This post was originally published on this site

From the early days of the Democratic primaries to the debates between Joe Biden and Donald Trump, the 2020 presidential candidates spent a lot of time talking about housing — and that’s somewhat unusual.

As various Democrats jockeyed for their party’s presidential nomination in the closing months of 2019 and early this year, many of the candidates, including Biden, released ambitious housing agendas, calling for everything from a tax on real-estate speculators to the construction of millions of new rental units nationwide. This summer, President Trump boasted of his administration’s decision to roll back an Obama-era fair housing rule, claiming that people in the suburbs would see higher home prices and less crime as a result.

“I’ve been involved in prior campaigns, and to get housing policy in the mix anywhere other than on the campaign’s website is usually pretty challenging,” Jim Parrott, a nonresident fellow at the Urban Institute, said, commenting on how rare it is to see housing as a core policy issue that candidates discuss regularly.

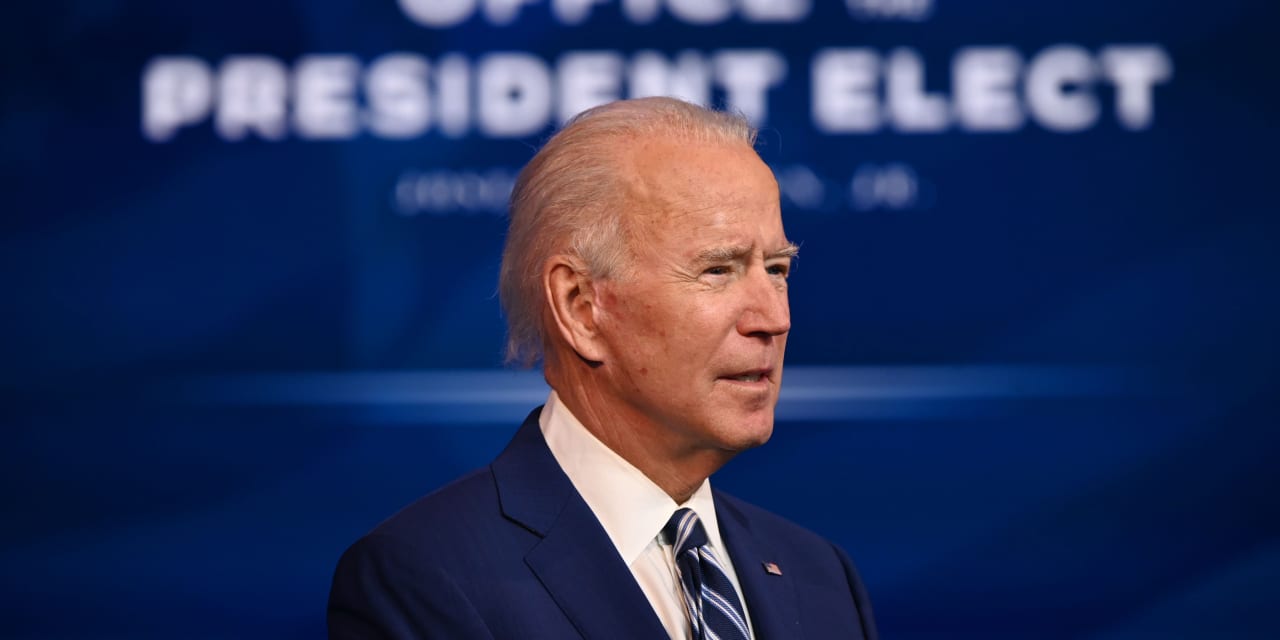

Since winning the election, Biden has continued to speak out on housing-related issues. While announcing his choice to nominate Janet Yellen as his Treasury secretary, Biden made note of the uneven economic recovery from the pandemic and how that has played out in terms of housing.

“Like the two lines coming out of a K, some people are seeing their prospects soar up while most others are watching their economic well-being drop sharply,” Biden said. He later said that luxury home sales were up 40% from last year, yet one in six renters were behind on their rent payments as of October.

Also see: What a Biden administration will mean for housing-finance reform

So what can Americans expect out of the Biden administration in terms of housing policies? Here’s what the experts say:

The economic recovery from the pandemic will take precedence

The recession sparked by the COVID-19 pandemic has had serious ramifications for renters and homeowners alike. Millions of renters could face eviction at the beginning of next year if the nationwide moratorium imposed by the Centers for Disease Control and Prevention is not extended.

And even then, the moratorium is only a stop-gap measure — without emergency rental assistance, those renters could still find themselves without housing whenever the moratorium does end after being unable to pay rent for months. Meanwhile, many mom-and-pop landlords are struggling to remain afloat after withstanding many months of not receiving payments from their tenants.

Homeowners might arguably be in a better position than renters, but many are also struggling. Millions of homeowners are still in mortgage forbearance programs allowed by the CARES Act, which let them skip monthly payments for up to a year. Come March, many homeowners may be forced out of those forbearance plans, without action on the part of Congress. At that point, they can negotiate a loan modification with lenders, but many will still struggle.

Banking regulators will need to ask lenders to differentiate between those mortgage borrowers who can recover and those who are unlikely to, and then come up with exit strategies for those in trouble. “The longer you delay loss mitigation, the bigger the loss,” said Karen Shaw Petrou, a managing partner at Federal Financial Analytics.

Even though most Americans have seen their home equity grow substantially amid the pandemic, some struggling homeowners will end up in foreclosure. “The most vulnerable households to foreclosure are, guess what, low and moderate homeowners, and they are the ones who haven’t seen that kind of house price increase,” Petrou said.

