This post was originally published on this site

What just happened?

You can say this, at least, about 2020: it hasn’t been boring.

This past week may have been the most head-spinning, since at least the one before that. It included formal confirmation from the U.S. government that Joe Biden’s transition to president would begin, and a third promising COVID-19 vaccine candidate. Not to mention the Dow Jones Industrial Average DJIA, -0.57% hit a fresh record, bursting through what’s often called a “psychological milestone” at 30,000.

The ETFs that caught our attention in the past week ranged from the lockdown trade to bets on moving goods around the globe. We covered funds that feature the year’s biggest stock gainer, and those with arguably the year’s biggest oxygen-sucker.

Yet another example: among our five best performers of the past week, found below, there’s one clean-energy ETF and three devoted to fossil fuels.

All that in only four trading days rather than our usual five.

Happy Thanksgiving, thanks for reading, and get ready for more 2020 next week.

Taxing times

‘Tis the season for getting ready to roast a turkey and watch too much television — not typically the time for filing tax returns. Still, for ETF investors, it may always be the right time for giving thanks for the lower tax burden of these investment vehicles, at least when compared to mutual funds.

Research firm CFRA in mid-November released an analysis of what ETF “tax benefits” meant in practice this year. Based on initial estimates, 94% of the ETFs from BlackRock, State Street Global Advisors and Vanguard will not incur any capital gains for investors. Those asset managers, often known as “The Big Three,” together account for 81% of all ETF assets under management, CFRA notes.

Among equity ETFs, one of the funds with the largest anticipated capital gain is iShares Evolved U.S. Innovative Healthcare ETF IEIH, +0.25%. It’s an actively-managed sector-tracking fund, and it’s expected to pay out capital gains between 53 and 65 cents a share, equal to a range of 1.7% and 2.1% of its net asset value, or NAV.

Overall, fixed-income ETFs are more likely to incur capital gains for investors than stock funds are, CFRA points out.

Is there an ETF for that?

Nope, there’s no Thanksgiving ETF. But in true All-American fashion, there are a bunch of random themes that can be cobbled together to make a happy, bespoke, extended-family portfolio. Here’s a key to the graphic above.

- TUR – The iShares MSCI Turkey ETF TUR, +1.20% is a bet on a single country, one where the central bank recently raised rates in an effort to curb inflation. There has been no word on the direction of tryptophan levels.

- PBJ – The Invesco Dynamic Food and Beverage ETF PBJ, -0.26% is one of the few ETFs that drill down into the broader consumer staples category. There is no correlation between the fact that Invesco chose this particular sub-category and Americans’ expanding waistlines, sources tell MarketWatch.

- PIE – The Invesco DWA Emerging Markets Momentum ETF PIE, -1.12%. We just liked the ticker. That’s all.

- GNOM – No, not a hint that little sisters are gnomes. The ticker here, for the Global X Genomics & Biotechnology ETF GNOM, +0.39%, alludes to genomics. As in family. As in what Thanksgiving is really all about anyway.

- ESPO – Okay, okay, for some people Thanksgiving is really all about football, whether a friendly game in the park, an expensive seat in the stands, or in true 2020 style, virtually — as in the VanEck Vectors Video Gaming & eSports ETF ESPO, +0.34%.

- XRT – This year, we had Black Friday in October, when Amazon re-scheduled its popular Prime Day and copycat retailers followed suit. Here’s hoping that the days of lining up at midnight on Friday to fight other Americans for random doorbusters are a thing of the past, COVID-19 vaccine or no.

Visual of the week

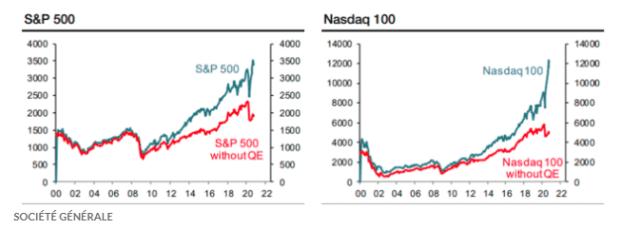

How much lower would stock benchmarks be without Federal Reserve intervention? Without the bond-buying program known as quantitative easing, the Nasdaq-100 would be closer to 5,000 than 11,000, and the S&P 500 would be around 1,800 rather than 3,300 through the end of October, according to a recent analysis from Société Générale, summarized here .

Weekly rap

| Top 5 gainers of the past week | |

| Direxion Moonshot Innovators ETF MOON, +0.95% | 12.1% |

| First Trust Nasdaq Clean Edge Green Energy QCLN, +1.04% | 9.7% |

| Invesco Dynamic Oil & Gas Services ETF PXJ, -2.04% | 9.6% |

| SPDR S&P Oil & Gas Equipment & Services ETF XES, -1.70% | 9.6% |

| First Trust Natural Gas ETF FCG, -1.22% | 9.5% |

| Source: FactSet, through close of trading Tuesday, November 24, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

| Change Finance U.S. Large Cap Fossil Fuel Free ETF CHGX, -0.35% | -4.4% |

| iShares Residential and Multisector Real Estate ETF REZ, -0.17% | -3.6% |

| Invesco S&P 500 Equal Weight Utilities ETF RYU, -0.01% | -2.9% |

| Utilities Select Sector SPDR Fund XLU, +0.23% | –2.9% |

| Pacer Benchmark Industrial Real Estate SCTR ETF INDS, +0.51% | -2.8% |

| Source: FactSet, through close of trading Tuesday, November 24, excluding ETNs and leveraged products | |

| Top 5 biggest inflows of the past week | |

| Vanguard Total Stock Market ETFVTI | $1.21 billion |

| iShares iBoxx $ Investment Grade Corporate Bond ETF LQD, +0.06% | $1.16 billion |

| iShares MBS ETF MBB, -0.03% | $935.4 million |

| Vanguard S&P 500 ETF VOO, -0.16% | $903.9 million |

| iShares Core S&P 500 ETF IVV, -0.18% | $771.8 million |

| Source: FactSet, through close of trading Tuesday, November 24, excluding ETNs and leveraged products | |

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.