This post was originally published on this site

Agence France-Presse/Getty Images

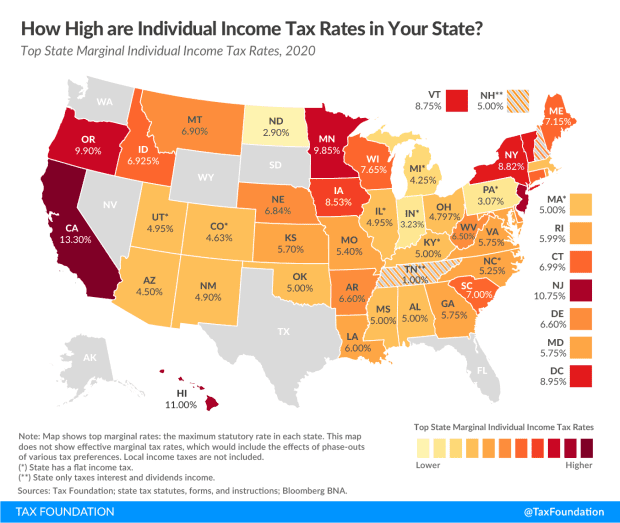

Whenever we mention to people that we moved from California to Reno, Nev., they all say it makes sense because we get to avoid the high state income tax in California. I don’t blame them. California has a reputation for high taxes. When you Google state income taxes, you get a map like this:

California is shown in the darkest color. Its 13.3% top marginal tax rate is the highest in the country. On the other hand, even when we worked full-time in California, we never paid 13.3%. The 13.3% rate is only for people making over $1 million. Our marginal state income tax rate was 9.3%, which was still high, but it was at least lower than the 9.9% rate in the neighboring state Oregon, or the 9.85% rate in Minnesota.

When you’re working, a 9.3% marginal state income tax rate isn’t ideal but you accept it for the job opportunities. When you’re no longer tied to a job, you think you finally get to escape it by moving to a place with no or low state taxes. That’s the motivation behind many searches for relocating to a retiree-friendly low-tax state. However, I like this tweet on this topic from Christine Benz, director of personal finance at Morningstar:

Taxes were very low on our list of considerations as well when we decided to relocate. We moved primarily to be closer to the destinations for the activities we enjoy — hiking in the summer and skiing in the winter.

Besides, the state income tax can be completely different when you no longer have a high income. Our California state income tax last year was under $1,000, whereas we paid five figures when we were working full-time. It isn’t productive to relocate out of a state only to escape a tax under $1,000.

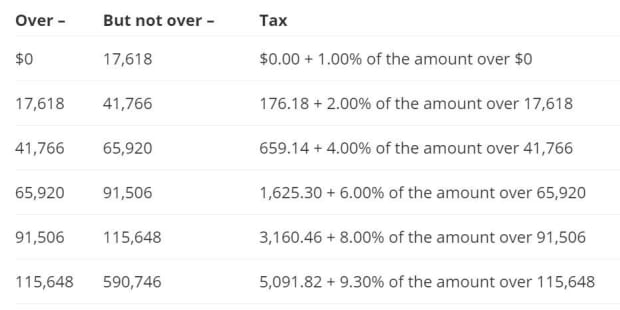

Our California state income tax was low because the state’s income tax rates are progressive. In 2019, a married couple first got $9,074 as the standard deduction. Then it went by this tax schedule:

Finally, a married couple got an exemption credit of $244. When a couple had $60,000 in gross income in 2019, their California state income tax was:

$659 + ($60,000 – $9,074 – $41,766) * 4% – $244 = $781

When you don’t have a big income, most of the income is taxed at 0%, 1%, and 2%. It’s a lot different than paying 9.3% on the bulk of your income when you’re working.

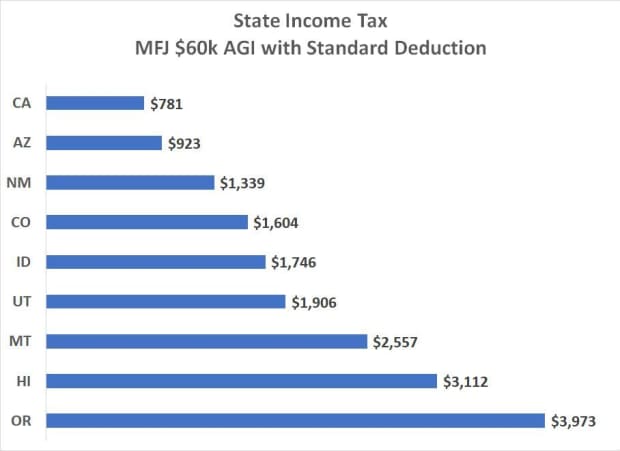

Out of curiosity, I did a mock tax return for all the states west of Rocky Mountains for a married couple with $60,000 in gross income. Besides states with no income tax (Alaska, Washington, Nevada, and Wyoming), California has the lowest income tax. That was a big surprise to me.

Some states (such as Hawaii) give special treatment to certain sources of income. Here I only did normal income without distinguishing the income types. I also only took the standard deduction in each state.

Property tax

What about property tax? California has the famous Prop 13. The property assessment increase is capped to 2% a year from the time of purchase. If you bought your home a long time ago, your property tax can be very low.

Prop 60 and Prop 90 allow someone 55 or older to sell their principal residence and transfer their low assessment to another property of equal or lesser value within the same county or in a welcoming county. Prop 19 passed in November 2020 expanded the transfer to the entire state, and it allowed transferring the assessment three times as opposed to only once in a lifetime.

Many California retirees’ property tax will increase if they move to another state.

ACA tax credit

In addition, if you’re retired and you need ACA health insurance before you’re eligible for Medicare but your income is over the cliff for the federal premium tax credit, California kicks in with its version of the premium tax credit. With the tax credit from the state, your effective California state income tax rate can be negative 10%!

My takeaway from this exercise: Don’t assume. Even if you consider state taxes as an important factor for relocating after retirement, high taxes when you’re working doesn’t mean high taxes when you stop. Contrary to the perception of many people, California may very well be a retiree-friendly low-tax state.

Also read: There is more to picking a place to retire than low taxes — avoid these 5 expensive mistakes

Harry Sit is a long-time personal finance blogger at The Finance Buff, where this was first published. His new book “My Financial Toolbox” goes into everything he uses to manage his finances.