This post was originally published on this site

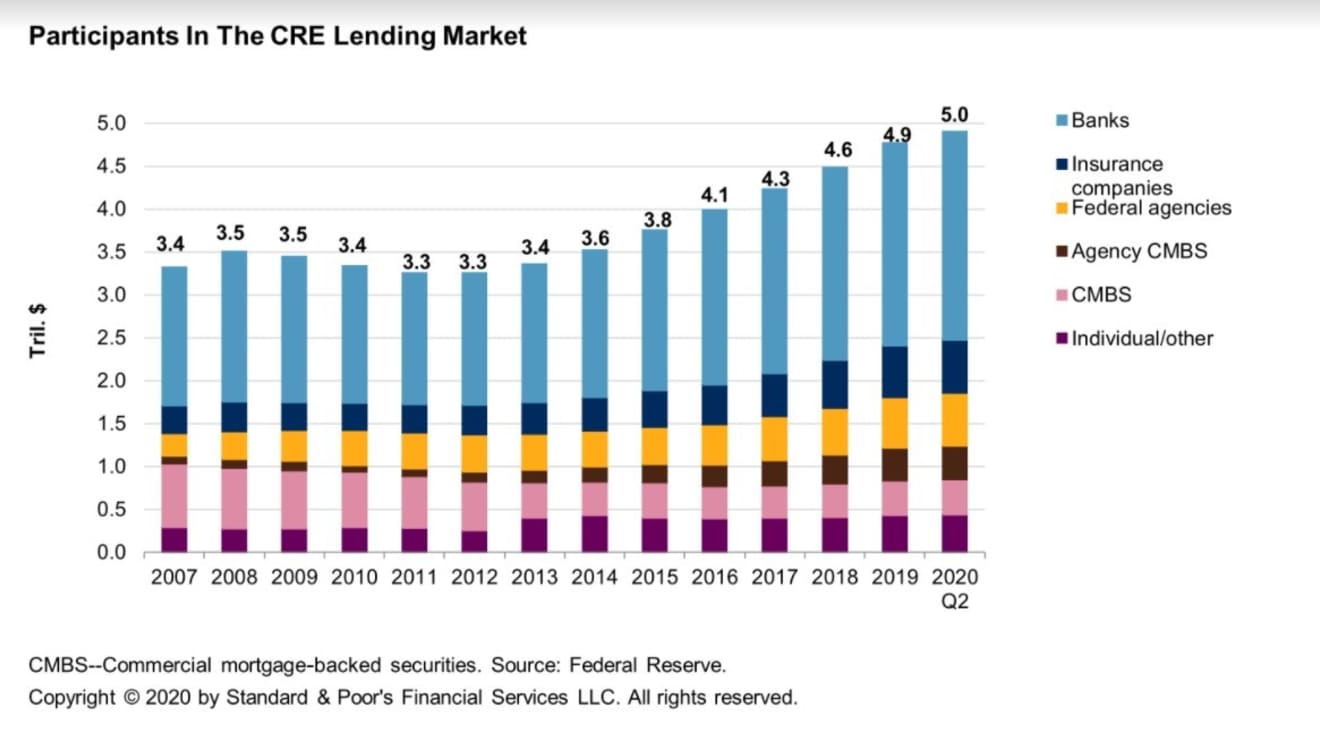

Low rates and rosy assumptions about how much rent properties might collect helped fuel the record $5 trillion debt boom in U.S. commercial real estate over the past decade.

But as the COVID-19 pandemic threatens to rewrite many of the rules about where people work, shop and spend their leisure time, the big question remains: What might it all mean for commercial real estate?

“Commercial real estate (CRE), in our view, tops the list of sectors that are most at risk of declining asset quality amid the coronavirus pandemic — which would lead to losses for U.S. banks,” wrote a team of analysts led by S&P Global Rating’s Stuart Plesser in a new report Monday.

While Plesser’s team expects most banks without heavy exposure to easily withstand their projected 3% “base case” loss on commercial real estate, they also warned that the loss rates could end up hitting 10% or higher, which would mean “a much more significant dent to the banking sector that would likely lead to downgrades for many banks.”

Here’s their chart showing banks own about half of U.S. commercial real-estate debt:

Who owns $5 trillion CRE debt

S&P Global, Fed data

For context, the Federal Reserve said it expects lenders to experience a 6.3% average loss under a “severely adverse scenario” on all loans held by banks, including credit cards, auto loans and corporate credit, as part of its 2020 stress tests.

That would equate to a combined $430 billion loss over a nine-quarter outlook, but the Fed also said losses could end up hitting 10.2% if the economic recovery ends up being rockier.

“If loss rates were to reach these levels, no doubt the smaller banks with more exposure would feel substantial pain,” Plesser’s team at S&P Global wrote.

What’s more, S&P thinks the pandemic could reshape parts of commercial real estate in ways that the Fed’s stress tests can’t foresee, including if companies adopt more “liberal work-from-home policies” that could cut into demand for office space.

See: Office sector is a ‘big question’ says this commercial real estate veteran

And while it’s known that retail and lodging have been hard hit, a complete picture of the economic toll of the worst public-health crisis in a century remains far from known, particularly since COVID-19 cases in November have surged to alarming new records.

Check out: Not again! Economy faces another stiff test from record coronavirus surge

In the struggling mall sector, Taubman Centers TCO, +8.40% over the weekend agreed to a lower price to merge with Simon Property Group SPG, +5.70%, evading what could have been a heated legal battle during the holidays.

Related: Simon Property gives up on four struggling malls. Why more could follow

But analysts at BofA Global also pointed out that distressed sales only accounted for about 1% to 2% of the total commercial real-estate transactions completed in the second and third quarters.

“Until distressed asset sales increase in a significant way, we anticipate that asset pricing metrics will remain relatively idiosyncratic,” BofA’s team wrote in a weekly report.

Until then, it may be wise to keep an eye on how real-estate investment Trust (REITs) stocks trade, according to S&P’s Plesser.

“Notably, the stock prices of publicly traded REITs are down roughly 25% for most of the CRE subsectors, signaling that investors believe the CRE market is likely to have some difficulties down the road.”

When looking at major exchange-traded funds in commercial real estate, the Vanguard Real Estate ETF VNQ, +1.12% ended Monday down 7% for the year to date, or roughly the same as the iShares U.S. Real Estate ETF IYR, +0.81% according to FactSet Data.

The S&P 500 index SPX, +1.16% and Dow Jones Industrial Average DJIA, +1.59% closed Monday at fresh records amid more promising developments on the COVID-19 vaccine front.