This post was originally published on this site

A fresh record high for bitcoin is going to have to wait, if it comes at all.

Bitcoin prices BTCUSD, -0.34% BTCUSD, -0.34% on Friday were being pummeled, pushing the cryptocurrency into correction territory, commonly defined as a decline in an asset from a recent peak of at least 10%.

At last check, Bitcoins changed hands on CoinDesk, down 2.4%, at $16,714, representing a more than 14% decline from its 52-week peak at $19,495, put in less than 24-hours before its Thanksgiving tumble.

Bitcoin has been a traditionally volatile asset since its inception, but if those observing the closely followed cryptocurrency are looking for reasons for its recent drop, market participants were pointing to at least three key factors:

- Coinbase CEO Brian Armstrong implied tougher regulation ahead in a Wednesday tweet

- Overbought and primed for a drop

- Bitcoin is volatility

Armstrong rumors

A series of messages from Coinbase’s CEO Armstrong via Twitter is being credited with some of the decline for bitcoin and the broader cryptocurrency complex. On Wednesday, Armstrong implied that the U.S. Treasury Department my attempt to push through tightened regulation before the Trump administration leaves office.

The the threat of tighter regulation has always loomed large over the nascent digital-currency sector but the comments may have been enough to set a bearish tilt in motion on the bitcoin’s which have enjoyed a more than 130% year-to-date gain, experts said.

Prime for a pullback

Charles Hayter, founder of CryptoCompare told MarketWatch that the retreat in bitcoin as “one of the fastest moves” that he has seen, adding it wasn’t unexpected after the cryptocurrency had made such a brisk run near its December 2017 all-time high.

“This was one of the fastest moves bitcoin has made. Naturally there is a pullback at these points as moves from off exchange to on exchange take place,” Hayter said in emailed comments to MarketWatch on Friday.

Bitcoin’s rise to the stratosphere comes as the Dow Jones Industrial Average DJIA, +0.12% is up 5% so far this year, the S&P 500 index SPX, +0.24% has gained over 12% during the same period and the Nasdaq Composite Index COMP, +0.92% has advanced 35% in the year to date. Gold GOLD, -0.22%, meanwhile, has climbed 19% thus far this year and is staging a reversal of much of its rally as viable COVID-19 vaccines emerge.

” A fair few of the buyers at 10k will be collecting their winnings and a fair few who have been hiding out at these levels from 2018 will be happy to exit the trade,” he speculated.

Inherent volatility

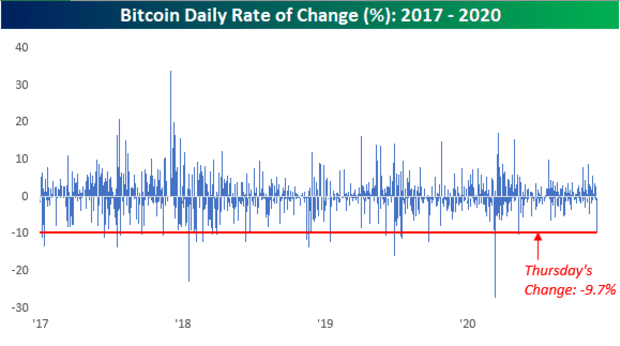

A chart published on Friday by Bespoke Investment Group highlights on key fact that those who are new to bitcoin must get accustomed to: its traditional volatility.

Bespoke wrote that declines of Thursday’s magnitude aren’t particularly out of the ordinary throughout bitcoin’s history, highlighting that since 2017, bitcoin has seen 24 one-day drops more gut-wrenching than on Thanksgiving day (see attached chart):

Bespoke Investment Group

Although bears might use this current retreat as a cautionary tale of why bitcoin is a problematic asset, many continue to hold the asset on hope of a more bullish horizon for cryptos.

Libra isn’t dead

Facebook’s FB, +0.80% digital-currency network, Libra, could launch as early as January, according to reports. If so, it would represent a major accomplishment for the history as a whole, even if critics, say that Libra coin, doesn’t truly represent the traditional crypto market.

That said, it might be a feather in the cap of proponents of digital assets at a time when virtual currencies are drawing greater mainstream appeal.

Last month, PayPal Holdings PYPL, -1.43% said it would allow customers to buy cryptocurrency through their accounts and use cryptocurrency for merchant payments, which also has lent some legitimacy of the nascent asset.

Mainstream appeal

Major investors, including hedge-fund luminary Paul Tudor Jones, have become proponents of the asset, describing its recent rally in a CNBC interview as in its “first innings.”

Those apparent endorsements highlight a growing focus by institutional investors into bitcoin as a legitimate alternative to fiat currency or other assets used to hedge their exposure to conventional investment instruments.

To be sure, bitcoin and its conterparts, critics warn, could still tumble to zero and therein lies the intrigue and potential peril of digital currencies.