This post was originally published on this site

DoorDash has plenty of competition.

Agence France-Presse/Getty Images

Is it a coincidence that DoorDash filed for its IPO so soon after vaccines for COVID-19 were announced? We think DoorDash’s current investors and bankers recognize that the window of opportunity to IPO this terrible business closes quickly when the threat of COVID-driven lockdowns no longer drives growth in food delivery demand.

With the latest S-1 filed, DoorDash is aiming for a price range of $75-$85, which could give the firm a valuation of $23.8 billion to $27.0 billion ($25.4 billion midpoint). Such a valuation would be well above the firm’s last private valuation of $16 billion.

At a valuation of $25.4 billion, DoorDash DASH, earns our unattractive rating and would be the most ridiculous IPO of 2020. We think this proposed public equity offering holds no value — $0 — beyond bailing out private investors before unsuspecting public investors realize the business is not viable in its current form.

This IPO reminds us of WeWork’s attempted IPO, which we called the most ridiculous IPO of 2019, because DoorDash’s business is similarly disadvantaged.

The fact that this company made it to the pre-IPO stage reflects the overblown fervor of the work-from-home theme. It is not a good idea to invest in businesses that have:

Worse yet, to justify a $25 billion valuation, the company needs to grow its share of global food delivery app market to 56% from about 16% over the trailing 12 months (TTM) while also raising margins from -12% to 8% in an intensely competitive business.

Throw in the auditor’s reports of weak internal controls, and investors could be holding stock in a business that might not be around in a few years.

Greater fool strategy looms large

We think the only chance for investors in this IPO to see any gain comes from a greater fool willing to pay a higher price for no economically justifiable reason. For that matter, the stupid money risk of a company overpaying for the stock to ride the work-from-home fad or follow Uber’s UBER, +6.97% Uber Eats strategy is real.

Nevertheless, the ceiling for the price rational investors could pay for DoorDash is $1.4 billion, which equals about $2.5 billion in capital the company has raised to date less the $1.1 billion in cash on its books. Why should anyone pay more than the costs to build the business, especially when it hasn’t come close to generating consistent profits and may never?

Not profitable yet, really?

It took a global pandemic to drive the firm’s one quarter (ended June 30, 2020) of GAAP profitability. The firm has not been profitable since, and we think it may never be.

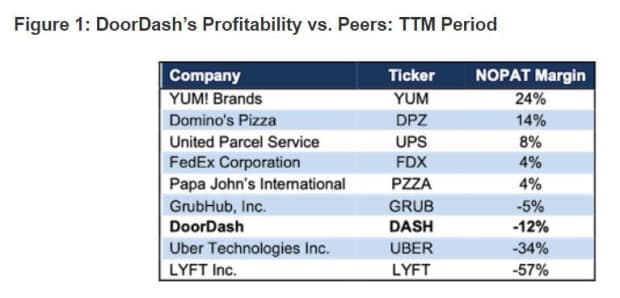

The only firms with worse TTM net operating profit after-tax (NOPAT) margins than DoorDash’s are Uber and Lyft LYFT, +9.56%. If DoorDash can’t do better than a -12% margin in this environment, perhaps the best possible environment for food delivery, then when will it ever be consistently profitable?

Figure 1 compares TTM margins for United Parcel Service UPS, +0.51% and FedEx FDX, +1.37% as well as Pizza Hut’s parent company YUM! Brands YUM, -1.27%, Domino’s Pizza DPZ, -1.00% and Papa John’s International PZZA, -0.99%.

Sources: New Constructs, LLC and company filings

*DoorDash’s TTM NOPAT margin is estimated assuming the firm’s NOPAT improved at the same rate as the firm’s income from operations from 2019 to the TTM period. We make this assumption as there is not enough information in the S-1 to definitively calculate NOPAT over the TTM period.

