This post was originally published on this site

How high is too high?

Joel Kowsky/Agence France-Presse/Getty Images

Bond yields are on the rise, and that can make stock-market investors nervous, especially when it comes to expensively valued tech shares. But guessing where the pain threshold lays can be tricky.

After all, if it’s about the speed of a rise in yields, then investors should be concerned. This month’s Treasury selloff (yields and bond prices move in opposite directions) sent the 10-year note yield TMUBMUSD10Y, 0.894% to just shy of 1% on Wednesday, up from 0.87% at the end of October and a low of nearly 0.5% in early August.

But if it’s about the absolute level, investors can take comfort in a yield that remains below 1%.

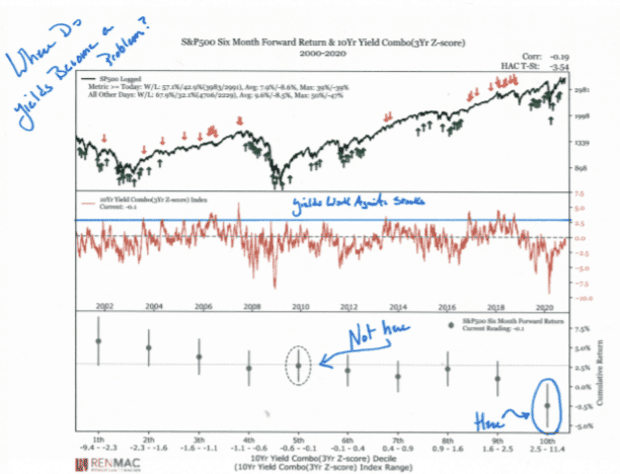

So what does the tape say? Technical analyst Jeff deGraaf, founder of Renaissance Macro Research, took a look in a Friday note, and offered this guidance: “The level is important, but so is the pace of change. Because of the near 40-year downtrend in yields, comparing levels today to anything more than three years ago is futile.”

DeGraaf said a rolling three-year window and a one-month rate of change serve as effective time frames when measuring against the performance of the S&P 500 SPX, +0.89% (see chart below).

Renaissance Macro Research

The takeaway, deGraaf said, is that yields aren’t yet at the pain threshold.

“Today, that figure for 10‐year yields is in the 50th percentile, well away from the 90th percentile that proves troublesome for stocks,” he wrote.

The yield on the 10-year note has pulled back from its midweek high to trade Friday around 0.899%. Yields rose and tech shares were hammered earlier this week after Pfizer Inc. PFE, +2.28% and BioNTech SE BNTX, +4.07% on Monday said their COVID-19 vaccine candidate was more than 90% effective in preventing infections during a trial.

The news sparked a sharp rally for stocks seen most tied to the economic cycle, which had been left behind by the stay-at-home phenomenon. That phenomenon has favored tech- and internet-oriented companies, which have seen shares soar this year.

Low bond yields, meanwhile, are seen as a boon for stocks overall, but particularly benefit so-called growth stocks, a category that includes large-cap tech shares. That’s because lower bond yields are assumed to make yield-hungry investors more willing to pay up for shares that offer strong growth prospects.

Analysts at Société Générale, in a note last week, underscored the sensitivity of tech shares to low yields as part of their attempt to calculate how much of the stock market’s gains since the financial crisis was attributable to asset-buying by major central banks.

See: How much of the stock market’s rise over the last 11 years is due to QE? Here’s an estimate

The tech-heavy Nasdaq Composite COMP, +0.59% was on track Friday for a weekly decline of 1.4%, while the more concentrated Nasdaq-100 Index NDX, +0.45% was off 2.1% for the week. The more cyclical-oriented Dow Jones Industrial Average DJIA, +0.94% was headed for a 3.5% gain, while the large-cap benchmark S&P 500 was up 1.5% for the week. The small-cap Russell 2000 RUT, +1.50% was a major beneficiary of the vaccine-inspired rotation moves, rising 5.5% so far this week.