This post was originally published on this site

Panic on Wall Street isn’t uncommon. So it is no surprise that when anxiety reached a fever pitch in financial markets back in March, investors unloaded assets considered risky like stocks, in attempt to avert the money-losing proposition implied by COVID-19 pandemic that was gripping the nation.

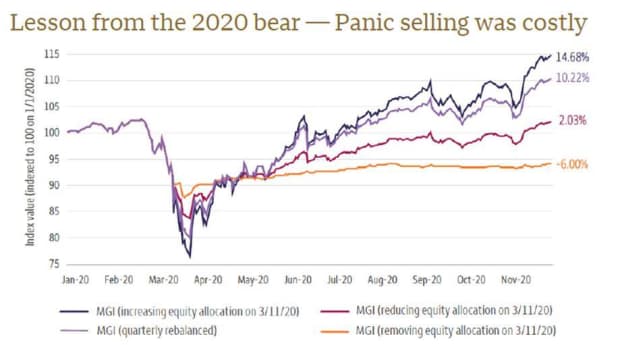

However, the knee-jerk attitude of sell-first-ask-questions-later can be tremendously costly in the long run. It is a point that Wells Fargo Investment Institute attempts to illustrate in a striking chart published on Tuesday (see attached).

Source: via Wells Fargo Investment Institute

Well Fargo’s team ran four hypothetical investment scenarios in which investors responded in the wake of U.S. stock markets hitting their bear-market lows in March by divesting varying portions of their stock portfolios.

As Wells describes the scenario, the first investor (dark purple line) increased equity exposure (added 30% more to equities,

taken from investment-grade fixed income); the second investor (light purple) maintained strategic allocations through rebalancing; the third investor (red) decreased equities (half of the equity exposure redistributed to cash and investment grade fixed income); meanwhile, the fourth investor (orange) completely exited equities.

By now, the results of this experiment should be obvious. The investor type who increased exposure outperformed the other groups by nearly 4.7 percentage points and that buyer was rewarded with a more than 20 percentage point margin compared against the investor that completely divested their holdings.

The rebound from the COVID-19 lows has been stunning, with the Dow Jones Industrial Average DJIA, -0.35% and the S&P 500 index SPX, -0.79% over 60% higher from their March 23 low, while the Nasdaq Composite Index COMP, -1.94% surged more than 80% from that low.

That recovery has largely been aided by aid from the Federal Reserve to help inject confidence and liquidity into debt markets, and direct intervention by the government to help American workers and businesses.

To be fair, it is impossible to know what the future holds when markets tumble at an unprecedented rate but the team at Wells Fargo, led by Darrell Cronk, chief investment officer, do have a takeaway.

“We believe investors may tend to exhibit certain cognitive and emotional behavioral biases that can lead to unwise decisions. In periods of high volatility, we suggest staying disciplined to a thoughtful investment plan

and avoiding emotional reactions,” the team writes.