This post was originally published on this site

An often-cited measure of stock valuations, popularized by Warren Buffett, is affirming a growing fear on Wall Street: equity prices are richer than their fundamental underpinnings.

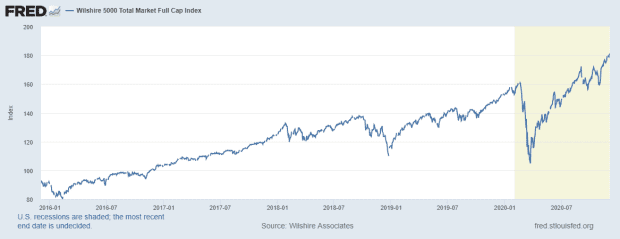

The so-called “Buffett indicator” measures the market capitalization of the Wilshire 5000 Total Market W5000, +1.04%, against that of the latest reading of gross domestic product in the third quarter, which stands at $21.16 trillion, as one measure of stock valuations.

The Wilshire 5000 is used as a gauge of the total value of the U.S. equity market, which would stand at $38.704 trillion, per the index reading as of midday Friday.

Dividing the total market cap against third-quarter’s GDP read translates to a reading of 182.91, which by some estimates is near the highest measure of equity values in history.

An article by Yahoo Finance in August recently noted that the indicator averages around 93 and 114 and that the second-quarter of 2020 represented a recent peak of 182.7. Market technicians say a reading of 70 to 80 represents a good time to invest in the market, while one at or over 100 suggests it is time to get out or stop buying.

St. Louis Federal Reserve

To be sure, the Buffett yardstick, which the Berkshire Hathaway BRK.A, +0.11% boss previously hailed as “the best single measure of where valuations stand at any given moment,” has been flagged numerous times during this recent post-pandemic rally, as a worrisome sign that markets are getting ahead of themselves and overly hyped up on COVID-19 vaccine progress.

MarketWatch has highlighted the indicator nearly a dozen times in the past few months, as a metric that presaged the 2001 crash.

That said, this latest reading comes as the chorus of folks talking about lofty stock valuations is growing.

Indeed, according to Deutsche Bank strategist Jim Reid, the recent run-up in U.S. stocks has taken markets “above the level seen on the eve of the 1929 stock market crash and the recent peak in January 2018,” citing the CAPE ratio of price-to-earnings created in part by Robert Shiller.

U.S. market action, however, has been unperturbed, rising to records unabated on the hope that a fresh round of coronavirus relief from Washington lawmakers will come to fruition, helping to fortify the virus-stricken economy.

On Friday, the Dow Jones Industrial Average DJIA, +0.83%, the S&P 500 index SPX, +0.88% and the Nasdaq Composite Index COMP, +0.70% all finished at all-time highs.

Shiller himself indicated that there could be a sound reason why stocks continue to defy gravity and market-cap logic, noting in commentary in MarketWatch from Project Syndicate that the current dynamic “confirms the relative attractiveness of equities, particularly given a potentially protracted period of low interest rates.”