This post was originally published on this site

“ ‘We are looking at a high probability of a vicious cycle. Public health is deteriorating… policy is not doing anything. The economy is slowly going into recession in Europe, and people are becoming more hesitant to interact socially and economically.” ”

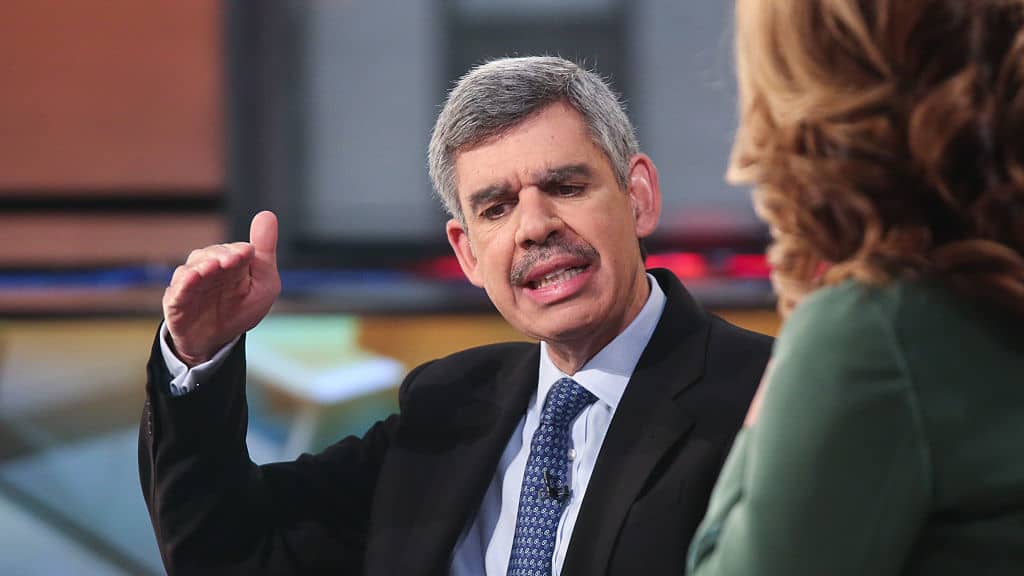

That’s Mohamed El-Erian, chief economist at Allianz, explaining to Bloomberg TV in a recent interview why the government needs to take action to “break that cycle” in the face of surging coronavirus numbers. “Unless we move on policy and health,” El-Erian continued, “you and I unfortunately will be talking about this vicious cycle.”

Read: The Fed and a vaccine aren’t enough to protect investors

What does that mean for the stock market and it’s bull run? Perhaps not much, considering what has been driving the record highs lately.

“I’m a believer that there’s a limit to how much you can disconnect Wall Street to Main Street,” El-Erian told Bloomberg on Friday. “Having said that, you’ve got to respect the technicals.”

And those technicals, he said, are “very strong” thanks to central banks that have provided “an umbrella that has protected the financial markets from all sorts of things.”

Watch this clip from the interview:

Meanwhile, the disconnect is alive an well, with stocks recently pushing into record territory. Last week, however, the Dow Jones Industrial Average DJIA, +0.16% took a breather with a 0.6% dip, while the S&P 500 SPX, -0.13% fell 1%, and the Nasdaq COMP, -0.23% lost 0.7%.