This post was originally published on this site

“ ‘What clients are telling me is that they tried the suburbs and they missed the city. They say they miss being able to walk to a grocery store or coffee shop and not relying on a car.’ ”

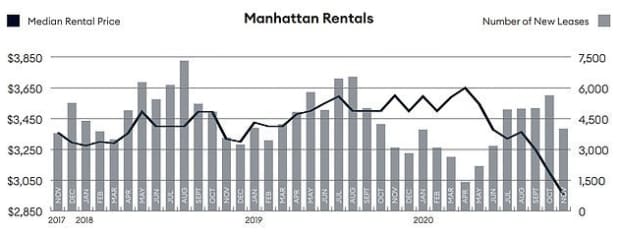

That’s Janna Raskopf, a broker with Douglas Elliman, in a television interview Thursday about a new report showing leases in Manhattan spiked by 30% in November to 4,000 new signees from a year ago.

A record drop in rents as landlords scramble to fill vacancies left by the pandemic outflow drove the strongest November in 12 years, according to the findings from Miller Samuel and Douglas Elliman.

The median net-effective rent, or prices including concessions, dropped 22% last month, tying October’s biggest drop on record. The median price for a rental is now down to $2,743, with most landlords offering more than two months free rent.

Miller Samuel

“Lower prices have created this this trigger for inbound migration,” Miller Samuel CEO Jonathan Miller said. “That’s one of the early signs of the market potentially improving.”

Industry experts cited by CNBC, on which the Raskopf interview aired, say the rising number of new leases is being driven by Manhattan residents taking the opportunity to upgrade, former residents returning from the suburbs after fleeing during the pandemic and millennials who had moved in with their parents.

Still, there are plenty of empty apartments — more than 15,000 — spread across the city, the report found. The vacancy rate, which typically hovers around 2%, remains at a record 6%.

When will the Big Apple return to some semblance of normal? There are plenty of differing opinions on when that day will come. Former Goldman Sachs GS, +0.65% CEO Lloyd Blankfein, for instance, recently expressed his optimism, while James Altucher, a best-selling author and former hedge-fund manager, has said it’s “dead forever.”