This post was originally published on this site

Wait for the signs.

AFP via Getty Images

Another struggle for equities is ahead, as investors begin to face up to the battle against the autumn/winter COVID-19 wave. Wednesday’s news that New York City is shutting schools took down stocks and overshadowed more positive vaccine news from drugmaker Pfizer PFE, +0.77% and partner BioNTech BNTX, +4.03%.

“The market now needs to balance the long term optimism of having a vaccine with the short term problem of a restrained economy,” sums up the team at South African money management firm Vestact.

That’s easier said than done, as the pandemic learning curve just keeps rising.

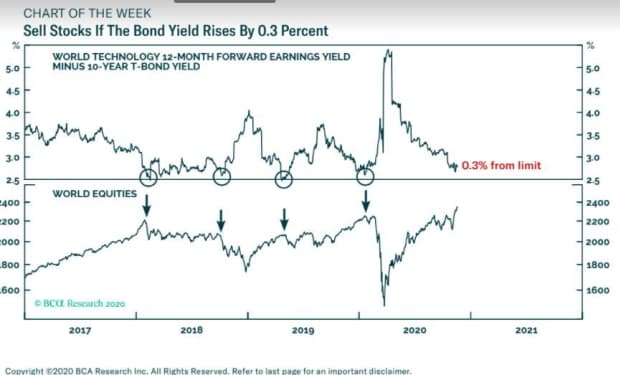

Our call of the day from BCA Research’s chief European strategist Dhaval Joshi lays out some clear-cut advice: Sell stocks and head to the sidelines if the U.S. 10-year bond yield TMUBMUSD10Y, 0.855% rises another 30 basis points.

“Since early 2018, a rise in the long bond yield has sent shudders through the stock market on four occasions: February 2018, October 2018, April 2019 and January 2020,” explains Joshi, in a note to clients.

“On all four occasions, the tipping point was the earnings yield premium on tech stocks versus the 10-year U.S. Treasury bond yield dipping toward its lower limit of 2.25%,” he says. The earnings yield premium is the excess return on stocks versus bonds.

BCA Research

Today, that yield premium stands at 2.8%, meaning another 30 basis point rise in the 10-year bond yield would trigger a retest of that tipping point. Alternately, a retest would come if the T-bond stayed unchanged and technology stocks rose another 10%.

“Crucially, this means that the stock market’s 60% rally since mid-March is reaching a near-term valuation test,” said Joshi, who says if that earnings yield gap reaches the 2.5% level in coming weeks, it will be time to sell stocks.

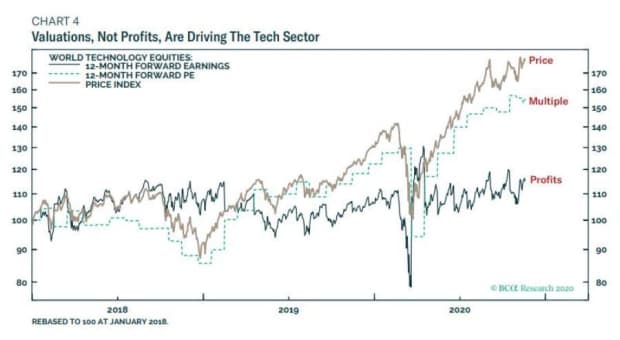

He explains that tech-sector valuations have become extremely sensitive to changes in 10-year bond yields. So for stock markets with a high-weighting to tech, such as in the U.S., the valuation boost from a fall in bond yields has “more than countered” a pandemic-driven profit slump.

BCA Research

In the sideways years for stocks of 2018 to 2019, stocks fell 30% then rose by the same amount, because the multiple paid for profits plunged, then surged in those years, respectively.

“How can the aggregate market stand at an all-time high when a terrible plague continues to ravage the global economy? The simple answer: because of record low bond yields,” he says.

What to do? Firstly, Joshi advises investors to “aggressively overweight” T-Bonds on any modest yield rise, and overweight health-care stocks versus technology. As the tech earnings yield cap nears 2.5%, the health-care sector’s earnings yield gap is at an attractive 4.1%, well below its lower limit of 2%. And the sector is being driven by profits not a boost in valuations, he notes.

The markets

Stock futures ES00, -0.03% YM00, -0.09% NQ00, -0.13% are drifting south, and in Europe SXXP, -0.58%, equities are also down.

The buzz

Continuing a run of positive COVID-19 vaccine news, the University of Oxford and AstraZeneca AZN, -1.76% say early data show their drug candidate triggered a robust immune response in older adults.

Weekly and continuing jobless claims, the Philadelphia Federal Reserve manufacturing index, existing home sales, and leading economic indicators are on tap for Thursday.

Retailers BJ Wholesaler’s BJ, +2.08% and Macy’s M, +2.15% will report ahead of the open.

Nvidia’s NVDA, +0.04% latest results blew out forecasts, but the chip maker may be facing a hard-to-repeat year.

AT&T’s T Warner Bros.’ “Wonder Woman 1984” will debut on streaming service HBO Max and in theaters on Christmas Day. It will face off against Pixar’s “Soul,” which will debut the same day on Disney’s DIS, -0.41% streaming service, Disney+.

France’s COVID-19 hospitalization numbers are falling, but the government says it is still far from ending lockdowns. California’s governor is in trouble over a dinner party, while in South Australia, a new lockdown won’t even permit dog walking.

Listen to chief executive officers from videogame maker Take-Two TTWO, -0.39%, digital textbook group Chegg CHGG, +1.45% and investment manager ARK for Barron’s Investing in Tech series this Thursday at 1 p.m. Register here.

Random reads

Tiny owl found clinging to New York City’s Rockefeller Plaza Christmas tree.

Dublin zoo raises €1 million in less than 12 hours, in a fundraiser aimed at preventing a pandemic closure.