This post was originally published on this site

The market rally in the past month that pushed the Dow DJIA, -0.35% above 30,000 points may have just set the stage for investors’ bullish expectations into next year.

As investors cycled out of outperforming technology stocks on Wednesday, they piled into cyclicals and downtrodden sectors like energy, financials, and real estate. This coincided with a frenzied enthusiasm that pushed DoorDash DASH, +85.79% shares 86% higher in the food-delivery company’s public trading debut.

These shifts are indicative of the investor bullishness described in our call of the day from a group of strategists at Goldman Sachs, who say that “more moderate risky asset returns are likely from here, rather than an imminent risk of a sizable correction.”

Alessio Rizzi and his team at Goldman wrote that a number of positioning indicators at very bullish levels suggest a noticeable improvement in growth expectations and reduced uncertainty around a recovery in 2021.

Positioning indicators are metrics that show the positions held by investors, and give representative examples of market sentiment. They can provide bellwethers of risk, including whether assets are flowing more toward risky or safe bets.

One of the bullish metrics that the Goldman strategists highlighted are put/call volume ratios, which describe whether more investors are buying put options — the option to sell a stock at a predetermined future price — or call options, which allow investors to buy a stock at an agreed future price.

We’re deep into call territory, with put/call ratios nearing the limits of their typical distribution, according to the Goldman strategists. Other indicators, like bull vs. bear investor surveys, have turned similarly bullish at extreme levels, they said.

Rizzi and his team said that indicators like put/call ratios tend to provide the most useful signals of where the market is moving when they are extreme, and that “that bullish positioning levels tend to remain strong for a long period if macro remains supportive.”

The macro environment may be headed in that direction. The European Central Bank is set to increase stimulus on Thursday, and Treasury Secretary Steven Mnuchin is offering a $916 billion stimulus package to Congress to try to break a legislative deadlock.

The markets

Stock futures YM00, +0.16% ES00, +0.06% NQ00, -0.15% are modestly lower, led by Nasdaq-100 futures. European stocks SXXP, +0.08% are up slightly in Thursday trading, while Asian equities fell. The pound GBPUSD, -1.04% is down amid volatile trading, as the U.K. and European Union enter the final stretch of Brexit negotiations.

The buzz

Weekly and continuing jobless claims (see preview) are ahead, along with consumer prices, and later an update on the federal budget. It is estimated that initial jobless claims rose to 720,000 in early December from 712,000 at the end of November.

Social media giant Facebook’s FB, -1.93% stock looks set to take a hit again after Wednesday’s slide, triggered by antitrust complaints from the U.S. government and attorneys general from 48 states.

The European Central Bank is widely expected to increase the size of the bloc’s Pandemic Emergency Purchase Programme by €500 billion ($605 billion), and extend its expiration until December 2021, in a closely watched decision.

A Food and Drug Administration committee will meet to discuss the COVID-19 vaccine candidate from U.S. drug company Pfizer PFE, -1.67% and its German partner BioNTech BNTX, -4.14%. If the committee votes that the FDA should authorize the vaccine, it would mark a crucial step toward full approval.

Vying for the biggest initial public offering of the year, lodging-booking platform Airbnb ABNB, reportedly priced its initial public offering at $68 a share ahead of Thursday’s debut. That price tops an already raised recent target range of $56 to $60.

More Americans died from COVID-19 in the U.S. on Wednesday than in the Sept. 11, 2001, terrorist attacks, with daily deaths topping 3,000 for the first time.

The chart

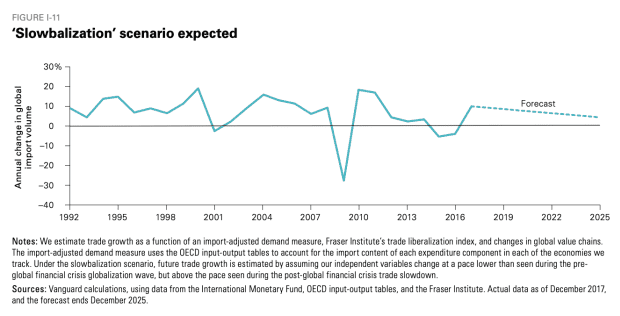

This chart from Vanguard’s global outlook for 2021 tempers the “overly pessimistic” view that rapid deglobalization will come in the wake of the COVID-19 pandemic. Instead, the group’s report said, “the current wide extent of economic and financial linkages poses challenges to a widespread reshoring back home, suggesting that the more likely path forward is a gradual slowdown in trade.” This, they say, is the coming “slowbalization.”

Random reads

Chinese “iron crotch” kung fu masters are fighting to preserve a tradition.

What are the odds? 50 people won the Massachusetts lottery game last weekend — the most ever.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.