If the Biden administration doesn’t secure a larger, comprehensive stimulus package that addresses the needs of renters and homeowners alike, “you’re going to wind up with potentially a massive amount of stress coming out of the housing market, and rippling all through the economy in general,” Parrott said.

But the Biden administration could pivot pandemic-related relief into its broader housing agenda, experts said. “The pandemic has provided us with a new opportunity to engage with members of Congress that really underscores why housing is so critical,” said Sarah Saadian, vice president of public policy at the National Low Income Housing Coalition. “And so I’m hoping that it helps us build the political pressure that we need to get big things done.”

Biden views housing as key to economic prosperity

One of the key reasons that so many candidates this election cycle focused on housing policy is because of concerns related to affordability. Even before the COVID-19 pandemic, renters were struggling to afford the roofs over their heads. In 2019, over 20 million renter households across the country had spent more than 30% of their incomes on housing, according to data from the Joint Center for Housing Studies of Harvard University.

But beyond the question of affordability, Biden sees housing as an integral component to other, broader societal issues that he hopes to address. For instance, as part of his broader proposal to address climate change, Biden called for “the construction of 1.5 million sustainable homes and housing units.”

“ They are much more likely to fold housing policy into their broader, high-priority economic policy agenda in a way that we haven’t seen in a long time. ”

“He is really trying to listen to different disadvantaged communities and ensure that equitable policy is interwoven between all aspects of his administration,” said Melody Zimmerman, program and policy director at the National Housing Resource Center, an organization that advocates for the housing counseling industry and consumers.

Another example of this can be seen in Biden’s plans to address the racial wealth gap. The historical lack of access Black and Latino Americans have had to homeownership has hindered their ability to build and transfer generational wealth, which contributes to the gap seen today.

For the Biden team, “solving some pretty big existential economic issues is going to require solving some important housing policy issues,” Parrott, who is also the owner of Parrott Ryan Advisors, a consulting firm that provides advice on housing finance issues to financial institutions, said. “It means that they are much more likely to fold housing policy into their broader, high-priority economic policy agenda in a way that we haven’t seen in a long time.”

Renters could get help with high housing costs

Also unlike past administrations, the Biden administration appears poised to take a close look at the housing situation that renters face, and not just the dilemmas faced by homeowners.

Several key components of the housing plan the Biden campaign released earlier this year are targeted toward easing the affordability concerns renters face. For starters, Biden has proposed expanding funding for the Section 8 housing voucher program, which subsidizes the cost of rental housing for low-income families. Currently, only one in four eligible households receives these vouchers because of inadequate funding.

“If we had universal housing vouchers we wouldn’t be seeing as many households on the on the cusp of evictions like we are now,” Saadian said.

“ We already have lots of tax credits that go to homeowners, and so this is a way of evening the playing field for renters, too. ”

Additionally, Biden proposed two tax credits primarily targeted to renters. One would allow renters who earn too much to qualify for housing vouchers to write off housing costs that exceed 30% of their income, which is similar to a proposal that Vice President-elect Kamala Harris had made during her presidential campaign. The other would provide a refundable, advanceable credit of up to $15,000 to cover the cost of a down payment on a house.

“We already have lots of tax credits that go to homeowners, and so this is a way of evening the playing field for renters, too,” Saadian said.

All of these policies would require legislative action, but some could garner bipartisan support in Congress, housing experts said. In particular, Biden’s proposed tax credits could be appealing to conservatives who are more inclined to cut taxes than raise them.

The Biden administration will refocus agencies on fair housing

One area where the Biden administration can take action without the assistance of Congress is in its oversight of existing regulations — particularly those related to fair housing and lending. The Trump administration has rolled back a number of Obama-era policies that were intended to reduce residential segregation and discrimination against people of color in the housing market.

“The place where the Trump administration has done the most harm is on undermining civil rights and fair housing protections. And so it has to be a major focus of the Biden administration next year,” Saadian argued.

Fair housing advocates have noted that Biden’s selection of Rep. Marcia Fudge, a Democrat from Ohio, to head the Department of Housing and Urban Development is an encouraging sign in this regard. In a statement following Fudge’s nomination, National Fair Housing Alliance President and CEO Lisa Rice noted that Fudge is “an unflagging advocate for civil rights” with “a strong commitment to ensuring equitable access to credit, education, healthy food, clean environments, and other resources, which go hand-in-hand with access to housing.”

But Biden’s team will likely do more than revert fair-housing rules back to what they were before Trump took office. Biden himself has suggested he will work to address discrimination in the home-appraisal process, for instance.

Certain proposals could backfire if not implemented correctly

Addressing the issues facing the country’s housing market isn’t fool-proof and could come with unintended consequences.

For instance, Biden’s proposed tax credit for down payment assistance could expand the number of Americans who could afford to buy a home. However, the country is already facing a shortage of homes for sale and fast-rising home prices as a result. If more people suddenly entered the home-buying market, it could be a recipe for disaster without additional action.

“You’ve got to find a way to deal with a supply side problem,” Parrott said. “If you don’t, then efforts to expand demand may incrementally help more people [into the home-buying market], but it will also make housing less affordable.”

To that end, Biden has proposed a $100 billion fund to construct or upgrade affordable housing, as well as the elimination of local zoning regulations that prevent the construction of more homes. Both proposals could expand the number of homes on the market if implemented.

“Hopefully, they can come up with a package that resonates with both sides,” Parrott said.