This post was originally published on this site

A couple takes a picture in front of a giant rainbow flag, as LGBT activists gather to celebrate ‘Coming Out Day’ in Kyiv, Ukraine, on Oct. 11, 2020.

sergei supinsky/Agence France-Presse/Getty Images

Companies more tolerant of differences in sexuality and gender identity have seen a stock-price boost as well, according to an analysis from Credit Suisse.

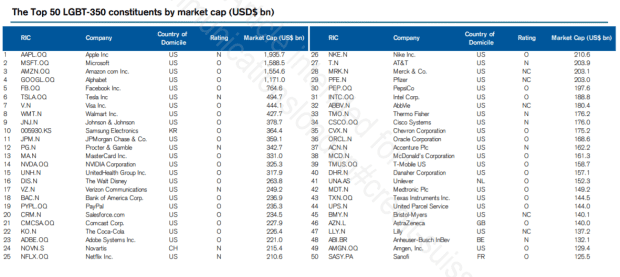

The investment bank put together a list of what it calls the LGBT-350. There are companies either with openly lesbian, gay, bisexual or transgender senior managers and/or are voted LGBT+ inclusive employers in leading surveys.

The top five companies are the same as in the S&P 500 — tech giants Apple AAPL, +2.11%, Microsoft MSFT, -0.53% and Alphabet GOOGL, -1.82%, online retailer Amazon.com AMZN, -0.85%, and social media company Facebook FB, -0.30%. The list is overwhelmingly U.S.-based, with Asian companies representing just 2% of its index.

The Credit Suisse team put its list of top LGBT+ friendly companies against the MSCI All Country world index without those components. Credit Suisse also adjusted by sector. What it found was a return, since the start of 2010, of 9.1% a year, an outperformance of 378 basis points a year.

Credit Suisse stressed it hasn’t found that LGBT friendliness is the cause of these gains. But the analysts — Eugene Klerk, Bahar Sezer Longworth and Richard Kersley — point out the benefits include the ability to attract and retain talent as well as draw in LGBT customers.

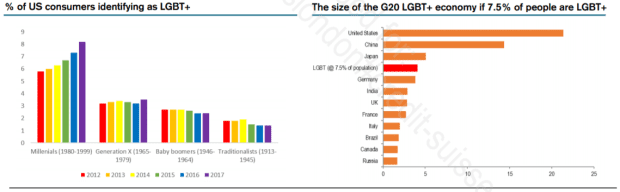

Citing data from Gallup, about 8% of U.S. millennials self-identify as LGBT+. If 5% to 10% of the population is LGBT+, that would make the group the world’s number three or four economy.