This post was originally published on this site

“ ‘Cash is trash…and [high-profile investors] realize it…At some point, it is hard to look at those data points and say that bitcoin isn’t an incredible store of value.’ ”

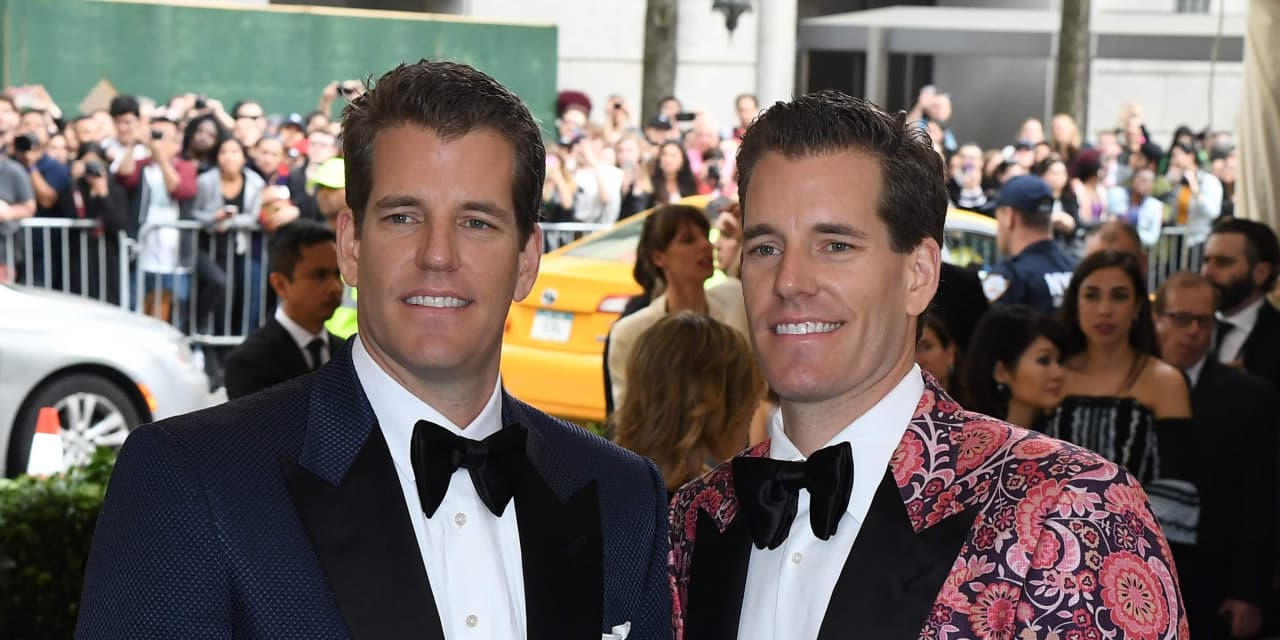

That is Tyler Winklevoss on CNBC Monday morning explaining his bullish outlook for bitcoin, the world’s most popular and most controversial cryptocurrency.

Appearing on the business network Monday, with his business partner and twin Cameron, Tyler explained the merits of bitcoin BTCUSD, -2.78% BTCUSD, -2.78% and why the blockchain-underpinned asset could one day change hands at around $500,000, boasting a market value of some $9 trillion, though he didn’t provide a specific timetable for such a surge in the interview.

“We think bitcoin’s here to stay,” said Tyler, who explained that his prediction for much higher prices for bitcoin are based on a number of factors but not least of all the recognition by high-profile investors, including Paul Tudor Jones and Stanley Druckenmiller, who have recently “extolled the virtues” of the nascent asset, which was created in 2009.

Cameron on Monday said that bitcoin is “really an emergent store of value” and “just needs to be better than gold” to see its overall value climb over time.

The comments from the prominent bitcoin bulls come as the asset was staging a fresh assault on records after a Thanksgiving tumble saw it skid by more than 10%, amid fears of tightened regulation and concerns that it the crypto had risen too far and too fast.

Read: Bitcoin Could Hit $500,000, the Founder and CEO of ARK Invest Says

At last check, bitcoin prices on Monday were up 5.3% at $19,142, after touching a recent nadir at $16,714 on Thanksgiving, according to CoinDesk.

Bitcoin’s stratospheric rise comes as the Dow Jones Industrial Average DJIA, +0.97% is up 5% so far this year, the S&P 500 index SPX, +1.44% has gained over 12% during the same period and the Nasdaq Composite Index COMP, +1.57% has advanced 35% in the year to date. Gold GOLD, +3.05%, meanwhile, has climbed 19% thus far this year and is staging a reversal of much of its rally as viable COVID-19 vaccines emerge.

Tyler said that “thoughtful” regulation is already baked into the price of bitcoin and predicted that it will be the best-performing asset of the next 10 years after enjoying a historic rally since its inception 11 years ago.

“If bitcoin can be used as a currency, then its [value] is even higher,” said Tyler, who runs Gemini, the digital-currency exchange, that he founded with his twin brother.

The duo have reinvented themselves as bitcoin pioneers, using proceeds from a legal settlement with Facebook Inc. FB, +4.05% over who came up with the idea for the social network run by CEO Mark Zuckerberg.