This post was originally published on this site

Calls for canceling some portion of the record $1.6 trillion pile of U.S. student loans have ramped up ahead of a Biden administration.

Now that Joe Biden’s win over President Trump has been certified by the Electoral College, spurring hopes that more lasting debt relief could be on the way, here’s a look at who in the U.S. owes the most on federal student loans.

Few, higher earners owe bulk of student loans

BofA Global, Federal Reserve

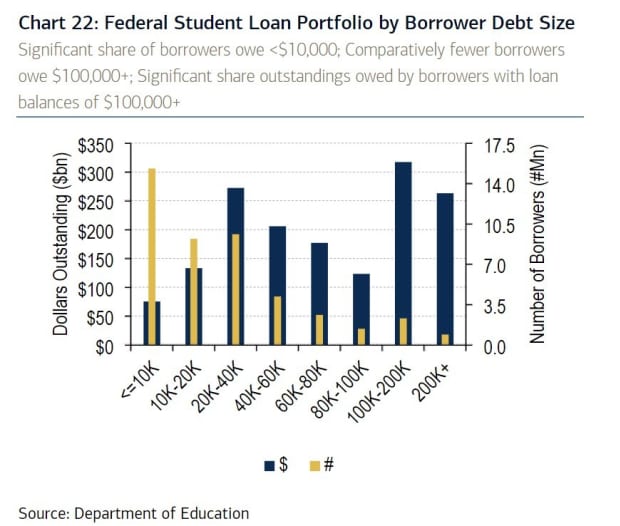

Analysts at BofA Global put together the attached chart showing that a relatively small group of less than 3.5 million borrowers owe the biggest single chunk of debt at more than $300 billion.

Each borrower in that group owes $100,000 to $200,000 perhaps after financing a medical, business or law-school degree, while the second-largest category of borrowers, at $250 billion of loans outstanding, owes more than $200,000 each.

In other words, a small portion of borrowers owe the big bucks, while the most in the U.S. with student debt — 14 million — owe the federal government less than $10,000 a piece for their education.

“The debate on whether the idea of canceling student loans is good (effective) or bad (ineffective) has covered a wide range of views,” wrote BofA’s team of analysts led by Chris Flanagan, in a weekly note.

President-elect Joe Biden proposed forgiving at least $10,000 of federal student loans per person under his Emergency Action Plan to Save the Economy, as COVID-19 cases set alarming records.

Back in September, Democratic Sens. Chuck Schumer (D-NY) and Elizabeth Warren (D-Mass.) urged the next president to cancel up to $50,000 in student debt immediately, a proposal outgoing Secretary of Education Betsy DeVos recently called a “socialist takeover of higher education.”

“There are valid arguments on both sides of the debate, but the data show that a targeted approach to forgiveness and/or improvement on existing forgiveness programs might be the best path forward,” Flanagan’s team wrote.

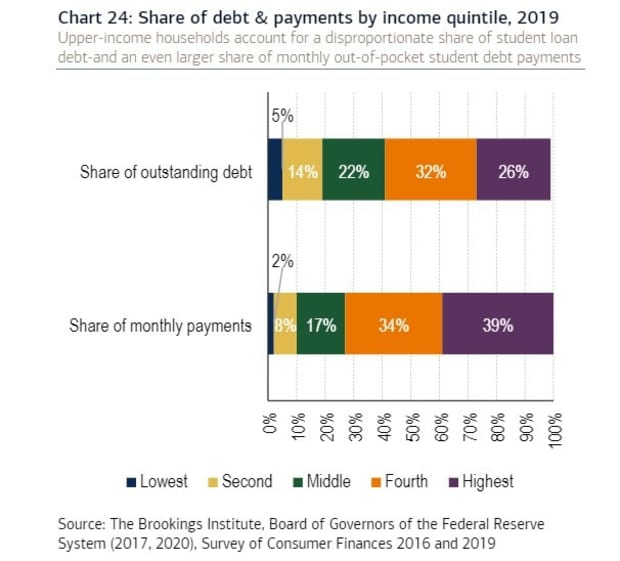

To further illustrate the debt burden, this chart shows that upper-income households owe about 60% of the outstanding student debt, and an even larger share of monthly out-of-pocket payments.

Upper-income households owe the most

BofA Global, The Brookings Institution, Federal Reserve

But the most indebted households with student loans also tend to have the lowest rates of unemployment and highest incomes, “so forgiveness might be better targeted towards those with some college,” or those who did not graduate,” the BofA team wrote.

“The focus of any loan forgiveness program will likely be on borrowers who are struggling to repay loans.”

Read: Should the Biden administration cancel student debt? Read this before you decide

In market action Tuesday, stocks closed near all-time highs as Wall Street awaited updates from Congress on its effort to produce another pandemic aid and government spending package.

Student lender SLM Corp SLM rose 2.5% on Tuesday and 37.7% in the year to date. Navient Corp NAVI advanced 2.7% in the session, but was down 30.6% on the year to date, while Nelnet, Inc. NNI added 1.1% Tuesday and 19% so far this year.

The Dow Jones Industrial Average DJIA, +1.13% rose 1.1%, or 5.8% in the year to date, while the small-cap Russell 2000 index RUT, +2.40% advanced 2.4% Tuesday to a record close, gaining 17.5% so far this year.