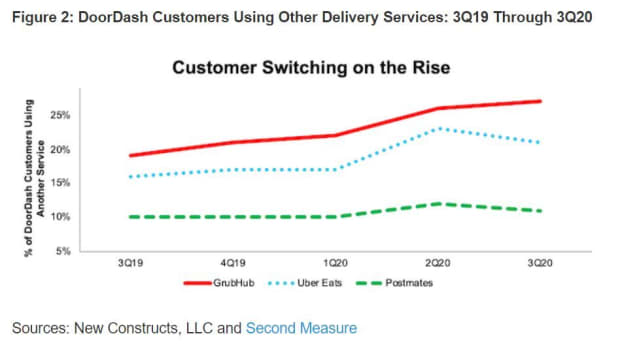

Low switching costs make profits unlikely

The food delivery market is filled with competitors offering the same service: cheap food delivery. They deliver at about the same speed. Without any other differentiating factors, switching costs are very low. Figure 2 demonstrates that consumers are increasingly exploiting the low switching costs.

You don’t have to be a business expert to understand that businesses without differentiated offerings struggle to charge prices above the cost of the service. In other words, they never turn a profit.

Damned if you do, damned if you don’t

The only competitive disadvantage that may be worse for DoorDash than low switching costs is competing with your suppliers. Before the standalone food delivery services entered the market, YUM! Brands, Domino’s and Papa John’s delivered food to customers for free. Now, most of the time, they charge for delivery albeit at prices usually far below the pure-play food delivery firms.

The point is that these restaurants can offer delivery for a much lower price or even free because they have core businesses that generate profits.

Doing the math: Valuation implies DoorDash captures 56% of global food delivery spend

When we use our reverse discounted cash flow (DCF) model to analyze the expectations implied by the midpoint of the IPO price range, DASH appears significantly overvalued with expectations for huge improvement in both market share and profit margins, two metrics that rarely improve simultaneously in competitive markets.

To justify a $25 billion valuation, DoorDash must:

In this scenario, DoorDash would earn nearly $24 billion in revenue in 2030. At its TTM take rate, this scenario equates to about $204 billion in marketplace gross order volume for DoorDash in 2030. Take rate measures the percentage of marketplace gross order volume (GOV) DoorDash captures as revenue.

For reference, UBS estimates the global food delivery market will be worth $365 billion in 2030, and the average NOPAT margin of peers in Figure 1 is -5%.

In other words, to justify the midpoint of its IPO price range, DoorDash must capture over 56% of the projected 2030 global food delivery spend, compared to around 16% TTM.

Importantly and even more challenging, DoorDash must capture this market share while also improving margins from -12% to 8%, well above peers’ average.

To illustrate the difficulty in maintaining market share and high margins in an industry competing on price, look no further than GrubHub GRUB, -0.85%. In 2017, GrubHub held around 55% of the U.S. food delivery app market (excludes restaurants that deliver their own food) and earned a NOPAT margin of 10%. As competition flooded the market, GrubHub’s market share fell to 18% in October 2020, and its TTM NOPAT margin is -5%.

Given the high level of competition in the food delivery app market, we think it is highly unlikely, if not impossible, for DoorDash to achieve anything close to the market share growth and NOPAT margin improvements baked into its projected IPO valuation. Hence, we’re calling this IPO the “most ridiculous of 2020”.

Catalyst: Declining revenue growth

DoorDash and its bankers want to get this deal done as soon as possible – before the COVID-19-driven tailwinds subside. Demand for food delivery soared earlier this year, as in-restaurant dining was shut down across the country. As the largest food delivery service in the United States, DoorDash greatly benefited from this increased demand.

The firm’s revenue grew 172%, 214%, and 268% year over year in the first, second and third quarters of 2020, respectively. What better time to IPO than when revenue is tripling year over year? However, such rapid revenue growth is expected to decline by the company’s own admission. Plus, the emergence of multiple highly-effective COVID-19 vaccines will likely bring food delivery back to levels where no one would consider trying to IPO a food-delivery company.

David Trainer is the CEO of New Constructs, an independent equity research firm that uses machine learning and natural language processing to parse corporate filings and model economic earnings. Kyle Guske II and Matt Shuler are investment analysts at New Constructs. They receive no compensation to write about any specific stock, style or theme. New Constructs doesn’t perform any investment-banking functions and doesn’t operate a trading desk. This is an abridged version of their report “DoorDash: The Most Ridiculous IPO of 2020”. Follow them on Twitter @NewConstructs.

Read: DoorDash IPO: 5 things to know about the app-based food-delivery company

Also: Uber completes Postmates acquisition, boosting its place in food delivery

Barron’s: D.A. Davidson Sets Buy Rating on DoorDash Ahead of IPO