This post was originally published on this site

The Dow Jones Industrial Average on Monday was knocking on the door of a psychologically significant 30,000 milestone, which would mark the first such round-number level for the benchmark since mid January as the stock market attempts to punch higher in the wake of the volatility inspired by the COVID-19 pandemic.

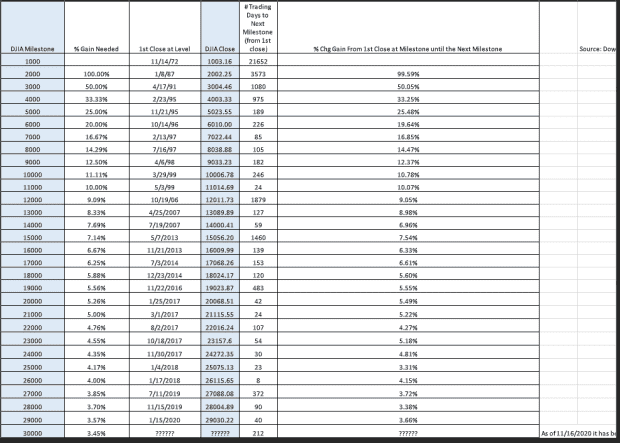

The blue-chip index has traversed some 212 trading days since hitting an important milestone at 29,000 on Jan. 15, but has struggled over the past several months as concerns about the viral epidemic has delivered an outsize hit to the large-capitalization gauge. The index needs to sustain a more than 520-point rally on Monday to get it to 30,000.

The Dow’s DJIA, +1.45% trade on Monday, sparked by further news of progress on an effective remedy for COVID-19, could also mark its first record closing high since Feb. 12, if the benchmark’s gains hold on Monday or into the week.

Dow Jones Market Data

Moderna on Monday said its COVID-19 experimental vaccine cut COVID-19 infections by 94.5%. The company said it plans to submit an Emergency Use Authorization with the U.S. Food and Drug Administration in the coming weeks. The report comes a week after Pfizer PFE, -3.79% and BioNTech SE BNTX, -16.91% on Nov. 9 announced that their vaccine candidate was more than 90% effective in preventing COVID-19 infections in a late-stage trial.

To be sure, round numbers like 30,000 aren’t necessarily significant for investors, but they can help to reflect growing upbeat sentiment, despite a number of risks that still face investors, including the resurgence of COVID-19 in parts of the world and concerns about how best to distribute the vaccine candidates when they are authorized to be used widely.

It’s also worth noting that the higher the Dow rises, the smaller each 1,000-point move is in percentage terms, but individual investors have tended to pay close attention to the Dow when it carves out fresh milestones.

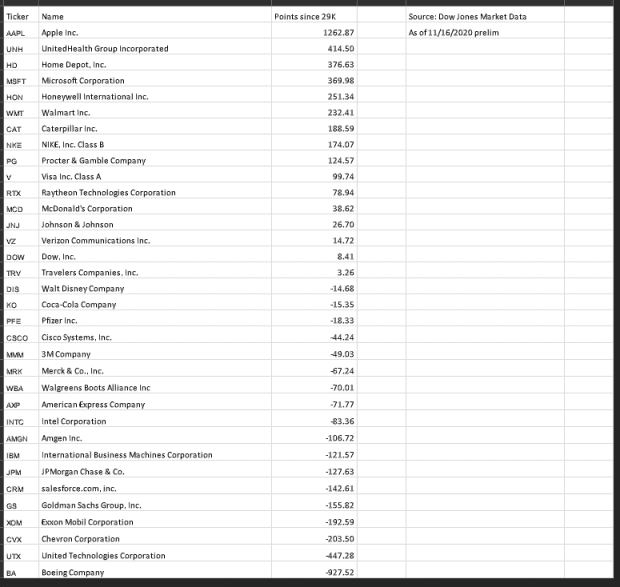

In company-specific terms, since hitting 29,000, Apple AAPL, +1.41% has been the largest contributor to the Dow’s rally, contributing more than twice any other component over the past 10 months. The Dow is price-weighted, so the stocks that have the highest price tend to be the most influential. However, Apple’s share price was split four-for-one at the end of August, shifting it from the most influential Dow component on a price basis to the middle of the pack.

At around $120, Apple’s shares rank 19th in terms of price among the Dow’s 30 components.

Still, according to Dow Jones Market Data, Apple has added 1,262 points to the Dow since the gauge hit 29,000, while UnitedHealth Group UNH, -0.50%, which is now the blue-chip member with the richest price at about $356, has added 414.50 points to the point-weighted index.

Dow Jones Market Data

Apple’s stock split a few months ago also set off a cascade of changes by the owners of the blue-chip benchmark, S&P Dow Jones Indices, which added undefined, undefined and undefined to the index, replacing iconic Exxon Mobil Corp. XOM, +5.25%, Pfizer and undefined.