This post was originally published on this site

European stocks edged higher early on Tuesday, as investors remained hopeful of a Brexit trade deal but fearful of rising COVID-19 cases and tighter restrictions.

The pan-European Stoxx 600 SXXP, +0.13% index was 0.2% up, while the German DAX DAX, +0.71% and French CAC PX1, +0.45% both climbed 0.5%, and the U.K.’s FTSE 100 nudged 0.3% higher.

U.S. stock futures pointed higher with more conviction, after the Dow Jones Industrial Average DJIA, -0.62% and the S&P 500 SPX, -0.44% closed lower on Monday as tougher measures in New York and parts of Europe concerned investors. Optimism over the vaccine rollout and a new bipartisan coronavirus aid bill, unveiled late on Monday, brought renewed optimism. Dow futures YM00, +0.52% were 0.5% up, implying a 160-point gain at the open, while S&P 500 futures ES00, +0.58% and Nasdaq futures NQ00, +0.42% also rose.

“Are we in the calm before the next storm? Equity markets were very quiet on Tuesday with little large-cap corporate news to drive trading volumes and investors sitting patiently for updates on the rate of COVID-19 infections, the vaccine rollout and EU-U.K. trade talks,” said AJ Bell investment director Russ Mould.

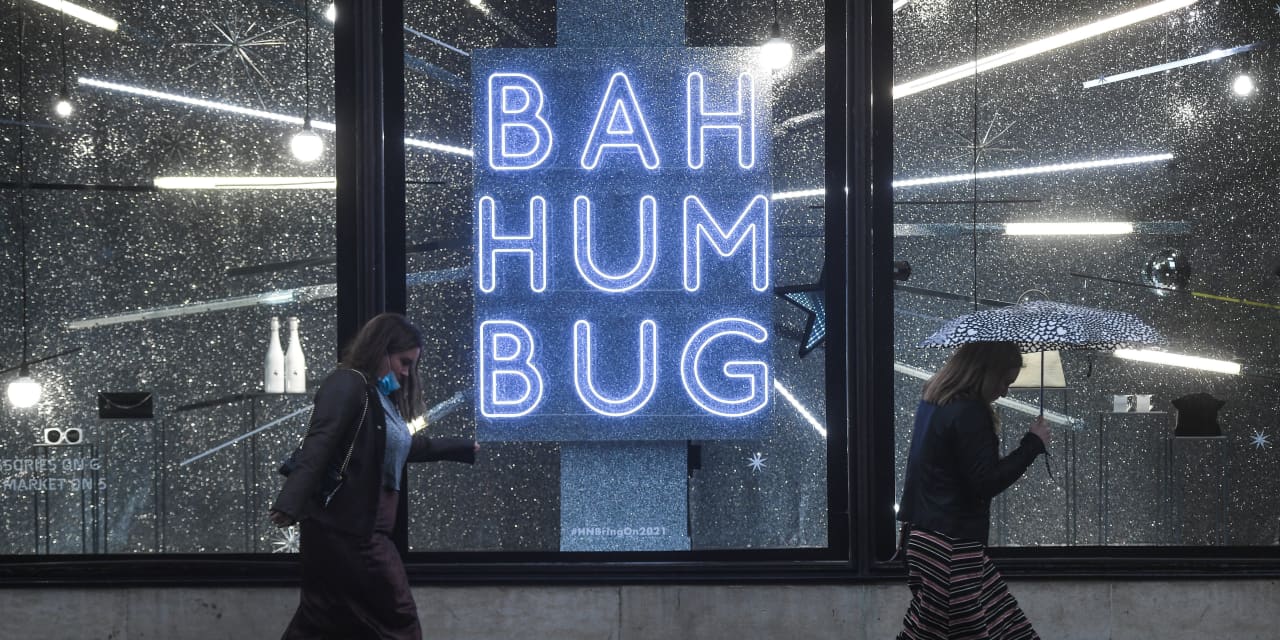

As the COVID-19 vaccine rollout continued in the U.K. and began in the U.S., stricter measures being implemented by countries across Europe have reminded investors that the pandemic is far from over.

The U.K. government said London would move into tier 3 — the toughest level of restrictions — on Wednesday, to combat surging cases in the capital. The Netherlands will enter a five-week lockdown, the country’s toughest restrictions to date, Prime Minister Mark Rutte announced in a television address to the nation late on Tuesday. Germany will also tighten restrictions over Christmas, starting on Wednesday.

The U.K’s health secretary Matt Hancock added to concerns, as he said a new variant of coronavirus has been identified, which may explain the fast spread of cases in the south of England.

The unemployment rate in the U.K. rose to 4.9% in the three months to October, with the number of people jobless climbing to 1.7 million. A record 370,000 people lost their jobs in the three month period.

The pound GBPUSD, -0.02% slipped 0.1% after Monday’s rally, as Brexit trade talks remained in the balance. U.K. and European Union leaders had promised to “go the extra mile” on Sunday and extend talks into this week.

Stocks in focus

Inditex’s ITX, -2.48% stock slipped, as the owner of clothing retailer Zara said sales fell 14% in the three months to October, compared with a 31% drop in the previous quarter, ahead of further restrictions that began in November.

The Spanish fashion group’s Swedish rival H&M HM.B, -3.50% said sales fell 10% in its fourth quarter but had suffered another hit from the end of October — with sales down 22% from Oct. 22 to Nov. 30 when compared with the previous year. The stock fell 2.8%.

Volkswagen VOW, +4.60% stock rose more than 4%, as the German car maker’s supervisory board said the company’s chief executive had its full support, potentially ending a power struggle.