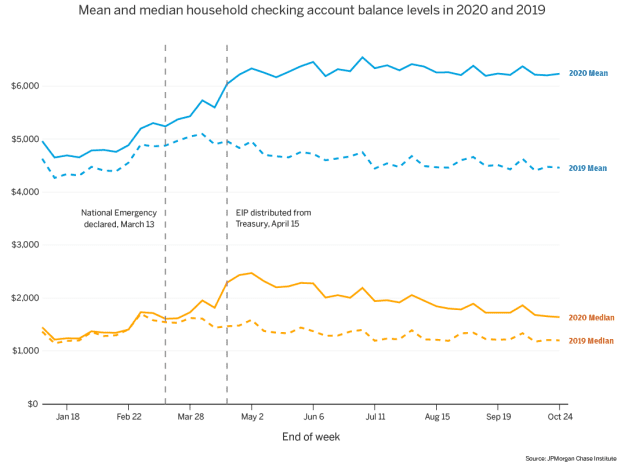

As a result of the enhanced unemployment benefits and direct stimulus checks, both part of the CARES Act, Americans’ median checking-account balances increased by 65% on the year in April, according to a JPMorgan Chase Institute JPM report published on Wednesday.

By September, Americans drew out 50% of the initial balance gains in April, the report, which analyzed 1.8 million families’ Chase personal checking accounts found.

The fall in checking-account balances signifies that “the ‘typical’ family is spending down the cash buffer they accumulated during COVID-19,” the report said.

Low-income households experienced the largest year-over-year percentage increase in median checking account balances in April (50%), compared to higher-income Americans who experienced a 35% increase in balances.

In contrast, by the end of October, “the highest earners had lost 38% of their gains relative to the prior year, while the lowest earners had lost 64% of their gains,” the report states.

The reversal can be explained by the fact that “low-income families experienced the greatest job losses and saw the largest proportional increase in unemployment benefits as a result of the $600 weekly benefit supplement under the CARES Act,” the report states. “As a result, many low-income families received more in unemployment benefits through the end of July than their pre-job-loss earning.”

A bipartisan stimulus package proposal that was unveiled shortly after Thanksgiving, if passed, would extend all pandemic unemployment insurance programs for 16-weeks.

Absent of any legislative action before Dec. 26, gig workers, independent contractors and self-employed Americans will become ineligible for unemployment benefits. In total, some 12 million Americans would stop receiving unemployment benefits, according to research by the liberal-leaning Century Foundation. As a result, personal incomes could see a roughly $226 million drop.

The proposal also calls for federal add-on payment on top of state jobless checks revived at $300 a week. As it stands, the proposal does not include a second round of direct stimulus-check payments, but that may change as lawmakers finalize a deal, Politico reported.